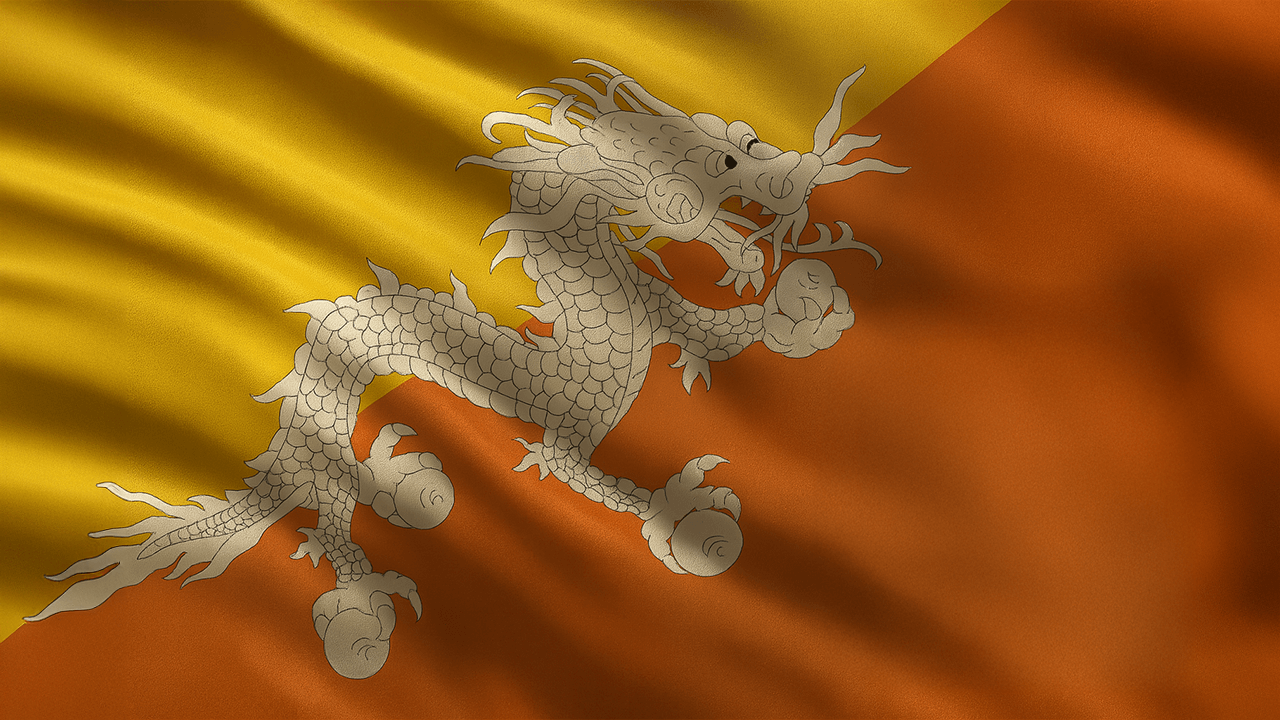

Bhutan, a small Himalayan kingdom renowned for its Gross National Happiness (GNH) philosophy, has quietly emerged as a significant player in the cryptocurrency landscape. Since 2020, the nation has strategically accumulated a substantial Bitcoin (BTC) portfolio, now estimated to be around 12,000 BTC, valued at approximately $1.3 billion. This digital treasure trove represents a staggering 40% of Bhutan’s Gross Domestic Product (GDP), placing it among the top sovereign Bitcoin holders globally, trailing only behind the United States and El Salvador. However, recent transactions involving the transfer of Bitcoin to Binance, a leading cryptocurrency exchange, have ignited discussions and speculation about Bhutan’s underlying motives and long-term strategy. Is this a calculated move to capitalize on market peaks, or a sign of a more profound shift in the kingdom’s approach to digital assets?

The Genesis of Bhutan’s Bitcoin Bet

Bhutan’s foray into Bitcoin mining began discreetly around 2020, spearheaded by Druk Holding and Investments (DHI), the state-owned investment arm. Leveraging the country’s abundant and relatively inexpensive hydropower resources, DHI established Bitcoin mining operations, transforming renewable energy into digital gold. This strategic decision positioned Bhutan as a pioneer in environmentally conscious Bitcoin mining, capitalizing on its natural resources while contributing to the global Bitcoin network.

The motivation behind this venture likely stems from a desire to diversify Bhutan’s economy and augment its national wealth. The kingdom’s economy traditionally relies on agriculture, forestry, and tourism. By embracing Bitcoin, Bhutan sought to tap into a rapidly growing asset class, potentially generating substantial revenue streams and bolstering its financial reserves. Furthermore, Bitcoin, with its decentralized nature, could offer a hedge against traditional financial systems and geopolitical uncertainties.

