Brazil’s Crypto Tax Tango: A Deep Dive into Lula’s Proposal and its Discontents

Introduction

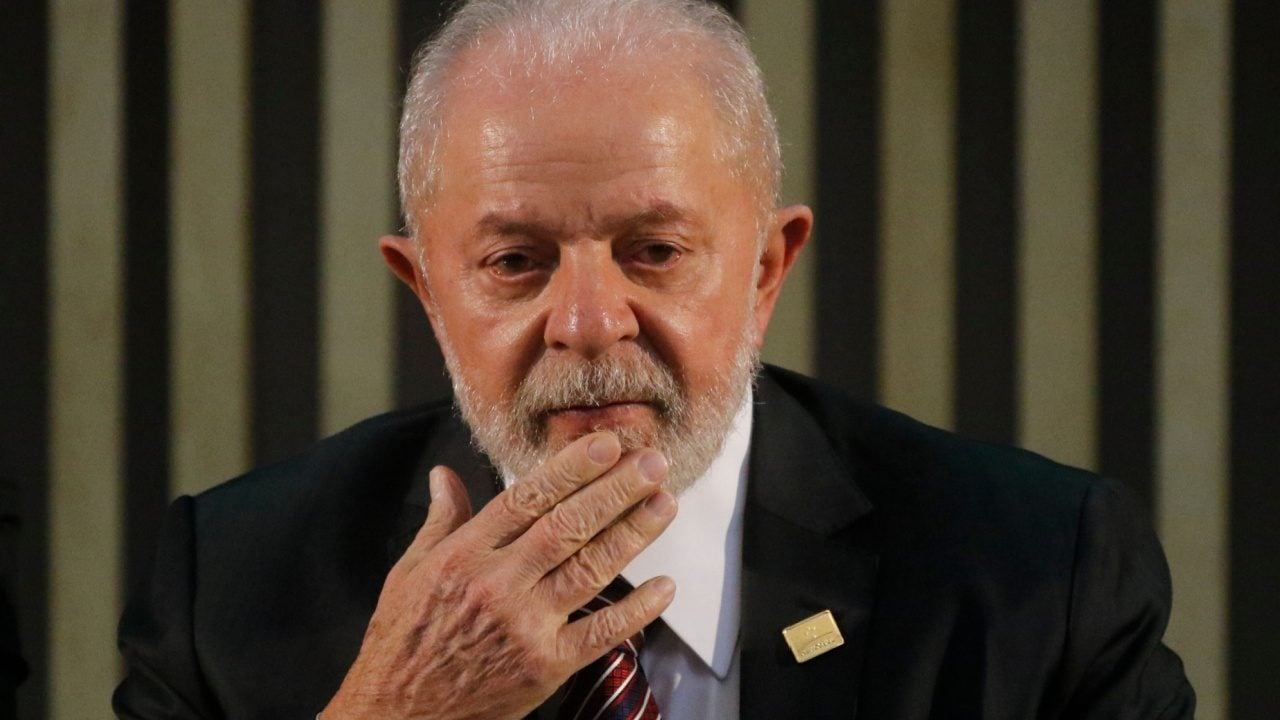

Brazil’s foray into cryptocurrency taxation is not just a fiscal maneuver but a pivotal moment that could redefine the country’s stance on digital assets. President Luiz Inácio Lula da Silva’s administration has proposed a sweeping tax reform that aims to capture revenue from the burgeoning crypto market, but the move has sparked intense debate. The proposal, encapsulated in Provisional Measure 1,303, seeks to impose a flat 17.5% tax on all crypto transactions, eliminating previous exemptions for small traders. This shift has drawn both praise and criticism, with stakeholders questioning its legality, fairness, and potential impact on Brazil’s crypto economy.

The Genesis of the Crypto Tax Proposal

The Brazilian government’s push for crypto taxation is rooted in its desire to modernize the tax system and tap into the growing crypto market. Cryptocurrency adoption in Brazil has surged, with millions of citizens and businesses engaging in trading, investment, and even mining. Recognizing the potential tax revenue, the Lula administration introduced Provisional Measure 1,303, which proposes a uniform 17.5% tax on all crypto profits. This marks a departure from the previous regime, which exempted small traders from income tax while imposing a progressive tax rate of up to 22% on larger investors.

