The European Central Bank (ECB) has recently proposed a plan to redirect retail savings into capital markets, a move that has sparked significant debate and drawn comparisons to Marxist economic policies. This proposal, while controversial, aims to address several economic challenges facing the European Union (EU), including low interest rates, underdeveloped capital markets, and the need to finance strategic projects. The initiative seeks to create standardized savings products that would encourage individuals to invest in capital markets, thereby deepening market liquidity and supporting economic growth.

Understanding the ECB Proposal

The ECB’s proposal is rooted in the current economic landscape, where traditional savings accounts offer minimal returns due to persistently low interest rates. This environment has left many savers seeking alternative investment opportunities. Additionally, the EU’s capital markets are relatively underdeveloped compared to those of other major economies, such as the United States. This underdevelopment limits the availability of funding for businesses and innovative projects. The ECB’s plan aims to address these issues by creating new savings products that would divert a portion of retail savings into capital markets.

These new products would be designed to be standardized, transparent, and potentially partially guaranteed or insured to reassure cautious savers. The goal is to make these products accessible and appealing to a broad range of investors, including those who may be unfamiliar with capital markets. By doing so, the ECB hopes to encourage greater participation in capital markets, which would not only benefit individual savers but also support the broader economy by providing more stable funding sources for businesses and strategic projects.

Mechanisms of Redirection: The New EU Savings Products

The proposed savings products would feature several key elements to ensure their success. First, they would be standardized across the EU to ensure transparency and comparability. This standardization would help investors understand the risks and potential returns associated with these products, making them more likely to participate. Second, the products would offer risk diversification by combining bonds, equities, and other assets to balance risk and return according to different saver profiles. This diversification would help mitigate the risks associated with investing in capital markets, particularly for those who are new to such investments.

Additionally, the products would be designed to be easily accessible and liquid, allowing investors to purchase and sell them with relative ease. This liquidity is crucial for attracting risk-averse individuals who may be hesitant to invest in capital markets due to concerns about being locked into long-term investments. Finally, the products would be subject to a coordinated regulatory framework to build trust and safety. This framework would address the fragmented regulatory landscape across EU member states, ensuring that investors are protected and that the products are reliable.

Potential Economic and Social Impacts

The ECB’s proposal has the potential to bring about several benefits for both savers and capital markets. For savers, these new products could offer higher returns and greater wealth accumulation over the long term. Capital market instruments generally outperform traditional savings accounts and government bonds, providing investors with the opportunity to grow their wealth more effectively. Additionally, these products would allow savers to diversify their savings, spreading risk across different asset classes and reducing the impact of market volatility on their overall portfolio.

For capital markets, greater retail participation would deepen liquidity, stabilize markets, and provide companies with more stable capital sources. This increased liquidity would make it easier for businesses to access the funding they need to grow and innovate, supporting economic growth and job creation. Furthermore, by channeling retail savings into capital markets, the ECB aims to finance strategic projects that are critical for the EU’s future competitiveness, such as infrastructure development, the green transition, and digitalization.

However, the proposal also carries certain risks and concerns. One of the primary risks is the increased exposure to market volatility that retail investors may face. Many individuals are unfamiliar with capital markets and may not fully understand the risks associated with investing in them. This lack of knowledge could lead to significant losses, particularly during periods of market volatility. To mitigate this risk, the ECB would need to ensure that investors are adequately educated about the potential risks and rewards of investing in capital markets.

Another concern is the potential for behavioral challenges, such as impulsive withdrawals or a lack of long-term commitment to investments. To address this, the ECB would need to implement measures to encourage investors to stay invested for the long term, such as offering incentives for long-term holding periods or providing clear communication about the benefits of long-term investing.