Decoding the Binance Transfers: Profit-Taking or Strategic Maneuvering?

Recent on-chain data reveals that the Royal Government of Bhutan has been actively transferring Bitcoin to Binance, raising eyebrows and prompting various interpretations. In July 2025, two transactions, each involving approximately 213.5 BTC (worth around $23.73 million), were executed, sending ripples through the crypto community. These transfers occurred amidst a Bitcoin surge, with the cryptocurrency reaching new all-time highs above $112,000.

One prevailing theory suggests that Bhutan is engaging in strategic profit-taking. By selling Bitcoin during periods of high prices, the kingdom can realize substantial gains, converting its digital assets into fiat currency to fund government initiatives, infrastructure projects, or other national priorities. This approach aligns with sound financial management principles, allowing Bhutan to maximize the value of its Bitcoin holdings and reinvest the proceeds into its economy.

However, some analysts argue that the Binance transfers may signify a more complex strategy. Rather than simply selling off its Bitcoin, Bhutan could be using the exchange for various purposes, such as:

- Liquidity Provision: Depositing Bitcoin on Binance could enable Bhutan to participate in liquidity pools, earning additional income through transaction fees.

- Trading and Arbitrage: The kingdom could be actively trading Bitcoin and other cryptocurrencies to capitalize on market fluctuations and arbitrage opportunities.

- Diversification: Bhutan might be using Binance to diversify its crypto holdings, exchanging Bitcoin for other digital assets with different risk profiles and growth potential.

- Custody Solutions: While seemingly counterintuitive, Bhutan might be leveraging Binance’s robust security infrastructure for the secure storage of a portion of its Bitcoin reserves.

It’s essential to remember that the precise reasons behind these transactions remain shrouded in mystery, as the Bhutanese government has not officially disclosed its crypto strategy.

The Broader Implications: Bhutan as a Crypto Pioneer

Bhutan’s involvement in Bitcoin mining and trading has broader implications for the cryptocurrency industry and the global financial landscape. The kingdom’s actions demonstrate that even small, traditionally conservative nations can embrace digital assets and leverage them for economic growth and diversification.

Bhutan’s commitment to hydropower-powered Bitcoin mining also sets a positive example for sustainable practices within the industry. By utilizing renewable energy resources, the kingdom is mitigating the environmental concerns associated with Bitcoin mining, promoting a greener and more responsible approach.

Furthermore, Bhutan’s Bitcoin strategy could inspire other countries, particularly those with abundant renewable energy resources or a desire to diversify their economies, to explore the potential of digital assets. As more nations embrace cryptocurrencies, the industry’s legitimacy and adoption will likely increase, paving the way for a more decentralized and inclusive financial system.

Challenges and Considerations

Despite the potential benefits, Bhutan’s Bitcoin strategy also presents certain challenges and considerations:

- Volatility Risk: Bitcoin’s price is notoriously volatile, and significant fluctuations could impact the value of Bhutan’s holdings, potentially affecting its national wealth.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions. Changes in regulations could impact Bhutan’s ability to mine, trade, or hold Bitcoin.

- Security Risks: Storing and managing large amounts of Bitcoin requires robust security measures to protect against hacking, theft, and other cyber threats.

- Transparency Concerns: The lack of transparency surrounding Bhutan’s crypto strategy raises concerns about accountability and potential misuse of funds.

Addressing these challenges will be crucial for ensuring the long-term success and sustainability of Bhutan’s Bitcoin venture.

A Kingdom’s Crypto Crossroads

Bhutan’s dance with Bitcoin represents a bold and potentially transformative step for the Himalayan kingdom. While the precise motivations behind the recent Binance transfers remain unclear, they underscore the evolving nature of Bhutan’s crypto strategy and its willingness to adapt to market dynamics. Whether it’s profit-taking, strategic maneuvering, or a combination of both, Bhutan’s experiment with Bitcoin offers valuable lessons for other nations considering embracing digital assets.

The story of Bhutan and Bitcoin is more than just a financial tale; it’s a narrative about innovation, adaptation, and the pursuit of economic prosperity in a rapidly changing world. As Bhutan continues to navigate the complexities of the crypto landscape, its actions will undoubtedly be closely watched by governments, investors, and crypto enthusiasts around the globe. The kingdom’s cautious yet determined approach could serve as a model for responsible and sustainable crypto adoption, paving the way for a future where digital assets play a more prominent role in the global economy.

The Enduring Enigma of Bhutan’s Bitcoin Bet

Ultimately, the true extent of Bhutan’s long-term vision remains a captivating enigma, leaving us to ponder: Is the Kingdom merely a savvy investor capitalizing on a lucrative opportunity, or is it subtly positioning itself as a pioneering force in a decentralized future? Only time will reveal the complete narrative of Bhutan’s crypto journey, and its impact on both the Kingdom and the wider world.