The proposal’s timing is strategic, as Brazil seeks to bolster its fiscal position amid global economic uncertainties. The government argues that the new tax will ensure fairness, as crypto investors will contribute to the national coffers like traditional financial market participants. However, the move has also raised concerns about overreach and the potential stifling of innovation.

Key Features of the Proposed Tax Scheme

The proposed crypto tax scheme is comprehensive, covering a wide range of activities and imposing a flat tax rate. Here are its key features:

Flat Tax Rate

The 17.5% flat tax rate applies uniformly to all crypto transactions, regardless of the trader’s size or frequency of trades. This simplifies the tax structure but also eliminates the previous exemption for small traders, which has drawn criticism.

Elimination of Exemptions

The removal of the income tax exemption for minor trading operations is one of the most contentious aspects of the proposal. Small traders, who previously enjoyed tax-free status, will now be subject to the same tax rate as large investors. This has raised concerns about the disproportionate impact on ordinary citizens who trade crypto as a supplementary income.

Broad Application

The tax applies to various crypto-related activities, including trading, sales, and even mining. This broad application ensures that the government captures revenue from all segments of the crypto market, but it also raises questions about the feasibility of enforcement.

Centralized Oversight

The proposal aims to centralize tax collection, potentially streamlining compliance and enforcement. However, this centralized approach has raised concerns about privacy and the government’s ability to monitor all crypto transactions effectively.

The Rationale Behind the Proposal

The Brazilian government justifies the crypto tax proposal on several grounds, emphasizing revenue generation, fairness, regulatory clarity, and combating illicit activities.

Revenue Generation

The primary motivation behind the proposal is to increase tax revenue. The government sees the crypto market as an untapped source of income that can contribute to its fiscal goals. With the crypto market’s rapid growth, capturing a portion of the profits through taxation is seen as a logical step.

Fairness and Equity

The government argues that the proposal ensures fairness by aligning crypto investors with traditional financial market participants. Previously, crypto traders enjoyed certain exemptions that were not available to other investors, creating an uneven playing field. The new tax regime aims to level this field.

Regulatory Clarity

The proposal also seeks to provide greater clarity and certainty to the crypto market. By establishing a clear tax framework, the government hopes to foster a more stable and predictable environment for investors and businesses.

Combating Illicit Activities

Cryptocurrencies have been associated with tax evasion, money laundering, and other illicit activities. The government believes that imposing a uniform tax rate and centralizing oversight will help curb these activities, making the crypto market more transparent and accountable.

The Crypto Sector’s Counterarguments

The crypto sector has strongly objected to the proposal, arguing that it could stifle innovation, drive away investors, and hinder the growth of the digital asset market in Brazil. Several key counterarguments have emerged:

Disproportionate Impact on Small Traders

The elimination of the tax exemption for small traders is seen as particularly detrimental. Many ordinary citizens engage in crypto trading as a supplementary income, and the new tax could discourage their participation. This could have a chilling effect on the broader adoption of cryptocurrencies in Brazil.

Uncertainty and Complexity

The lack of clarity regarding the scope and application of the tax has created confusion. Investors and businesses are unsure about how the tax will be enforced, leading to uncertainty and potential non-compliance. This could undermine the government’s goal of fostering a stable and predictable environment.

Potential for Double Taxation

Concerns have been raised about the potential for double taxation. If crypto assets are subject to both income tax and other levies, such as capital gains tax, investors could face a disproportionate tax burden. This could deter investment and innovation in the crypto market.

Brain Drain

The increased tax burden could incentivize crypto entrepreneurs and investors to relocate to countries with more favorable tax regimes. This could lead to a loss of talent and investment in Brazil, undermining the government’s goal of fostering a thriving crypto economy.

Legality Concerns

Some legal experts have questioned the legality of imposing the tax through a provisional measure. They argue that the proposal may exceed the executive branch’s authority and require congressional approval. This has raised concerns about the government’s overreach and the potential for legal challenges.

Congressional Scrutiny and Debate

The crypto tax proposal has faced considerable scrutiny and debate in the Brazilian Congress. Lawmakers are tasked with evaluating the merits of the proposal, weighing its potential benefits against its potential drawbacks, and determining whether it aligns with the country’s broader economic goals.

Several key issues have been raised during the congressional debates:

The Appropriateness of Using a Provisional Measure

The use of a provisional measure to implement such a significant tax change has been questioned. Some lawmakers argue that the proposal should be subject to a more thorough legislative process, involving public consultation and debate.

