Cryptocurrency Market Analysis: Trends, Insights, and Future Outlook

Introduction: A Volatile Yet Opportunistic Market

The cryptocurrency market remains one of the most dynamic and unpredictable financial landscapes, where rapid price swings, regulatory shifts, and technological advancements shape investor sentiment. Recent data and expert analyses reveal key trends, strategic moves, and technical insights that could influence market behavior in the coming months.

This report explores Bitcoin’s historical performance, Ethereum’s resurgence, altcoin movements, and the broader market sentiment influenced by macroeconomic factors such as the Federal Reserve’s interest rate decisions.

—

Bitcoin’s Historical Performance: A Mixed August Track Record

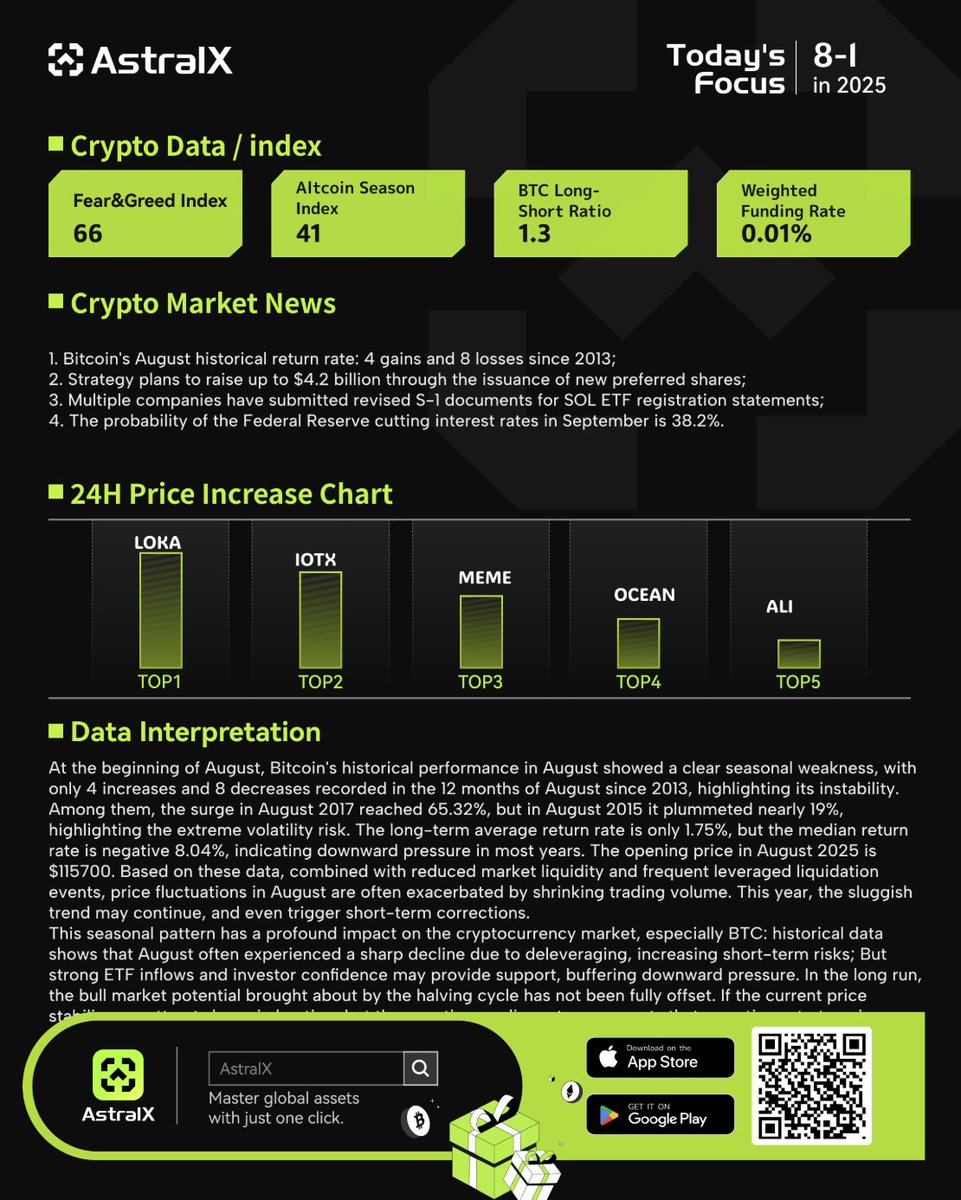

Bitcoin (BTC) has historically shown mixed performance in August, with a 4-to-8 win-loss ratio since 2013. This suggests that while August can be bullish, traders should remain cautious due to the higher likelihood of downward trends.

