Navigating the Crypto and NFT Landscape: A Deep Dive into Recent Trends and Insights

Introduction: The Ever-Evolving Crypto and NFT Ecosystem

The cryptocurrency and NFT markets continue to evolve at a rapid pace, with new projects, shifting trends, and evolving strategies shaping the landscape. From reward mechanisms in decentralized platforms to technical analysis of NFT cycles, the space is filled with opportunities and challenges. This report explores recent developments, analyzes key insights, and provides a structured breakdown of the current state of the market.

—

1. Reward Mechanisms and Creator Incentives: The Case of @boundless_xyz

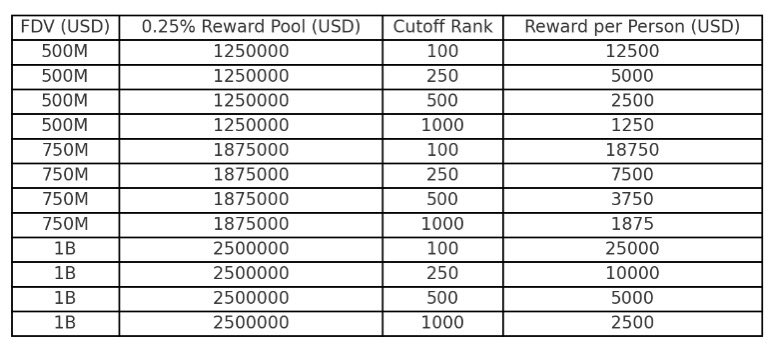

The 0.25% Reward Announcement

@boundless_xyz recently announced a 0.25% reward for creators through Kaito, a move that has sparked discussions within the community. While the percentage itself is modest, the distribution method is what matters most. According to @soonlidaero’s analysis, the valuation potential of this reward structure depends on how it is allocated among creators, stakeholders, and NFT holders.

Why Distribution Matters

A well-structured reward system can foster long-term engagement and incentivize participation. If the rewards are distributed fairly and transparently, it could lead to sustained growth for the ecosystem. However, if the distribution is skewed, it may lead to dissatisfaction among participants.

—

2. NFT Market Cycles: A Potential Turning Point

The Bearish Cycle and Bullish Reversal

David (@dj_david943) highlights a potential turning point in the NFT market, suggesting that a 15M OE (Order Execution) has completed its bearish cycle. If the market breaks through key resistance levels, it could signal a shift back to a bullish trend.

The Role of LTFs (Low-Timeframe) and HTFs (High-Timeframe) in Market Movements

For a sustained bullish reversal, LTFs must build into HTFs. This means that short-term traders and investors should align with long-term market trends to push prices toward new all-time highs (ATHs). If this alignment occurs, we could see significant upward momentum in the NFT space.

—

3. Anoma’s Yapping: A Testnet Success Story

User Engagement and Point Accumulation

One user (@OOPS_NFT) shared their experience with Anoma’s Yapping, a testnet activity where participants accumulate points. After five days, the user had accumulated 150,000 points, moving around 1,000 ranks daily. This indicates strong engagement and competition among participants.

Top Performers and Community Activity

Many top-ranked participants remain active, suggesting that the testnet is not only attracting early adopters but also retaining them. This level of engagement is crucial for the long-term success of any blockchain project.

—

4. AI-Powered Trading and Market Insights

Trade365days: A Hub for Real-Time Analysis

@trade365days provides real-time insights, technical analysis, and AI-powered trading strategies across multiple asset classes, including stocks, crypto, forex, and commodities. Such platforms empower traders by offering data-driven decision-making tools, reducing reliance on speculation.

The Role of AI in Crypto Trading

AI-driven analysis helps traders identify patterns, predict market movements, and execute trades more efficiently. As the crypto market becomes more complex, AI tools will play an increasingly vital role in strategy formulation.

—

5. $AMI: A Rising Star in Aptos DeFi

Solid Foundation and Community Support

Cristinatinto (@nft_pokeworld) highlights that $AMI is setting up a strong foundation in the Aptos DeFi ecosystem. With real traction and community backing, it has the potential to become a core asset in the space.

Why $AMI Stands Out

Projects that gain community trust and real-world utility tend to outperform those that rely solely on hype. $AMI’s growing influence suggests it could be a long-term player in the Aptos ecosystem.

—

6. The Importance of Discipline in Trading

Emotion vs. Strategy

@YoCryptoclub emphasizes the importance of discipline over emotion in trading. Successful traders rely on technical analysis, risk management, and strategic execution rather than impulsive decisions.

Key Takeaways for Traders

– Stay sharp with continuous market education.

– Trust your analysis over FOMO (Fear of Missing Out).

– Discipline beats emotion in the long run.

—

7. UMA Alpha: Analyzing $CORRUPTED

Meme-Themed NFT Project with a Twist

UMA (@umaonsol) provides an analysis of $CORRUPTED, a meme-themed NFT project that leverages internet culture to critique societal norms. With a CMC score of 335.0 and a Tier C rating, it remains a niche but intriguing project.

The Appeal of Meme NFTs

Meme NFTs often gain traction due to their cultural relevance and viral potential. However, their long-term value depends on community engagement and utility beyond mere speculation.

—

8. Sonic NFT Market Health Check

Real-Time Market Insights

Gangsta City (@GangstaLions) provides a health check of the Sonic NFT market, highlighting:

– Global marketplace trends (volume, trades).

– Market sentiment analysis.

– Summary metrics across PaintSwap.

Why Real-Time Data Matters

Accurate, real-time data allows traders and investors to make informed decisions rather than relying on outdated or speculative information.

—

Conclusion: The Future of Crypto and NFTs

The crypto and NFT markets are in a constant state of flux, with new opportunities emerging daily. Whether it’s reward mechanisms, NFT cycles, AI-driven trading, or community-backed projects, the key to success lies in adaptability, discipline, and data-driven decision-making.

As we move forward, projects that prioritize utility, transparency, and community engagement will likely outperform those that rely on short-term hype. The future of crypto and NFTs is bright, but only for those who navigate it wisely.

—

Sources