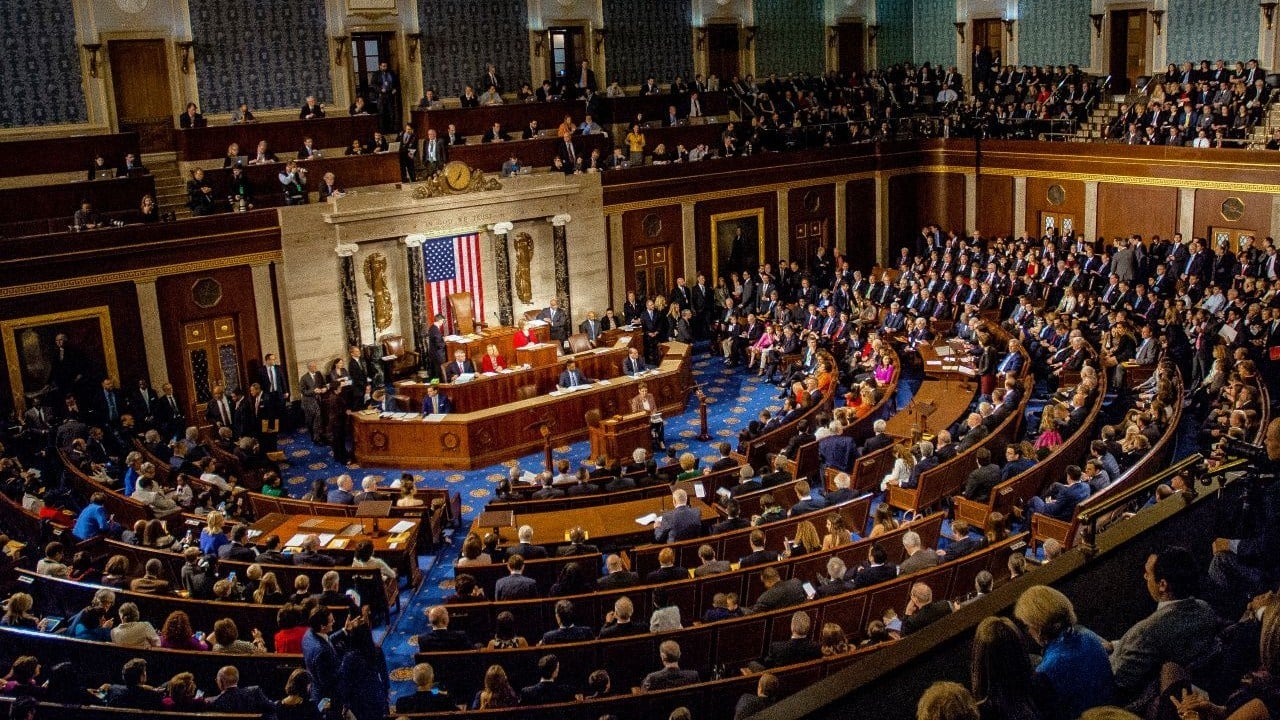

The digital asset landscape in the United States is on the cusp of a transformative period. With the US House of Representatives designating the week of July 14th as “Crypto Week,” the stage is set for a concentrated legislative effort that could redefine the regulatory framework for cryptocurrencies and blockchain technologies. This initiative, led by Republican House leaders, aims to address critical industry challenges, from regulatory ambiguities to concerns about government overreach. However, the journey toward legislative success is fraught with political divides and technical complexities that could shape the future of crypto in the US.

The Legislative Core: Three Key Bills

At the heart of “Crypto Week” are three pivotal bills, each targeting distinct yet interconnected challenges within the crypto ecosystem. Understanding these proposals is essential for assessing their potential impact.

The CLARITY Act: Resolving Regulatory Ambiguity

The CLARITY Act, or “Creating Legal Accountability for Rigid Terms Involving crypto assets and Innovative Technologies Act,” seeks to resolve the persistent ambiguity surrounding the classification of digital assets. The lack of clear guidance on whether tokens should be classified as securities or commodities has created regulatory uncertainty, stifled innovation, and fueled conflicts between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The CLARITY Act proposes a framework for determining the appropriate regulatory treatment of digital assets, considering factors such as decentralization, intended use, and ownership rights. By providing a clear compliance roadmap, this legislation could unlock significant investment and innovation in the crypto space.

The Anti-CBDC Surveillance State Act: Safeguarding Financial Privacy

The Anti-CBDC Surveillance State Act addresses concerns about government overreach through central bank digital currencies (CBDCs). While CBDCs could enhance financial efficiency and inclusion, critics warn of potential privacy violations and surveillance risks. This legislation likely includes provisions to prevent the Federal Reserve from issuing a CBDC without congressional approval and to enforce strong privacy protections for user data.

The GENIUS Act: Fostering Innovation

The GENIUS Act, though details are limited, is expected to focus on promoting innovation and competitiveness in the digital asset space. It may address regulatory sandboxes, tax treatment of digital assets, and blockchain technology development. The goal is to position the US as a global leader in crypto innovation.

The Political Landscape: Challenges and Opportunities

While “Crypto Week” represents a significant step forward, the political environment presents challenges that could hinder legislative progress.

Partisan Divides and Shifting Alliances

The initiative is led by House Republicans, reflecting growing recognition of the importance of digital assets. However, some Democrats have raised concerns about consumer protection, financial stability, and illicit finance, which could lead to opposition if they believe the bills do not adequately address these issues.

The Trump Factor: A Complex Influence

Former President Trump’s increasing interest in crypto adds complexity to the political dynamic. His support could galvanize crypto advocates but may also alienate Democrats wary of aligning with him. Allegations of Trump’s financial ties to crypto ventures could further polarize the debate.

The SEC-CFTC Turf War: A Regulatory Challenge

The ongoing jurisdictional conflict between the SEC and CFTC over crypto regulation creates uncertainty for businesses. Resolving this ambiguity is crucial for establishing a clear and consistent regulatory framework.

Broader Implications for the Crypto Ecosystem

The outcome of “Crypto Week” will have far-reaching consequences for the crypto ecosystem, influencing innovation, investment, and adoption in the US.

Impact on Innovation and Investment

A clear regulatory framework could attract significant investment and foster innovation in the crypto space. Conversely, a lack of clarity could stifle growth and drive businesses to more favorable jurisdictions.

Consumer Protection: Balancing Innovation and Safety

Consumer protection is a key concern, particularly after recent high-profile crypto company collapses. The legislation could include provisions to safeguard consumers from fraud and scams while balancing innovation.

The Future of CBDCs in the US

The Anti-CBDC Surveillance State Act could shape the future of CBDCs in the US by preventing the Federal Reserve from issuing a CBDC without congressional approval.

Impact on Bitcoin and Altcoins

The CLARITY Act’s definitions will influence Bitcoin and altcoins, encouraging innovation and adoption within the crypto ecosystem.

Conclusion: A Defining Moment for US Crypto Regulation

“Crypto Week” marks a critical juncture for the US crypto landscape. The legislation under consideration has the potential to reshape the regulatory framework, impacting innovation, investment, and consumer protection. However, political divides, regulatory complexities, and evolving dynamics could complicate the process. The decisions made during this week will have lasting implications for the future of crypto in the United States. Whether “Crypto Week” ushers in an era of clarity and growth or further uncertainty remains to be seen, but its impact will undoubtedly be profound.