The Glittering Allure of Gold

Imagine holding a piece of history in your hands. Gold, with its timeless shine and intrinsic value, has been a symbol of wealth and security for centuries. As we stand on March 26, 2025, the spot gold market is a dynamic arena where investors seek to capitalize on the precious metal’s enduring appeal. Let’s dive into the factors influencing gold’s price, the technical analysis at play, and the broader economic context that shapes this market.

The Current Market Landscape

A Bearish Trend with Bullish Potential

The spot gold market is currently forming a new H1 range, exhibiting a minor bearish trend. This trend is influenced by a mix of market sentiment, economic indicators, and geopolitical events. However, the market is anything but static; trends can shift rapidly, presenting opportunities for both seasoned investors and newcomers.

The Influence of Economic Policies

Economic policies, particularly those from the United States, significantly impact the gold market. Interest rates, inflation rates, and fiscal policies are all crucial factors. As of March 2025, the U.S. Federal Reserve’s policies are under intense scrutiny. The Fed’s decisions on interest rates, for example, affect the opportunity cost of holding gold, which does not yield interest or dividends. Lower interest rates can make gold more attractive, while higher rates can deter investors seeking yield.

The Role of Safe Haven Assets

Gold’s reputation as a safe haven asset is well-earned. During times of economic uncertainty or market volatility, investors often flock to gold, driving up its price. This inverse relationship with riskier assets like stocks makes gold a crucial component of diversified portfolios. Understanding this dynamic is key to navigating the spot gold market effectively.

Technical Analysis: The Art of Predicting Price Movements

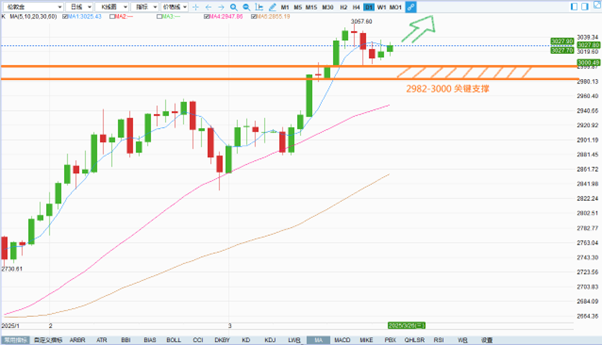

The H1 Bullish CHoCH Pattern

Technical analysis involves studying historical price data and trading volumes to predict future price movements. One notable pattern in the current market is the H1 bullish CHoCH (Change of Character) pattern. This pattern suggests a potential shift in market sentiment, which could lead to a bullish trend. Recognizing such patterns can provide valuable insights for traders looking to capitalize on market movements.

The Importance of Clear Breakouts

In technical analysis, a breakout occurs when the price of an asset moves above a resistance level or below a support level. In the current market, traders are watching for clear breakouts to guide their strategies. A breakout in a bearish direction could signal continuation sells, while a bullish breakout could indicate a reversal. Understanding these technical indicators is essential for making informed trading decisions.

The Omnichain and DeFi Impact

The Rise of Digital Assets

The financial landscape is evolving rapidly, with digital assets like cryptocurrencies and NFTs (Non-Fungible Tokens) gaining traction. These assets, often associated with blockchain technology, are part of the broader DeFi (Decentralized Finance) ecosystem. While they are not direct competitors to gold, they offer alternative investment opportunities that can influence the gold market. As digital assets become more mainstream, their impact on traditional safe haven assets like gold will be worth monitoring.

The Omnichain Revolution

The concept of omnichain refers to the interoperability of different blockchain networks. This technology allows for the seamless transfer of assets between different blockchains, potentially making digital assets more accessible and liquid. As the omnichain revolution unfolds, it could impact the demand for traditional safe haven assets like gold. Investors may need to consider how these technological advancements fit into their broader investment strategies.

The Gold Market and the Broader Economy

The Interplay of Market Trends

The gold market does not operate in isolation. It is influenced by a myriad of factors, including market trends, economic indicators, and geopolitical events. For instance, a strong U.S. dollar can make gold more expensive for foreign buyers, potentially reducing demand. Conversely, a weak dollar can make gold more affordable, driving up demand. Understanding these interplays is crucial for predicting market movements.

The Impact of Global Events

Global events, such as political instability or economic crises, can also impact the gold market. These events can increase the demand for safe haven assets, driving up the price of gold. For example, during the 2008 financial crisis, gold prices soared as investors sought refuge from market volatility. Staying informed about global events can provide valuable context for understanding gold market trends.

Conclusion: The Golden Path Forward

Navigating the Spot Gold Market

As we navigate the spot gold market on this March day in 2025, it’s clear that the market is influenced by a complex interplay of factors. From technical analysis patterns to economic policies and global events, each element plays a role in shaping the price of gold. Staying informed and adaptable is key to successfully navigating this dynamic market.

The Enduring Appeal of Gold

Despite the rise of digital assets and the ever-changing economic landscape, gold’s enduring appeal as a safe haven asset remains. Its lustrous allure and historical significance continue to captivate investors, making it a staple in many portfolios. Whether you’re a seasoned investor or a curious observer, understanding the dynamics of the spot gold market can provide valuable insights into the broader economic landscape.

The Future of the Gold Market

As we look to the future, it’s essential to stay informed about the factors influencing the gold market. Whether you’re a seasoned investor or a curious observer, understanding the dynamics of the spot gold market can provide valuable insights into the broader economic landscape. The golden path forward is one of continuous learning and adaptation, ensuring that investors can capitalize on the opportunities presented by this timeless asset.

—

Sources: