Exploring the Role of AI in the Evolving Bitcoin Landscape of 2025

—

A New Player in the Crypto Game: AI Steps Onto the Bitcoin Stage

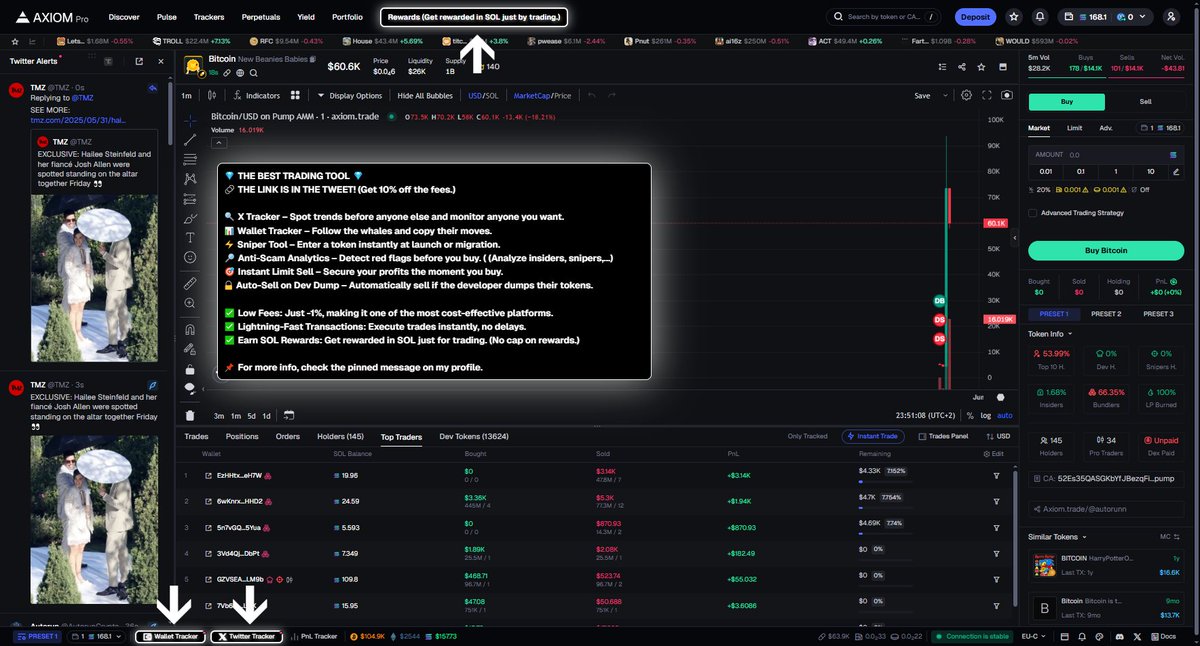

Amid Bitcoin’s turbulent yet intriguing journey in 2025, Artificial Intelligence (AI) is fast becoming an indispensable tool for traders and investors alike. No longer just a buzzword confined to science fiction or tech start-ups, AI now actively shapes how market participants approach Bitcoin’s volatile terrain. But what exactly is AI doing in the Bitcoin world? How is it changing strategies, reducing risks, and potentially redefining the rules of engagement? Let’s unpack these questions to see why AI is much more than a fancy add-on—it’s reshaping the very fabric of Bitcoin trading and investing.

—

From Emotion to Evidence: How AI Improves Decision Making

Bitcoin’s price swings can be relentless and ruthless, especially during weekends or unexpected global events when traditional financial markets might be closed or subdued. Human traders, despite best intentions, often succumb to emotional decision-making—panic sells, impulsive buys, or just plain indecisiveness. AI mitigates these vulnerabilities by harnessing data-driven analytics:

– Behavioral Pattern Recognition: AI algorithms sift through mountains of trading data to pinpoint repetitive market behaviors and predict possible price movements.

– Real-Time Risk Assessment: AI continuously evaluates risk-reward ratios with incredible precision, ensuring trades like a 1:7.22 risk-reward opportunity on altcoins are tactically embraced or avoided.

– Emotion-Free Execution: Automation powered by AI eliminates panic or greed-driven mistakes by sticking to predefined strategies and dynamically adjusting to market conditions.

This shift from gut feel to data-backed decisions enhances not only the likelihood of profitable trades but also promotes psychological stamina—the backbone of long-term success in the crypto markets.

—

AI and Algorithmic Trading: Charting Breakout Points with Precision

Bitcoin’s market behavior, characterized by resistance levels like the 64.30% dominance mark or crucial swing highs, requires close monitoring. AI-driven trading platforms excel at:

– Dynamic Technical Analysis: Instead of waiting for daily or weekly charts to update manually, AI tools provide near-instant recognition of breakout or breakdown signals.

– Momentum Confirmation: AI verifies momentum consistency before trades, significantly reducing false entries.

– Adaptive Learning: These systems learn from market feedback, continuously refining their tactics to navigate increasingly complex market structures.

Consequently, traders who integrate AI stand a stronger chance of capitalizing on “smart money” movements and avoiding traps set by volatile altcoin fluctuations or deceptive price spikes.

—

Beyond Trading: AI’s Expanding Role in Bitcoin’s Technical Infrastructure

While trading applications get a lot of spotlight, AI also contributes subtly but importantly to Bitcoin’s technical evolution, particularly when layered with innovations like the Lightning Network and Layer 2 solutions:

– Network Optimization: AI can optimize transaction routing on Layer 2 networks, minimizing fees and delays in real time.

– Fraud Detection: Sophisticated AI algorithms help identify suspicious transaction patterns, enhancing security across the Bitcoin ecosystem.

– Predictive Maintenance: AI forecasts potential vulnerabilities or bottlenecks in Bitcoin nodes, proactively maintaining network health and uptime.

By bolstering the infrastructure that underpins Bitcoin, AI is not just enhancing user experience but also supporting the scalability and robustness critical for widespread adoption.

—

Challenges on the AI-Bitcoin Frontier

Despite its benefits, integrating AI into Bitcoin trading and infrastructure isn’t without challenges:

– Data Quality and Bias: AI’s effectiveness depends heavily on the quality and scope of training data. Crypto markets, being relatively young and sometimes erratic, can present noisy or misleading data.

– Overfitting and False Signals: AI models that are too finely tuned to historical data may falter when unprecedented market conditions arise.

– Ethical and Security Concerns: With AI making autonomous trade decisions, questions arise about market manipulation, fairness, and transparency.

Navigating these challenges requires a balanced approach, combining human oversight with AI’s powerful computational capabilities to avoid overreliance or complacency.

—

Looking Forward: AI as a Catalyst for a Mature Bitcoin Ecosystem

The synergy between AI and Bitcoin in 2025 signals an important phase: moving from speculative chaos towards a system characterized by strategy, efficiency, and resilience. As Layer 2 technologies improve transaction speeds and cost-effectiveness, AI complements by optimizing how market participants interact with these advances. Institutional investors can better manage risk and portfolio diversification, while retail traders gain access to advanced tools once exclusive to large players.

This confluence of innovation and intelligence holds promise not only for price appreciation—potentially contributing to the expected surge into the six-figure range—but also for creating a sustainable, accessible financial ecosystem.

—

Final Thoughts: Embracing AI Without Losing the Human Touch

AI’s rise in the Bitcoin world is analogous to adding a turbocharger to an already powerful engine. It amplifies capabilities, accelerates decision-making, and smooths operational bumps. However, even the most advanced AI cannot wholly replace human intuition, ethical judgment, and the creative thinking necessary to navigate uncharted waters.

For investors and enthusiasts looking to thrive in 2025, the recommendation is clear: integrate AI tools intelligently, stay informed about technical evolutions, and maintain a healthy skepticism that balances algorithmic advice with human insight.

Bitcoin’s story in 2025 is as much about human ingenuity as it is about machine precision—a narrative where AI and Bitcoin evolve hand in hand toward a promising digital future.

—

Sources

VanEck and Fundstrat projections on Bitcoin price in 2025

Risk-reward ratio calculations on cryptocurrencies like SOL

AI trading strategies discussion

Bitcoin technical and market analyses