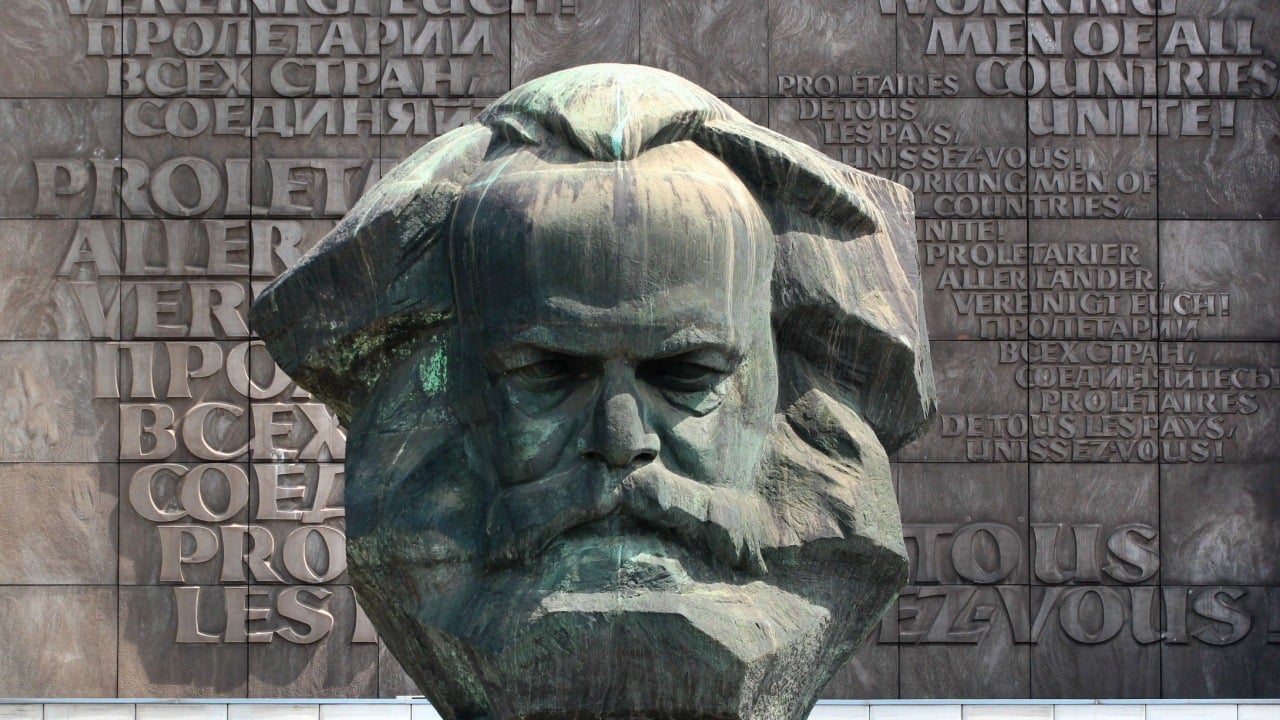

Finally, the proposal has sparked political backlash and ideological framing, with some critics labeling it as “Marxist.” This characterization reflects underlying tensions between those who advocate for greater state-guided economic coordination and those who support purely free markets. The ECB’s proposal is not intended to dismantle property rights or free market mechanisms but rather to improve market efficiency and mobilize private resources for mutual benefit. However, the political and ideological sensitivities surrounding the proposal cannot be ignored, and the ECB would need to navigate these carefully to ensure the success of the initiative.

The “Marxism” Label: Why the Controversy?

The label of “Marxism” attached to the ECB’s proposal stems from critics interpreting the plan as a form of “planned” or “controlled” capital allocation. This interpretation reflects a broader clash of economic philosophies, with free-market purists viewing any government intervention in the economy as an infringement on personal freedom and market signals. Additionally, critics wary of increased EU-level economic integration or direction may frame these initiatives as creeping centralization or socialism.

However, the ECB’s proposal is not driven by ideological motivations but rather by a pragmatic attempt to address structural shortcomings in Europe’s financial ecosystem. The plan aims to improve market efficiency and mobilize private resources for mutual benefit, not to dismantle property rights or free market mechanisms. Nevertheless, the political and ideological sensitivities surrounding the proposal cannot be ignored, and the ECB would need to navigate these carefully to ensure the success of the initiative.

Contextualizing with Cryptocurrency and Alternative Money Systems

The rise of cryptocurrencies like Bitcoin has challenged traditional monetary and capital market systems. While cryptocurrencies offer the potential to redistribute wealth toward early adopters, they also come with significant risks, such as speculative nature and limited real economic need. In contrast, the ECB’s proposal provides a counterbalance by offering savers a route toward productive investment within a safer, controlled framework.

This contrast highlights a larger financial evolution: while decentralized digital assets appeal due to distrust in centralized authorities, regulated financial innovations seek to harness capital effectively for broad economic development. The ECB’s approach reflects confidence in structured markets while acknowledging risks and the need for regulatory oversight. As Europe navigates the intersections of traditional finance and disruptive technologies, the marriage of policy innovation and market development will be critical to enhancing prosperity across the region.

Conclusion: Navigating Between Innovation and Stability

The ECB’s proposal to channel retail savings into capital markets through standardized EU savings products represents a bold, strategic move to deepen Europe’s financial markets and support economic priorities. While not without risks and political sensitivities, it addresses fundamental economic challenges, from boosting savers’ returns to financing innovation and sustainability.

Far from “Marxism,” this initiative exemplifies pragmatic policymaking aimed at balancing individual investor protection with systemic growth imperatives. The success of such efforts hinges on effective regulation, investor education, and transparent communication to build trust. As Europe navigates the intersections of traditional finance and disruptive technologies, the marriage of policy innovation and market development will be critical to enhancing prosperity across the region.