The Current Crypto Landscape

The crypto market is a dynamic and ever-evolving landscape, much like the ocean, with its own set of currents, waves, and hidden treasures. As we delve into the trends and predictions for June 2025, it’s essential to understand the underlying forces shaping this digital financial ecosystem. From the dominance of Bitcoin to the impact of geopolitical events and the role of artificial intelligence, let’s explore the key factors influencing the crypto market.

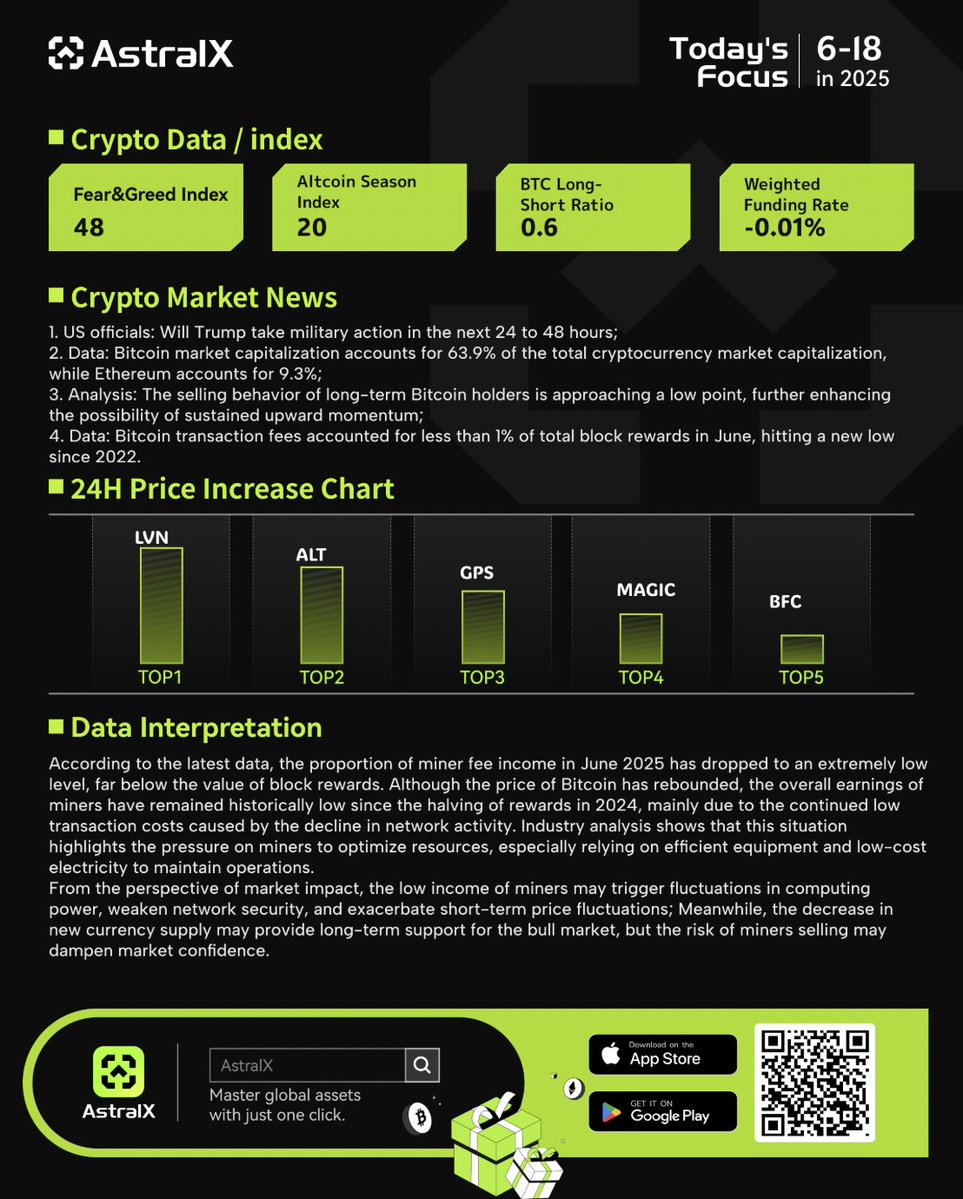

Bitcoin’s Dominance and Market Capitalization

Bitcoin, often referred to as the king of cryptocurrencies, continues to maintain its stronghold in the market. As of June 18, 2025, Bitcoin’s market capitalization stands at an impressive 63.9% of the total cryptocurrency market capitalization[REF]astralxcom[/REF]. This dominance is a clear indication of Bitcoin’s enduring appeal and its status as a reliable store of value.

The Significance of Bitcoin’s Market Share

Bitcoin’s market share is more than just a statistic; it reflects the confidence investors have in the cryptocurrency. This dominance can significantly influence market sentiment, with Bitcoin’s price movements often setting the tone for the broader crypto market. When Bitcoin rises, other cryptocurrencies tend to follow suit, and vice versa. This phenomenon is crucial for investors to understand, as it can help them make more informed decisions.

Geopolitical Factors: The Trump Factor

Geopolitical events can have a profound impact on the crypto market. As of June 18, 2025, there are speculations about potential military actions by former US President Trump[REF]astralxcom[/REF]. While the direct impact on the crypto market is uncertain, such geopolitical tensions can lead to increased volatility. Investors often turn to Bitcoin and other cryptocurrencies as safe-haven assets during times of uncertainty, which can drive up prices.

Navigating Geopolitical Uncertainty

For crypto traders and investors, staying informed about geopolitical developments is crucial. Tools like chart analysis, market trackers, and portfolio managers can help navigate these uncertain waters[REF]marcus_rya74582[/REF]. By staying ahead of the game, investors can make more informed decisions and potentially capitalize on market movements. It’s essential to keep an eye on global events and understand how they might affect the crypto market.

The Role of AI in Crypto Analysis

Artificial Intelligence (AI) is revolutionizing the way we analyze and understand the crypto market. AI-powered tools can provide precise blockchain data and advanced forecasting, helping investors make better decisions. For instance, Sentient Chat is built with a crypto mode feature that offers detailed blockchain data, setting it apart from other AI tools like ChatGPT[REF]akratomi[/REF].

Leveraging AI for Better Insights

AI can analyze vast amounts of data quickly and accurately, identifying trends and patterns that human analysts might miss. By leveraging AI, investors can gain a competitive edge, making more informed and timely decisions. This is particularly important in a fast-paced market where seconds can make a significant difference. AI can also help in risk management by providing real-time data and alerts, allowing investors to react swiftly to market changes.

The Power of Community and Education

The crypto community is a vibrant and dynamic ecosystem. Platforms like MatHloni provide the latest in cryptocurrency news, signals, and market updates, helping investors stay ahead of the game[REF]Jinduofweb3[/REF]. Additionally, resources like crypto podcasts and expert insights can offer valuable perspectives and analysis on the latest trends in the digital asset space[REF]TamaraWalk94448[/REF].

Educating Yourself for Success

Education is a key component of success in the crypto market. Whether you’re a seasoned trader or a newcomer, continuous learning is essential. Engaging with the community, attending webinars, and reading up on the latest developments can enhance your understanding and improve your trading strategies. The crypto market is constantly evolving, and staying informed is crucial to making the right decisions.

Risk Management: The Cornerstone of Successful Trading

In the volatile world of crypto, risk management is paramount. As one trader aptly put it, “Always prioritize risk management ABOVE ALL in TRADING”[REF]CRPTO_Kowalsky[/REF]. This means setting stop-loss orders, diversifying your portfolio, and being prepared to hedge your positions. By managing risk effectively, you can protect your investments and navigate market fluctuations more confidently.

Strategies for Effective Risk Management

The Future of Crypto: Trends and Predictions

Looking ahead, several trends are shaping the future of the crypto market. The increasing adoption of blockchain technology, the rise of decentralized finance (DeFi), and the growing interest in non-fungible tokens (NFTs) are just a few examples. As the market evolves, staying informed and adaptable will be key to success.

Embracing the Future

The crypto market is in a state of constant flux, with new technologies and innovations emerging rapidly. Embracing these changes and staying ahead of the curve can open up new opportunities. Whether it’s exploring new cryptocurrencies, investing in DeFi projects, or diving into the world of NFTs, the future of crypto is full of possibilities. The key is to stay informed, adaptable, and open to new ideas.

Conclusion: Navigating the Crypto Ocean

As we sail through June 2025, the crypto market presents both challenges and opportunities. From Bitcoin’s dominance to the impact of geopolitical events, understanding these dynamics can help you navigate the crypto ocean more effectively. By leveraging AI, staying informed, and prioritizing risk management, you can position yourself for success in this ever-changing landscape. So, grab your compass, chart your course, and set sail on the exciting journey of crypto trading.