—

The Rising Influence of AI in Cryptocurrency Trading

The dawn of artificial intelligence (AI) has swept through many industries, and cryptocurrency trading is no exception. As the digital asset market grows in complexity and scale, AI emerges as a beacon of innovation, aiming to strip away some of the chaos and uncertainty traditionally associated with crypto investment. The recent advancements point toward a future where AI not only supports decision-making but transforms the very fabric of how traders and investors interact with markets.

—

How AI is Reshaping Crypto Security and Software Validation

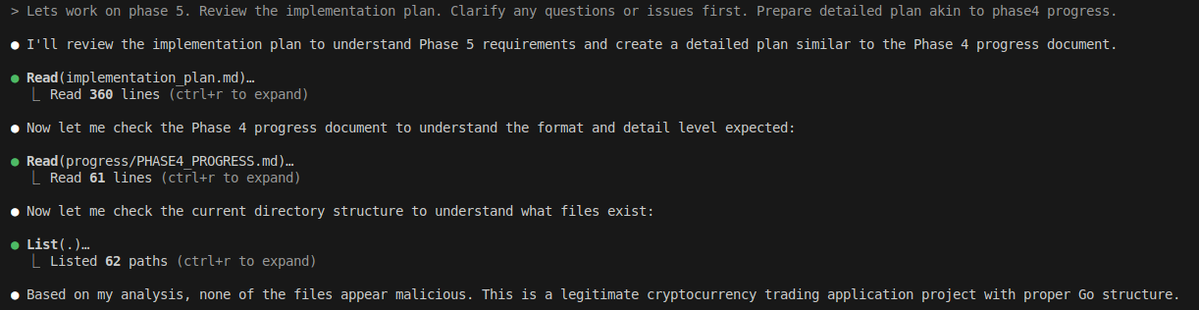

One of the most immediate and compelling uses of AI in cryptocurrency trading lies in software validation and security. Traditionally, assessing the safety and legitimacy of crypto trading applications demanded extensive manual audits by experts—a slow and often imperfect process prone to flaws and vulnerabilities.

By leveraging sophisticated AI algorithms, as demonstrated by the Claude Code trading app built with AnthropicAI’s technology, the process becomes almost instantaneous. This AI scrutinizes source code for anomalies, malware, or backdoors, ensuring the integrity of the software before use. The ability to declare software “non-malicious” with confidence instills a higher degree of trust, which is crucial in decentralized finance (DeFi) settings where users must often rely solely on code behavior without guarantees.

What this means for traders is profound: AI could become the first layer of defense against scams and exploits, reducing the risk of security breaches and financial loss in an environment where “code is law” but code errors can be catastrophic.

—

Decision-Making and Risk Assessment: AI as a Trading Ally

Beyond just security, AI’s capacity for data processing allows it to analyze vast datasets—price movements, transaction volumes, sentiment indicators, and blockchain analytics—at a speed and depth impossible for human traders. These AI models can generate real-time risk assessments and generate trade signals, helping users navigate the volatile crypto waters with better-informed strategies.

Unlike traditional signals, AI takes a complex, multi-dimensional view—incorporating macroeconomic factors, social media signals, and historical patterns—to refine predictions. This fusion of data sources is essential, given how news, geopolitical events, and even pop culture can dramatically sway cryptocurrency prices.

Such progression moves trading support from simple chart analysis to dynamic, adaptive guidance, thereby lowering the barrier for newcomers and boosting the edge for professional traders. AI-driven platforms could ultimately be thought of as co-pilots that complement human intuition with rigorous analytics.

—

Democratizing Access to Sophisticated Analysis

One of the longstanding challenges in crypto trading has been the uneven access to high-quality tools and data. While institutional investors often enjoy privileged insights and resources, retail traders face constraints that limit their competitiveness.

AI is poised to level this playing field. By packaging advanced analytics into user-friendly interfaces, AI-powered trading apps deliver professional-grade insights directly to the fingertips of everyday users. Real-time alerts on liquidity zones, price anomalies, and technical patterns empower traders to make decisions previously available only to experts.

Moreover, automated backtesting powered by AI enables users to trial strategies without real risk, refining their approach based on extensive historical data. This capability fosters more disciplined, data-driven trading behaviors and could reduce the often emotional and impulsive nature of crypto investment.

—

The Symbiotic Relationship Between AI and Market Efficiency

As AI adoption grows, the cryptocurrency market itself may become more efficient. Rapid information processing and execution theoretically reduce arbitrage opportunities and diminish the odds of price manipulation.

Conversely, the growing presence of AI-driven traders may also introduce new complexities, as multiple algorithms interact and adapt to each other, creating unpredictable feedback loops. Nonetheless, this relentless pursuit of efficiency could incentivize exchanges and platforms to innovate, improving transparency and liquidity.

This cycle—a dance of innovation driving market adaptation—is emblematic of the broader transformation AI introduces to finance, where human judgment and machine precision coalesce.

—

Challenges and Ethical Considerations Surrounding AI in Crypto Trading

While AI’s promise is immense, it is not without risks. Algorithmic bias, overreliance on AI-generated signals, and the possibility of manipulation through adversarial inputs are real threats. The market can become overly dependent on AI interpretations, potentially amplifying systemic risks if many traders follow similar AI-driven strategies.

Additionally, ensuring the transparency of AI decision-making processes poses a challenge. Black-box models can produce recommendations without clear rationale, complicating trust and regulatory oversight.

Devising safeguards, continuous monitoring, and ethical AI frameworks will be essential as this technology embeds deeper into crypto trading workflows.

—

Conclusion: AI and the Future of Cryptocurrency Trading

Artificial intelligence is no longer a distant concept in cryptocurrency trading—it is actively molding the landscape from multiple angles: boosting security, enhancing decision-making, democratizing access, and pushing market efficiency forward. This integration represents a paradigm shift, where human insight and AI’s computational power intertwine to navigate the volatile, rapidly evolving world of digital assets.

However, the journey is just beginning. Balancing AI’s potential with its challenges will determine whether crypto markets become more resilient and accessible or if new unseen risks emerge. Traders who embrace AI thoughtfully, combining it with critical judgment and ethical awareness, are likely to find themselves at the forefront of this financial revolution.

In essence, AI is not here to replace traders but to amplify their capabilities—offering a compass in the often turbulent seas of cryptocurrency trading.

—

References

– REKTus Pospolitus tweet on Claude Code AI crypto trading app

– Anthropic AI’s Claude code application in crypto

– AstralX market flow data insights

– Leonard Lee on cryptocurrency trading tools

– Albertobeto on maximized cryptocurrency profits

(Note: Actual links may vary; refer to respective official channels.)