The Evolving Landscape of NFTs: A Deep Dive into Market Trends and Whale Behavior

Introduction: The NFT Market’s Rollercoaster Ride

The Non-Fungible Token (NFT) market has been on a wild ride since its inception. From the explosive growth in early 2021 to the subsequent corrections and resurgence, the space has seen dramatic shifts in trading volumes, investor behavior, and technological advancements. Recent analyses reveal fascinating insights into NFT trading patterns, whale activity, and long-term holder behavior. This report explores these trends, providing a comprehensive overview of the current state of the NFT market.

—

Monthly NFT Volume Analysis: A Bullish Outlook

The 2022 Peak and Subsequent Decline

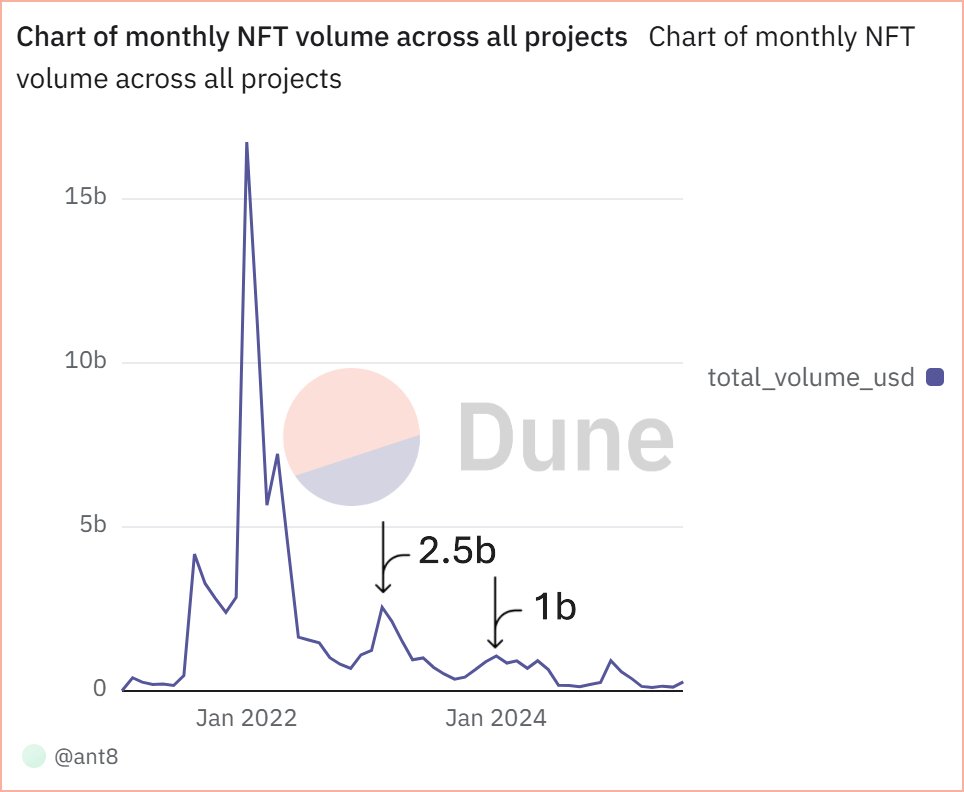

A detailed examination of monthly NFT trading volumes in USD highlights a significant spike around January and February 2022, coinciding with the peak of the crypto bull market. This surge was followed by a sharp decline in trading activity, which gradually tapered off through 2023 and into 2024. Despite this downturn, recent data suggests a resurgence in interest, fueling optimism among investors and analysts alike.

The Resurgence of NFT Trading

While the market saw a decline post-2022, the gradual recovery indicates sustained interest in NFTs. The recent uptick in trading volumes suggests that the market may be entering a new phase of growth, driven by improved infrastructure, better use cases, and increased adoption.

—

Whale Activity: A Key Indicator of Market Sentiment

The “Purt the Adventure” Whale Wallet

A notable observation comes from a whale wallet holding 1,518 tokens of the “Purt the Adventure” collection, created by Red Planet DAO. This wallet has not listed a single token for sale, and in fact, acquired an additional 24 tokens just a few months ago. This behavior suggests strong confidence in the collection’s future value, potentially signaling an upcoming price surge.

Long-Term Holder Behavior in the “Chimpers” Collection

Further analysis of the “Chimpers” NFT collection reveals that out of 6,936 wallets that have ever held a Chimpers NFT, 1,822 have never sold their tokens. This represents 26.2% of all holders, indicating a high level of long-term commitment. Such behavior is a strong bullish signal, as it suggests that these holders believe in the project’s long-term value.

—

Technological Advancements and Market Expansion

Bitlock Wallet’s Upcoming Features

The crypto wallet space is also evolving, with Bitlock Wallet announcing a series of updates over the next 14 days. These include advanced token analysis, support for new blockchain networks, a trending tokens section, NFT support, and a referral system. These enhancements aim to improve user experience and drive further adoption of NFTs and digital assets.

The Role of Data Analysis in NFT Investing

As the market matures, data-driven analysis is becoming increasingly important. Platforms like The Ant Academy provide detailed insights into NFT trading volumes, whale activity, and long-term holder behavior. This data helps investors make more informed decisions, reducing speculation and increasing market stability.

—

Conclusion: A Promising Future for NFTs

The NFT market has undergone significant changes since its peak in early 2022. While trading volumes have fluctuated, recent trends suggest a resurgence in interest and investment. Whale activity and long-term holder behavior indicate strong confidence in certain projects, while technological advancements continue to enhance the ecosystem.

As the market evolves, data-driven analysis will play a crucial role in shaping investor strategies and market stability. The future of NFTs looks promising, with continued innovation and adoption driving growth in the years to come.

—

Sources