– Historical Data: Since 2013, Bitcoin has experienced gains in only four out of 12 August periods, indicating a tendency for bearish movements in this month.

– Current Market Sentiment: Recent price drops below the $115,000 mark have sparked discussions about whether this is a correction or the beginning of a larger downtrend.

Despite the volatility, Bitcoin remains a dominant force in the crypto market, with its price movements often setting the tone for altcoins.

—

Ethereum’s Resurgence: A Bullish Rebound

Ethereum (ETH) has recently shown strong recovery signs, climbing back to levels near its March 2024 high of $3,980. This rebound has been driven by increased trading activity and renewed investor confidence.

– Technical Analysis: ETH’s price action suggests a potential continuation of the uptrend, supported by strong buying pressure.

– Market Impact: Ethereum’s performance often influences altcoins, meaning a sustained ETH rally could boost broader market sentiment.

—

Altcoin Movements: Lista DAO and Polymesh in Focus

Lista DAO (LISTA) – A Strong Uptrend

Lista DAO (LISTA) has seen significant gains over the past 60 and 90 days, with price increases of +41.05% and +62.63%, respectively. This suggests strong momentum, though traders should monitor for potential corrections.

Polymesh (POLYX) – Volatility and Recovery

Polymesh (POLYX) has experienced high volatility, with a year-to-date (YTD) decline of -47.02%. However, a recent 60-day positive trend indicates a potential recovery phase.

—

Macroeconomic Influences: Federal Reserve’s Stance

The Federal Reserve’s decision to keep interest rates unchanged for the fifth consecutive time has had a stabilizing effect on the crypto market. Lower interest rates typically encourage risk-on investments, benefiting cryptocurrencies.

– Market Reaction: Bitcoin and altcoins have shown increased trading activity, suggesting that investors are capitalizing on the relatively stable macroeconomic environment.

– Future Implications: If the Fed maintains its dovish stance, we could see further bullish momentum in crypto markets.

—

Trading Strategies and Tools for Success

Automated Trading and Real-Time Analysis

Traders are increasingly relying on automated trading tools and real-time market insights to optimize their strategies. These tools help streamline analysis, execute trades efficiently, and reduce emotional decision-making.

Risk Management: The Importance of Execution

A recent trader’s experience highlights the critical role of execution in trading success. Even with strong analysis, poor execution (such as incorrect stop-limit orders) can lead to missed opportunities or unnecessary losses.

—

Emerging Trends: AI, Metaverse, and New Projects

Virtuals Protocol (VIRTUALS Coin) – AI and Metaverse Integration

Virtuals Protocol is gaining attention for its innovative approach to combining artificial intelligence (AI) with Metaverse technologies. This project represents the growing trend of blockchain-based AI applications.

$VAPE: Structured Arbitrage Opportunities

The launch of the world’s largest BNB treasury program by $VAPE is creating new arbitrage opportunities, attracting traders looking for structured profit strategies.

—

Conclusion: Navigating the Crypto Market in 2025

The cryptocurrency market in 2025 continues to evolve, presenting both challenges and opportunities. Bitcoin’s historical August performance suggests caution, while Ethereum’s rebound and altcoin movements indicate potential upside. Macroeconomic factors, such as the Federal Reserve’s policies, will play a crucial role in shaping market trends.

For traders and investors, staying informed through reliable sources, leveraging advanced trading tools, and maintaining disciplined risk management strategies will be key to navigating this dynamic landscape successfully.

—

Sources: