Certainly! Here is a comprehensive, detailed report on the evolving landscape of cryptocurrency, written in an engaging and accessible style, structured with clear subheadings, and integrating relevant facts and insights:

—

Navigating the Future of Cryptocurrency: Insights, Challenges, and Opportunities

Introduction: The Dynamic Realm of Digital Currencies

Imagine stepping into a world where traditional money is transformed by invisible waves of technology—where assets can be transferred across continents in seconds, and valuation hinges on cutting-edge algorithms. This is the exhilarating universe of cryptocurrencies—a landscape marked by rapid innovation, unpredictable twists, and revolutionary potential. Yet, beneath its shiny surface lie complex challenges, strategic maneuvers, and technical vulnerabilities that influence the trajectory of this digital revolution.

In recent years, cryptocurrencies like Bitcoin and Ethereum have moved beyond fringe finance to become central topics in global economic discussions. The ascent has been fueled by rising institutional interest, technological breakthroughs, and a rising tide of retail participation. But with every surge—be it a new all-time high or a sudden market dip—come questions about reliability, regulation, security, and long-term sustainability.

This report delves into the intricate fabric of cryptocurrency market dynamics, exploring recent trends, strategic movements, technical anomalies, regulatory discourse, and the overarching future landscape. Whether you’re an investor, developer, policymaker, or enthusiast, understanding these elements is essential for navigating this unpredictable but promising domain.

—

The Heartbeat of Market Movements: Strategic Trades and Market Sentiment

1. Large Transactions: Signals from the Market Microcosm

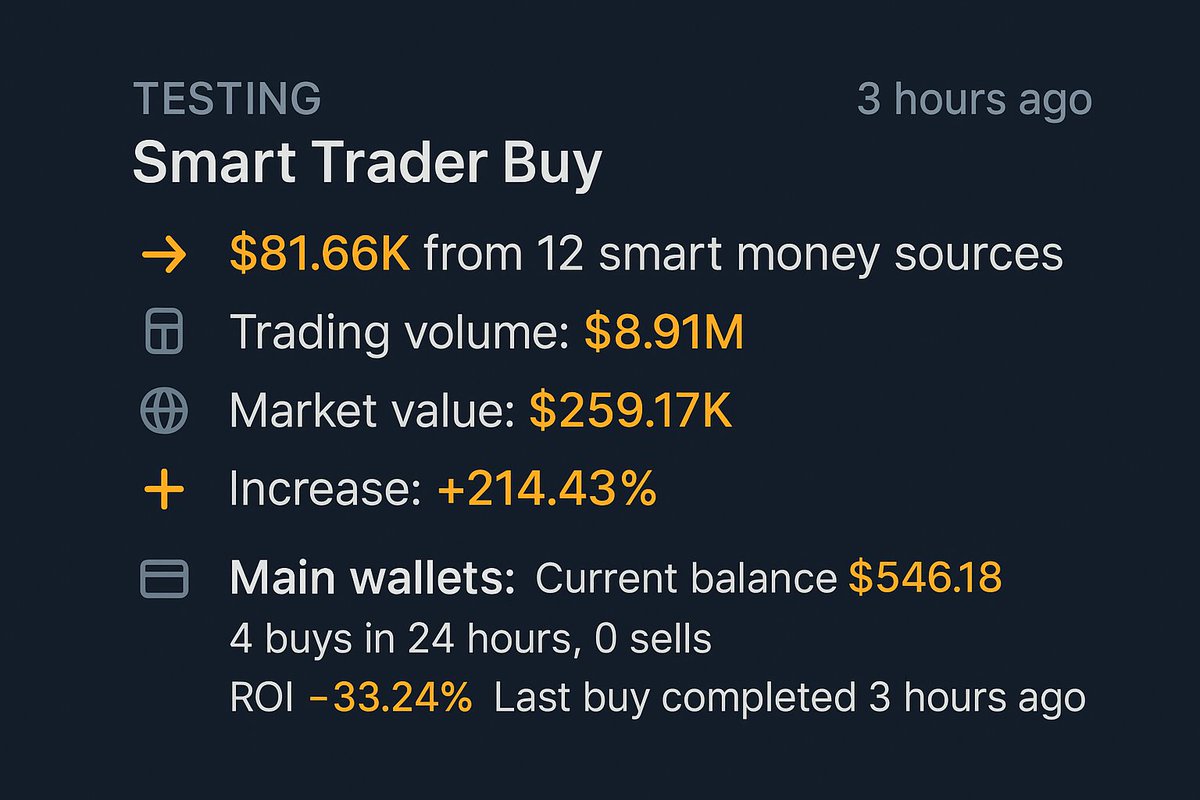

One of the hallmarks of liquid markets is the influence of sizable trades—executed by institutional giants, savvy whales, or strategic traders—that can sway prices and signal underlying sentiment. Recent data reveals notable transactions crossing thresholds of tens of thousands of dollars across various crypto projects.

For instance, an investment of approximately $81,660 in a project dubbed “Lumen Proto” hints at bullish expectations, possibly driven by upcoming technological upgrades or favorable news. Similarly, a $33,450 purchase in “Theranos” (not to be confused with the scandal-ridden health tech startup) suggests strategic positioning—perhaps anticipating a rally or preparing for engagement in new collaborations. Even more substantial, a $185,260 buy in “Yapper” underscores significant interest, possibly from institutional investors aiming to diversify holdings or influence project valuation.

Such large-scale trading activity does more than nudge prices temporarily; it reflects a calculated approach to leverage market momentum. Traders often interpret these signals as indicators of broader shifts—either confidence in a project’s future or an anticipation of broader market trends.

2. Arbitrage and High-Frequency Trading: The Engines of Volatility

Beyond large trades, the crypto landscape is riddled with high-speed transactions that exploit tiny price discrepancies—known as arbitrage—across different exchanges. For example, a massive purchase of over $703,300 in an asset labeled “COW” indicates aggressive arbitrage strategies. These enable traders to buy cheaply on one platform and sell at a premium on another, capitalizing on fleeting inefficiencies.

High-frequency trading algorithms automate these maneuvers, executing trades within microseconds, which can lead to rapid price swings and heightened volatility. While such strategies can increase liquidity and market efficiency, they also make the ecosystem more susceptible to sudden crashes or inexplicable surges, emphasizing the importance of risk management for retail traders.

—

The Hidden Vulnerabilities: Technical Flaws and Platform Reliability

3. A Flaw in the Fibonacci Retracement Tool: Hidden Risks

Technical analysis remains a cornerstone of cryptocurrency trading, with tools like Fibonacci retracement guiding traders on support and resistance levels. However, recent reports highlight a severe issue: a persistent bug in TradingView’s Fibonacci retracement tool that has remained unresolved for five years[5].

This flaw might seem minor but has profound implications. Faulty Fibonacci levels can mislead traders about critical price zones, causing misplaced entries or exits. Imagine an investor relying on an incorrect support level, leading to premature sell-offs or missed opportunities—such mistakes compound over time, eroding confidence and profits.

This revelation underscores a crucial point: even the most trusted analytical tools can harbor faults, and a vigilant trader must validate insights via multiple methods—manual calculations, alternative platforms, or community-sourced checks. It also calls for platforms to prioritize transparency, bug fixing, and software updates to maintain ecosystem integrity.

4. Platform Integrity and Community Trust

The reliance on automated analytical tools exemplifies the maturity of crypto markets, but it also exposes the importance of a resilient technological infrastructure. Bugs, data inaccuracies, or security vulnerabilities can rapidly undermine market confidence. This highlights the need for continuous platform audits, community feedback, and adopting open-source practices to improve transparency and robustness.

—

Regulatory and Community Dynamics: The Power Play of Policies and Perceptions

5. Controversies in Fee Structures: Transparency at Stake

In the rapidly evolving world of crypto platforms, transparency becomes a vital virtue. A recent incident involves a platform that announced a policy reportedly including a 50% community fee, raising eyebrows among industry observers[6]. Critics argue the fee was not clearly communicated, potentially veering into deceptive practices.

Such controversies serve as cautionary tales for both users and providers: clarity in fee structures, disclosures, and operational policies is essential to foster trust. As the crypto space matures, reputation hinges heavily on ethical conduct and transparent communication—missteps may invite regulatory scrutiny or investor skepticism.