The Potential Impact on Competitiveness

The potential impact of the tax on the competitiveness of the Brazilian crypto market has been a major concern. Lawmakers are worried that the increased tax burden could drive investors and businesses to other jurisdictions, undermining Brazil’s position in the global crypto economy.

The Need for Greater Clarity

The need for greater clarity and specificity in the tax regulations has been emphasized. Lawmakers argue that the current proposal lacks detail, making it difficult for investors and businesses to comply with the new regulations. This could lead to non-compliance and potential legal challenges.

The Possibility of Alternative Tax Structures

The possibility of introducing alternative tax structures has been explored. Some lawmakers argue that a more nuanced approach, such as a progressive tax rate or a higher exemption threshold, could strike a better balance between revenue generation and market growth.

Implications for Brazil’s Crypto Economy

The outcome of the congressional debate on the crypto tax proposal will have significant implications for Brazil’s crypto economy. If the proposal is approved in its current form, it could lead to:

Reduced Trading Volumes and Investment Activity

The increased tax burden could lead to a reduction in trading volumes and investment activity in the Brazilian crypto market. This could undermine the growth of the crypto economy and limit its potential.

A Slowdown in Adoption

The proposal could slow down the adoption of cryptocurrencies among ordinary citizens and businesses. The increased tax burden and uncertainty could deter potential investors, limiting the growth of the crypto market.

An Exodus of Talent and Investment

The increased tax burden could incentivize crypto entrepreneurs and investors to relocate to more favorable jurisdictions. This could lead to a loss of talent and investment in Brazil, undermining the government’s goal of fostering a thriving crypto economy.

Increased Compliance Costs

The proposal could increase compliance costs for crypto businesses. The need to track and report all crypto transactions could impose a significant administrative burden, undermining the competitiveness of the Brazilian crypto market.

Conversely, if the proposal is rejected or amended, it could:

Maintain Growth Momentum

Rejecting or amending the proposal could maintain the momentum of growth in the Brazilian crypto market. This could attract more investment and innovation, fostering a thriving crypto economy.

Attract More Investment

A more favorable tax regime could attract more investment to Brazil. This could position the country as a hub for crypto innovation and investment, boosting its global standing in the crypto economy.

Foster a More Inclusive Ecosystem

A more inclusive tax structure could foster a more inclusive and accessible crypto ecosystem. This could encourage broader participation in the crypto market, benefiting ordinary citizens and small businesses.

Provide Greater Certainty

A more nuanced tax structure could provide greater certainty and clarity for crypto businesses and investors. This could foster a more stable and predictable environment, encouraging investment and innovation.

Beyond Crypto: Trade Wars and Economic Nationalism

The crypto tax debate exists within a broader context of international trade tensions and rising economic nationalism. Former U.S. President Donald Trump’s threats to impose tariffs on Brazilian imports, coupled with President Lula’s warnings of retaliatory measures, highlight the potential for trade wars to disrupt global markets and undermine economic growth.

These trade tensions could further complicate the crypto tax debate in Brazil. Policymakers must balance domestic revenue goals with the desire to maintain competitiveness in the global economy. The outcome of the crypto tax debate will have implications not just for the crypto market but also for Brazil’s broader economic strategy.

Conclusion: Navigating the Crypto Crossroads

Brazil stands at a critical juncture in its relationship with the crypto world. The decisions made regarding the crypto tax proposal will shape the future of the country’s digital asset market and its role in the global crypto economy. Striking the right balance between revenue generation, regulatory oversight, and fostering innovation will be crucial to unlocking the crypto market’s full potential.

The crypto tax debate is not just about taxation but about Brazil’s vision for its digital future. The government’s proposal reflects its ambition to modernize the tax system and capture revenue from the growing crypto market. However, the crypto sector’s concerns about the proposal’s impact on innovation, investment, and competitiveness cannot be ignored.

As Brazil navigates this crypto crossroads, it must consider the broader implications of its decisions. The outcome of the crypto tax debate will not only shape the country’s crypto economy but also its position in the global digital landscape. By striking the right balance, Brazil can foster a thriving crypto market that benefits all stakeholders, from ordinary citizens to large investors. The path forward is fraught with challenges, but with careful consideration and nuanced policymaking, Brazil can emerge as a leader in the global crypto economy.