Navigating the Role of AI in Shaping the 2025 Financial and Crypto Ecosystem

—

The New Architect of Finance: How AI Is Steering the Future

Imagine a world where financial markets react not just to human intuition but to a seamless stream of data analyzed in real time by intelligent systems. This is not some distant sci-fi fantasy — it’s unfolding right now in 2025, fundamentally altering the landscape of crypto and traditional finance. Artificial Intelligence (AI) acts no longer as a background tool but as a central driver, transforming decision-making and market interactions.

From AI-powered prediction markets to automated smart contracts, AI’s expansion into finance is more than technological progress—it’s a cultural shift redefining trust, speed, and accessibility.

—

AI as the Pulse of Crypto Prediction and Trading

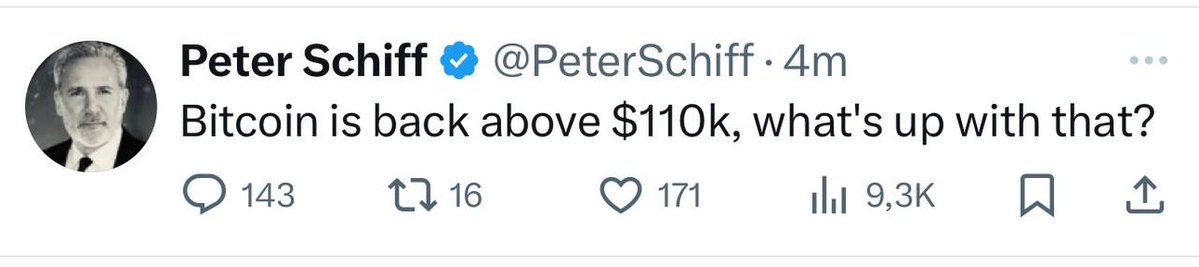

One of the most palpable impacts of AI is its integration into crypto market forecasting. Platforms like the partnership between Elon Musk’s rebranded X and Polymarket leverage AI-driven insights (notably Grok by xAI) to analyze news, social trends, and trading patterns in real time. This melding of AI and crowd-sourced data delivers an unprecedented predictive edge.

– Dynamic Sentiment Analysis: AI tools sift through millions of social media posts, financial reports, and news sources to gauge market mood instantly.

– Enhanced Decision Support: Traders—from novices to institutions—receive actionable insights tailored to their strategies, improving timing and risk management.

– Interactive Prediction Markets: AI allows markets to respond dynamically, where price movements are influenced not just by trades but by live data interpreted by algorithms.

This phenomenon signals a future where financial decisions are collaborative dialogues between human intuition and machine precision.

—

Democratizing Finance: AI Breaking Down Barriers

Artificial Intelligence isn’t just for hedge funds and Wall Street firms. Its infusion into accessible platforms encourages broader participation:

– No-Code Smart Contracts: AI-driven interfaces enable users without programming skills to create secure, automated contracts, opening DeFi and blockchain tech to everyday investors.

– AI-Powered Research Assistants: Tools like Chain GPT simplify complex blockchain research, providing insights and technical analysis through conversational interfaces integrated in apps like Telegram.

– Guided Trading Communities: VIP groups now incorporate AI analytics to coach members on entry and exit strategies, making disciplined, informed trading achievable without exhaustive technical background.

This evolution reshapes finance from an elite game into a knowledge-rich arena encouraging learning and inclusion.

—

AI Meets NFTs and Digital Assets: Creating New Ecosystems

The fusion of AI with Non-Fungible Tokens (NFTs) and gaming represents a fascinating frontier. Take Pixel Ground (PG) NFTs as an example—these collectibles aren’t just static art but interactive gaming assets enhanced by AI algorithms that personalize experiences and predict trends.

AI contributes by:

– Generating Intelligent NFTs: AI-created art and dynamic tokens that evolve based on user interaction foster a living digital economy.

– Valuation and Market Prediction: Machine learning models assist in determining NFT worth and advising on optimal buying or selling windows.

– Community Engagement: AI moderates and stimulates social platforms around NFT projects, cultivating vibrant ecosystems.

This interplay is expanding NFTs beyond speculation into functional, integrated digital assets.

—

Managing Risk and Ethical Considerations: The AI Double-Edged Sword

While AI dramatically augments capabilities, it also introduces novel risks:

– Market Volatility Amplification: High-frequency AI trading algorithms can exacerbate rapid price swings if unchecked.

– Algorithmic Bias and Transparency: AI models may embed biases from training data, influencing investment advice in unintended ways.

– Security Concerns: Automated smart contracts require rigorous auditing as bugs or exploits could be financially devastating.

Thus, balancing AI innovation with regulation, transparency, and education is crucial for sustainable growth.

—

The Road Ahead: What’s Next for AI in Finance?

Looking forward, AI’s trajectory in finance points toward deeper personalization, integration, and autonomy:

– Hyper-Personalized Financial Products: AI will craft individualized portfolios and risk profiles, dynamically adapting to market conditions and user goals.

– Cross-Chain and Multi-Asset Intelligence: Integrative AI will navigate complex webs of tokens, stocks, and commodities with fluid strategy execution.

– Human-AI Collaboration: Financial analysts and AI will coalesce into hybrid teams where insight and creativity join computational power.

The vision is a financial ecosystem where AI empowers, educates, and amplifies human potential without replacing it.

—

Concluding Thoughts: Embracing AI as Co-Pilot, Not Replacement

Artificial Intelligence is unquestionably revolutionizing the way we engage with crypto and traditional finance in 2025. The blend of AI’s speed and analytical depth with human judgment charts a new course in financial markets—one full of promise but demanding vigilance.

Investors who cultivate AI literacy, remain skeptical of black-box solutions, and partake in community learning will harness the best of both worlds. As AI increasingly takes the wheel, consider it your co-pilot—guiding through turbulence, spotting new horizons, but still relying on the pilot’s insight to truly soar.

—

For Further Insight:

– X and Polymarket Partnership Announcement

– Chain GPT AI on Telegram

– Pixel Ground NFT Analysis

– Alex’s Crypto Recovery Twitter

– Crypto Bulletin Disclaimer Tweet

By observing and adapting to AI’s evolving role, financiers and enthusiasts alike can better navigate the complex currents of 2025’s financial seas.