## Analysis: Why Trump’s Crypto Order Disappointed

Introduction

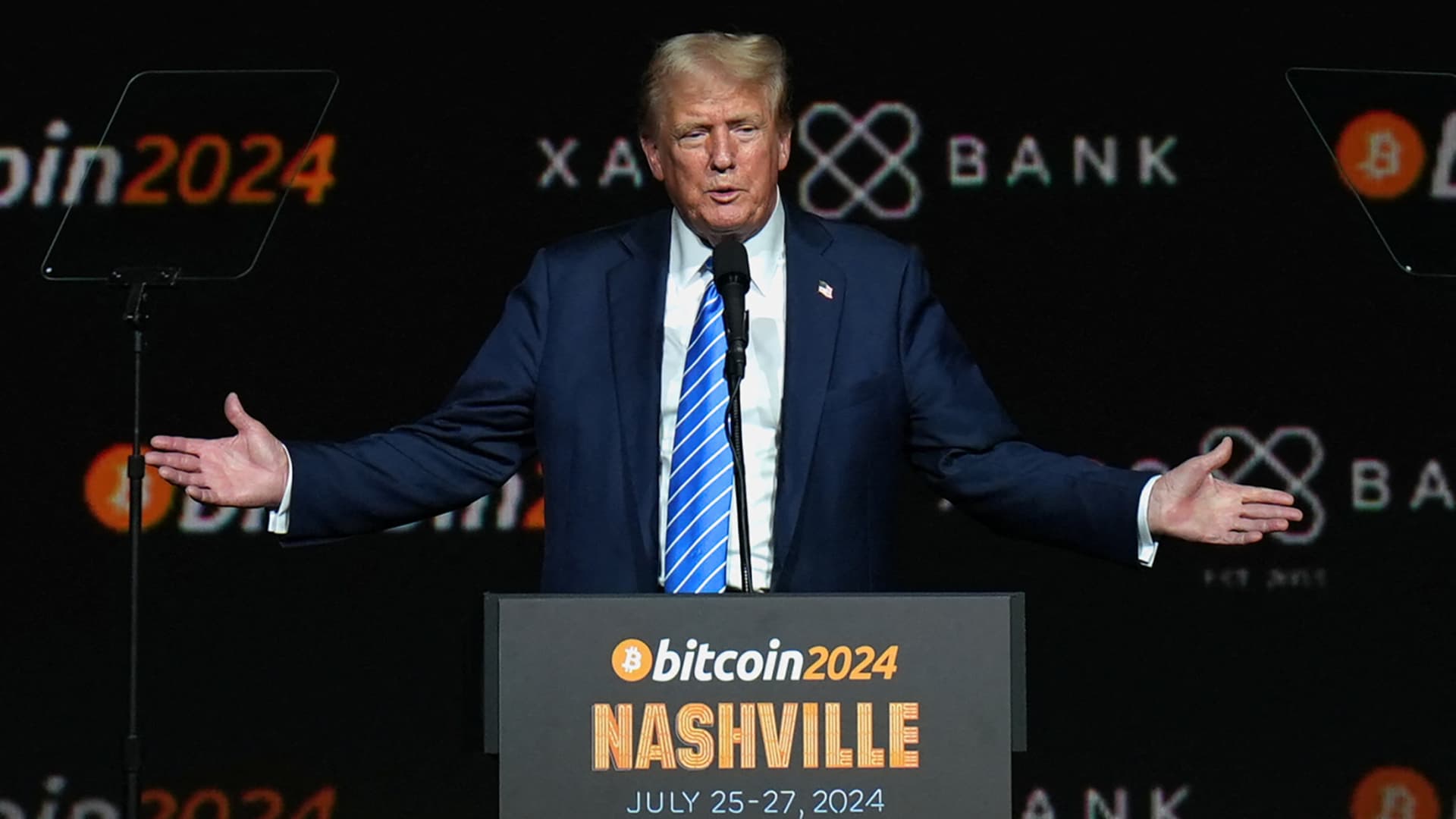

On March 6, 2025, President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve and a United States Digital Asset Stockpile. This move was anticipated to be a significant step forward in the U.S. government’s approach to cryptocurrency. However, the announcement was met with disappointment from many in the crypto community. This report analyzes the reasons behind this disappointment and explores the implications of the order.

Background

The executive order aims to create a reserve for Bitcoin and other digital assets seized by the government through civil or criminal forfeitures. The Bitcoin reserve is likened to a “digital Fort Knox,” emphasizing its role as a secure store of value. The order does not permit new purchases of Bitcoin or other cryptocurrencies, which was a key point of disappointment for many investors and enthusiasts[1][3].

Disappointment Factors

1. Lack of New Acquisitions

– The order does not allow for the purchase of new Bitcoin or other cryptocurrencies. This means that the reserve will only consist of assets already seized by the government, which was seen as less impactful than expected[1].

– Many had hoped for a more aggressive approach, where the U.S. would actively accumulate Bitcoin, similar to how some countries build gold reserves.

2. No Market Impact

– The announcement led to a decline in Bitcoin’s price, dropping nearly 5% to $85,000. Other cryptocurrencies like Ethereum, Ripple, Cardano, and Solana also saw decreases between 4% and 8%[1].

– This market reaction suggests that investors were looking for a more substantial commitment from the U.S. government, which would have potentially boosted prices.

3. Perception of Inaction

– Critics argue that without a purchasing strategy, the initiative is merely symbolic. Charles Edwards, founder of Capriole Investments, described it as “putting lipstick on a pig,” implying that the move lacks real substance[1].

Implications and Future Directions

– Global Impact: Despite the disappointment, the establishment of a Bitcoin reserve could encourage other countries to follow suit. This could lead to increased global recognition and adoption of Bitcoin as a strategic asset[1].

– Policy and Legislation: The order highlights the need for clearer legislation and policy frameworks regarding digital assets. The U.S. government may need to revisit and refine its approach to fully leverage the potential of cryptocurrencies[3].

– Market Sentiment: The initial market reaction indicates that investors are cautious about government actions that do not directly support new investments in cryptocurrencies. Future policy moves will be closely watched for signs of more substantial engagement with the crypto market.

Conclusion

Trump’s executive order on establishing a Strategic Bitcoin Reserve and a Digital Asset Stockpile was met with disappointment due to its limited scope and lack of new acquisitions. While it represents a step towards recognizing the strategic value of cryptocurrencies, it falls short of the aggressive reserve-building some had anticipated. The move underscores the need for more comprehensive policies that could potentially boost market confidence and encourage broader adoption of digital assets.

—

References

[1] Coindesk: Trump Signs Order Setting Up Bitcoin ‘Fort Knox’ and Digital Assets Stockpile

[2] Atlantic Council: Commentary and Testimony

[3] White House: Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile

—

Additional Insights

– Economic and Geopolitical Context: The U.S. move into digital assets comes at a time when global economic stability is a concern. Emerging markets have shown resilience, but they remain vulnerable to external shocks. The role of multilateral institutions and the U.S. dollar’s dominance are critical in this context[2].

– Future Policy Directions: The U.S. government may need to consider more proactive strategies for managing and expanding its digital asset holdings. This could involve legislative changes or international cooperation to establish clearer guidelines for digital asset management[3].

Related sources:

[1] www.coindesk.com

[4] news.va.gov