The Current State of Bitcoin: A Deep Dive into Market Sentiments and Technical Analysis

Imagine standing at the edge of a vast, ever-changing landscape. This is the world of Bitcoin, a digital frontier where fortunes are made and lost in the blink of an eye. As of June 21, 2025, Bitcoin finds itself in a landscape of mixed signals and geopolitical tensions. Let’s embark on a journey to explore the current state of Bitcoin, delving into the sentiments, technical analysis, and external factors that influence its price.

The Bullish Perspective

Bitcoin has always been a rollercoaster ride, and the bullish camp is optimistic about its future. Some analysts predict significant upside potential. For instance, the On-Chain CapFlow Sentiment Index suggests that Bitcoin is entering a new distribution phase, hinting at a potential rally. This index tracks capital movement on the Bitcoin blockchain, providing insights into the market’s sentiment[1].

Moreover, the liquidity on the lower side of Bitcoin has been filled, indicating that the price is ready to move upwards. This perspective is shared by many who believe that Bitcoin will soon break out of its current range and head towards new highs. The bullish scenario is further supported by the fact that Bitcoin bounced cleanly off the 50 EMA / 200 SMA at $103,000, keeping the bullish scenario in play. The Daily StochRSI is also oversold, suggesting that a short-term relief rally may follow[2].