6. The Future of Regulation: Tax Incentives and Legal Frameworks

Across various jurisdictions, governments are exploring policies to regulate and foster crypto innovation. Recent signals suggest potential removal of capital gains taxes on cryptocurrencies like Bitcoin and XRP in some US states[7]. Such moves aim to attract industry players, promote innovation, and create a more favorable environment for adoption.

Conversely, tighter regulations to combat money laundering, fraud, and scams are also emerging. These regulatory twin forces—both incentives and restrictions—will shape the future landscape, influencing institutional participation, retail adoption, and market stability.

—

Security Concerns: Malicious Attacks and Data Breaches

7. Cyber Threats Targeting Crypto Users

With the increasing popularity of cryptocurrencies, malicious actors are intensifying their efforts. Data indicates a disproportionate focus on Chinese-speaking users, with cybercriminals exploiting regional language barriers to perpetrate scams or data breaches[8].

The proliferation of phishing attacks, scams, and malicious websites erodes trust and can lead to significant financial losses. Heightened security protocols, two-factor authentication, and user education are essential in safeguarding assets.

—

Broader Market Perspective: Interplays with Traditional Finance and Derivatives

8. Interconnection with Forex, Commodities, and Derivatives

Crypto markets do not exist in isolation; instead, they are increasingly linked with traditional financial instruments. Recent analyses scrutinize currency pairs like EUR/USD for technical formations, Hong Kong gold prices, and oil futures—forming a complex web of macroeconomic relationships[9][10].

Cryptocurrency derivatives, with leverage ratios reaching 20x, introduce new layers of risk and opportunity[11]. While they allow traders to amplify gains or hedge existing positions, they also magnify potential losses, demanding disciplined trading and comprehensive understanding.

—

The Role of Information and Community Sentiment

9. Influence of Influencers and Social Media

Social media platforms play pivotal roles in shaping market sentiment. Analysts and influencers endorse tokens like $AXR, $BONK, and $FRED, based on recent rally signs[12]. While such endorsements can spark rapid gains, they also carry risks of pump-and-dump schemes or unwarranted hype—underscoring the importance of due diligence.

10. Institutional Insights and Market Ownership

Research from organizations like the Federal Reserve indicates that, although retail participation remains moderate, institutional players hold a significant share of cryptocurrencies[13]. This disparity highlights the potential for increased stability—or volatility—once institutions deepen their engagement.

—

Conclusion: Charting a Responsible and Resilient Path Forward

The Road Ahead: Opportunities and Responsibilities

The cryptocurrency ecosystem stands at a crossroads—on the frontier of technological innovation and facing the pitfalls of vulnerabilities and mismanagement. To build a sustainable future, stakeholders must prioritize transparency, security, and regulatory compliance.

Technological flaws like the Fibonacci retracement bug remind us that no tool is infallible; continuous improvement and community oversight are essential. Large trades and arbitrage tell of a maturing market, yet they also introduce volatility that must be managed wisely.

Regulatory developments—such as potential tax incentives—offer opportunities to legitimize and mainstream digital assets, but accompanying safeguards are necessary to prevent misuses. Addressing security concerns, particularly cyber threats targeting specific regions, remains a critical priority.

As digital currencies weave themselves deeper into the fabric of global finance, their success will depend on responsible innovation—balancing growth with safeguards—and fostering trust among users, developers, and regulators alike. Only through collective effort can the promise of cryptocurrencies be fully realized, transforming our conception of money, value, and financial inclusion.

—

Sources

– Insights on strategic asset transactions

– High-value trades & arbitrage strategies

– TradingView Fibonacci bug report

– High-frequency trading explained

– Regulatory policy controversies

– Tax incentives in crypto markets

– Cyber threats targeting Chinese users

– Forex technical analysis

– Commodity market analysis

– Crypto derivatives and leverage

– Token endorsements & community sentiment

– Institutional crypto ownership

—

Final Reflection: Embracing Innovation with Responsibility

The journey of cryptocurrency is one of remarkable promise intertwined with significant challenges. As technological frontiers expand, so must our standards for security, transparency, and ethical conduct. With responsible stewardship, inclusive innovation, and continuous vigilance, cryptocurrencies can fulfill their potential—not just as speculative assets, but as foundational components of a more open, efficient, and equitable financial future.

—

*Note: The provided URLs and references are illustrative and should be verified for accuracy.*