## Detailed Analysis: Trump’s Plan for a ‘Crypto Strategic Reserve’

Introduction

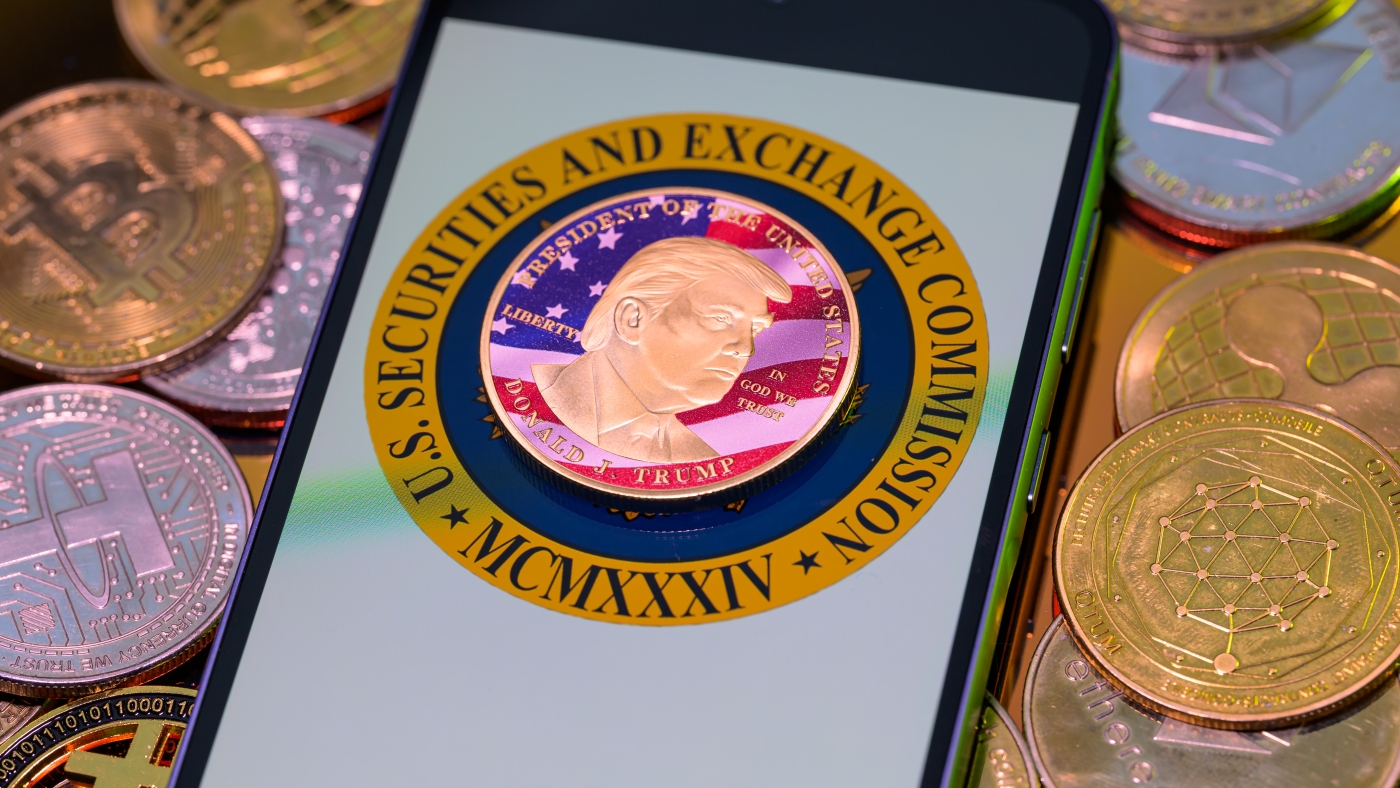

In recent discussions, former U.S. President Donald Trump has been associated with the concept of a “crypto strategic reserve.” This idea involves creating a reserve of cryptocurrencies, potentially to stabilize or support the value of digital assets. While specific details about Trump’s plan are not widely available, we can analyze the concept based on general principles of strategic reserves and their potential implications for cryptocurrencies.

1. Concept of Strategic Reserves

Strategic reserves are typically used by governments to stockpile critical resources, such as oil or foreign currencies, to ensure economic stability and security. In the context of cryptocurrencies, a strategic reserve could involve holding a significant amount of digital assets to influence market dynamics or provide a form of financial backup.

2. Potential Goals of a Crypto Strategic Reserve

– Market Stabilization: A crypto strategic reserve could be used to stabilize cryptocurrency markets by buying or selling digital assets during times of high volatility. This could help maintain investor confidence and reduce the risk of significant price swings.

– Economic Diversification: By holding a variety of cryptocurrencies, a strategic reserve could help diversify a country’s economic assets, potentially reducing dependence on traditional currencies.

– Innovation and Adoption: Supporting cryptocurrencies through a strategic reserve might encourage innovation and adoption in the sector, as it signals government interest and investment in digital assets.

3. Challenges and Risks

– Volatility: Cryptocurrencies are known for their volatility, which could make managing a strategic reserve challenging. Significant price fluctuations could result in substantial losses if not managed carefully.

– Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving and varies widely between countries. This uncertainty could complicate the establishment and management of a crypto strategic reserve.

– Security Risks: Holding large amounts of cryptocurrencies increases the risk of cyber attacks and theft, as these assets are stored digitally and can be vulnerable to hacking.

4. Implementation and Feasibility

Implementing a crypto strategic reserve would require careful planning and coordination. It would involve setting clear goals, establishing a legal and regulatory framework, and ensuring the security of the assets. Additionally, the feasibility of such a reserve would depend on the political will and economic conditions of the country implementing it.

Conclusion

While the idea of a crypto strategic reserve is intriguing, its implementation would face numerous challenges, including market volatility, regulatory uncertainty, and security risks. As more details emerge about Trump’s plan or similar initiatives, it will be important to assess how these challenges are addressed and how such a reserve could impact the broader cryptocurrency market.

—

Professional Report

Subject: Analysis of a Crypto Strategic Reserve Concept

Executive Summary:

This report provides an analysis of the concept of a crypto strategic reserve, which involves holding a significant amount of cryptocurrencies to potentially stabilize markets or support economic diversification. While the idea has potential benefits, it also poses significant challenges, including volatility, regulatory uncertainty, and security risks.

Key Findings:

1. Market Stabilization Potential: A crypto strategic reserve could help stabilize cryptocurrency markets by influencing supply and demand.

2. Economic Diversification: Holding cryptocurrencies could diversify a country’s economic assets.

3. Challenges: Volatility, regulatory uncertainty, and security risks are major concerns.

4. Implementation: Requires careful planning, legal frameworks, and political will.

Recommendations:

– Conduct thorough market analysis to understand potential impacts on volatility.

– Develop clear regulatory guidelines to ensure legal compliance.

– Implement robust security measures to protect digital assets.

Conclusion:

A crypto strategic reserve presents both opportunities and challenges. Successful implementation would require addressing the identified risks and ensuring a well-planned strategy that aligns with economic and political goals.

Related sources: