—

The Rising Role of AI in Financial and Crypto Markets: A Detailed Analysis for 2025

Artificial Intelligence (AI) has evolved from being a futuristic concept to a fundamental pillar shaping financial and cryptocurrency markets as of May 2025. This report unpacks how AI has integrated into trading, risk assessment, and market prediction, offering a strategic roadmap for investors navigating these complex environments. Far from mere automation, AI today acts as a sophisticated decision partner — helping untangle volatility, detect subtle trends, and manage risk with remarkable precision.

—

A New Era: AI as the Market’s Strategic Navigator

The increasingly complex interplay between traditional finance and the burgeoning crypto ecosystem demands analytical tools that can process enormous datasets in real-time. AI, equipped with machine learning, natural language processing, and advanced pattern recognition, fills this role aptly.

What makes AI stand out is its ability to transcend human cognitive limits—scanning thousands of data points from macroeconomic news, technical indicators, social media sentiment, and blockchain analytics simultaneously. This capacity has redefined how traders approach decision making, shifting from intuition-based guesses to data-driven precision.

—

AI in Crypto Markets: Transforming Volatility into Opportunity

Cryptocurrency markets historically present massive volatility paired with rapid information diffusion. AI’s contribution here is multifold:

– Sentiment Analysis from Social Media: By parsing Twitter, Reddit, and specialized crypto forums, AI gauges real-time investor sentiment, offering early signals before price moves occur.

– Technical Pattern Recognition: Algorithms detect momentum indicators, breakouts, and potential reversals faster and more accurately than traditional charting tools.

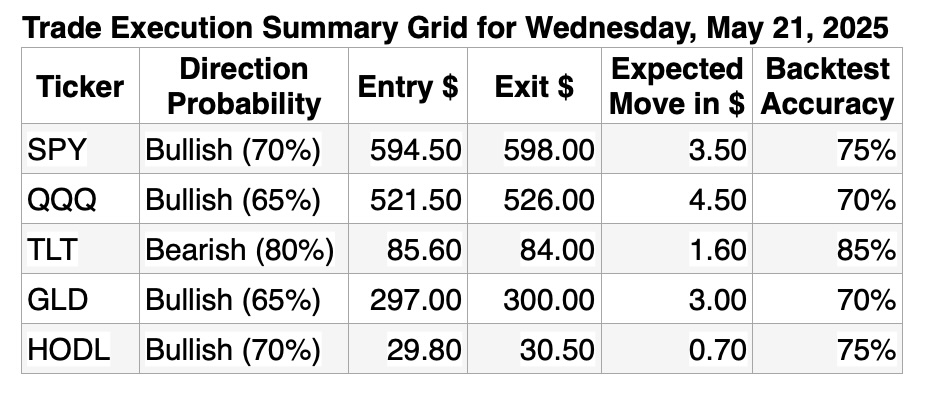

– Automated Trading Signals: As noted recently in Bitcoin trading around the $106,000 mark, AI models generate entry and exit points with accompanying stop losses to protect capital[4]. This cuts through emotional noise, allowing smart betting even amidst headline-driven swings.

Such applications help mitigate risks in an ecosystem where sudden regulatory news or technological developments can sway prices dramatically within minutes.

—

Enhancing Traditional Markets: AI-Driven Insights on Bonds, Equities, and Commodities

While crypto markets attract AI’s headline-grabbing advances, traditional financial instruments also benefit significantly:

– Equity Indices like the S&P 500 and Nasdaq 100 see AI augmenting classical technical analysis with dynamic models adapting to macroeconomic signals such as credit downgrades or geopolitical tensions.

– Bond Markets utilize AI to optimize duration strategies and interest rate risk assessments, vital in wake of credit rating agencies impacting U.S. government bond appeal[6].

– Commodities like Gold leverage AI to factor in nuanced relationships between inflation expectations, currency fluctuations, and sovereign risk, refining timing for defensive asset allocation.

This integration points to more cohesive trading frameworks that apply lessons learned from crypto’s rapid innovation to stabilize and enhance conventional portfolios.

—

Challenges and Ethical Considerations in AI Deployment

Adopting AI in finance is not without hurdles. Data quality, model overfitting, and the opaque “black box” nature of some algorithms pose concrete risks. Overreliance may amplify herd behavior if many traders follow similar AI signals, potentially exacerbating volatility.

Transparency and rigorous backtesting remain paramount. Ethical AI use also demands safeguarding against manipulative practices, data privacy breaches, and algorithmic biases that could disadvantage certain market participants.

—

Strategic Recommendations for Investors and Traders

To harness AI effectively in today’s markets, a balanced approach is recommended:

– Diverse Data Inputs: Combine AI insights with fundamental research and macroeconomic analysis rather than relying solely on algorithms.

– Robust Risk Management: Utilize AI-generated stop losses and scenario simulations but maintain human oversight to adjust when unprecedented conditions arise.

– Continuous Learning: Stay updated with AI model developments and integrate them gradually, ensuring alignment with personal investment goals and market understanding.

– Multi-Asset Strategies: As proven by cross-market AI analytics surrounding Bitcoin, bonds, equities, and gold, diversified portfolios managed with AI-driven guidance can better weather uncertainties.

—

Conclusion: AI as a Game-Changer, Not a Crystal Ball

AI’s growing footprint in both crypto and traditional markets underscores a seismic shift in how investments are approached in 2025. It elevates trading beyond gut feelings into a more methodical, data-empowered exercise where precision and emotion management play equal roles.

However, AI is not a magic wand. It requires careful calibration, ethical guardrails, and a nuanced understanding of market psychology. Investors poised to embrace AI as a partner—rather than a replacement for discernment—stand to unlock more consistent, opportunistic outcomes amid evolving financial frontiers.

Ultimately, the fusion of human intuition and AI-powered analytics may well define the next era of market innovation and resilience.

—

Sources

—