The Bearish Perspective

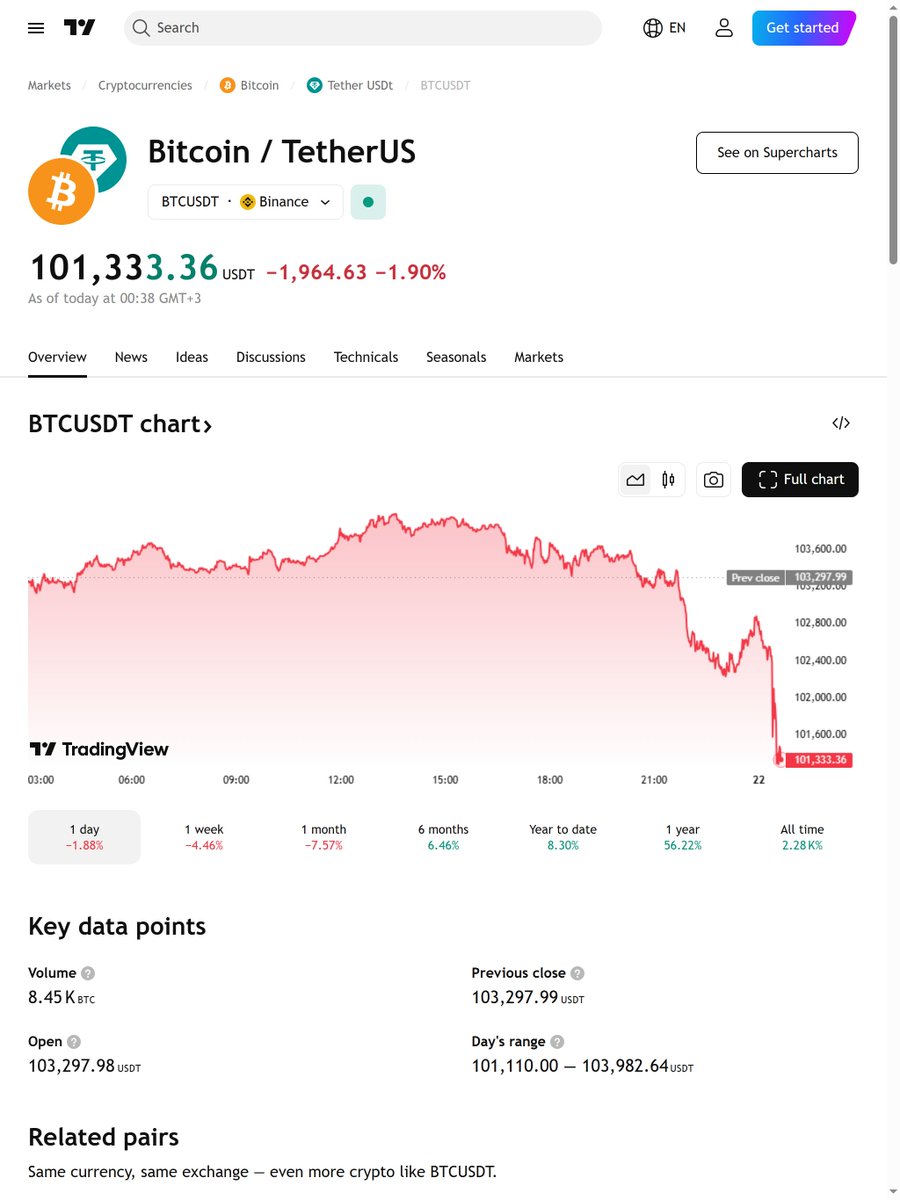

On the other hand, the bearish camp paints a different picture. Some analysts believe that Bitcoin is in a downtrend, with the price potentially dropping to the $98,000 area. This perspective is supported by the fact that Bitcoin has recently dropped below the 50-day EMA, indicating a bearish trend. The Relative Strength Index (RSI) is at 35.13, hinting at an oversold condition, but this could also mean that a further drop is imminent[3].

Geopolitical tensions, such as the Israel–Iran conflict, are also shaking the crypto market, with Bitcoin dropping below $103,000. This uncertainty could lead to a big crash, as suggested by some analysts. The bearish sentiment is further fueled by the fact that Bitcoin has not yet reaped the benefits of a golden cross, which is a bullish indicator[4].

The Neutral Perspective

Amidst the bullish and bearish sentiments, there are analysts who adopt a neutral stance. They believe that Bitcoin’s price is currently in a consolidation phase, with the price oscillating around the EMA9. This perspective is supported by the fact that Bitcoin’s price is trading in a falling wedge pattern, approaching the lower support line. This could mean that Bitcoin is preparing for a breakout, but the direction is still uncertain[5].

Some analysts also believe that Bitcoin’s price is influenced by external factors, such as the US markets and the dollar’s strength. For instance, the US Markets Analysis shows that the dollar’s strength could impact Bitcoin’s price, with a potential drop to the $98,000 area[6].

The Impact of External Factors

Bitcoin’s price is not only influenced by market sentiments and technical analysis but also by external factors. Geopolitical tensions, such as the Israel–Iran conflict, can shake the crypto market, leading to a drop in Bitcoin’s price. Similarly, the US markets and the dollar’s strength can also impact Bitcoin’s price, with a potential drop to the $98,000 area[7].

Moreover, the regulatory environment can also impact Bitcoin’s price. For instance, courses on “Combating Terrorism Financing, Operational Analysis of Suspicious Transaction Reports, and Bitcoin and Cryptocurrency Forensic Investigation (OSINT)” indicate that regulators are keeping a close eye on the crypto market. This could lead to stricter regulations, impacting Bitcoin’s price[8].

The Future of Bitcoin

So, what does the future hold for Bitcoin? The answer is not straightforward, as Bitcoin’s price is influenced by a multitude of factors. However, one thing is clear: Bitcoin is here to stay, and it will continue to command attention and spark debates among investors and analysts alike.

As for the question of when Bitcoin will hit $60,000, the answer is not straightforward either. Some analysts believe that it could take until 2026, while others are more optimistic. However, it’s important to note that Bitcoin can only be analyzed in terms of price structure and long-term trends, not specific prices on specific dates[9].

Conclusion: Navigating the Bitcoin Landscape

In conclusion, the current state of Bitcoin is a mix of bullish, bearish, and neutral sentiments. The price is influenced by market sentiments, technical analysis, and external factors. As investors and analysts navigate this landscape, it’s important to stay informed, stay vigilant, and stay patient. After all, Bitcoin is a marathon, not a sprint. So, buckle up and enjoy the ride.

As the famous saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.” The same applies to Bitcoin. The best time to invest in Bitcoin was when it was worth a few cents. The second best time is now. So, whether you’re a bull, a bear, or a neutral, remember to do your own research, stay informed, and make informed decisions.

—

Sources