Certainly! Here’s a detailed, engaging, and professionally crafted analysis and report on the evolving landscape of the NFT and cryptocurrency ecosystem in 2025, adhering to your specified requirements:

—

The Digital Revolution’s Next Chapter: Navigating the Complex Terrain of NFTs and Cryptocurrency in 2025

*Introduction: Embracing the Dawn of a New Era*

Imagine walking into a bustling marketplace not of physical goods, but a vibrant digital universe brimming with assets, stories, and communities—all grounded on blockchain technology. It’s 2025, and the landscape of NFTs and cryptocurrencies has transformed into a complex, yet fascinating realm that continues to evolve at breakneck speed. For newcomers and veterans alike, understanding this ecosystem can seem daunting, filled with technical jargon, market manipulations, technological innovations, and profound societal implications.

But what if we could decode this landscape in simple terms? What if behind the seemingly chaotic activity lies a pattern—an intricate dance of technology, finance, and human behavior? This report aims to peel back those layers, presenting a clear, comprehensive outlook on how the NFT and crypto world is shaping up in 2025, highlighting trends, challenges, and opportunities that define this dynamic frontier.

—

Unveiling the Power of On-Chain Analytics: The Digital Investigator’s Toolkit

*Understanding Market Integrity and Malpractices*

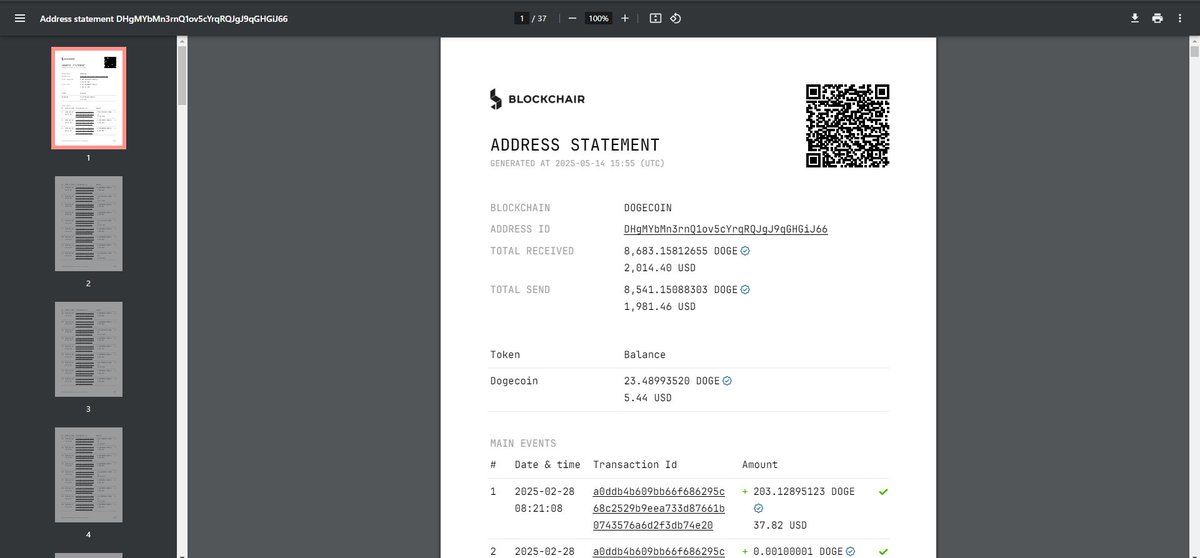

The backbone of the digital asset world is transparency—data recorded immutably on blockchains. This transparency invites scrutiny, especially when it comes to market fairness. In 2025, sophisticated on-chain analytics tools serve as digital detective agencies, uncovering illicit activities like wash trading, which can distort market perceptions.

Take wash trading, for example. This practice involves a single entity buying and selling the same NFT repeatedly to fake demand, inflating prices artificially. Analyzing transaction patterns—such as rapid, repetitive transfers between interconnected wallets—reveals the red flags. Blockchain explorers and analysis platforms scrutinize transaction intervals, wallet connections, and transfer volumes to unmask these manipulative tactics. Without such tools, investors might fall prey to false hype, driving the market into bubbles eventually prone to bursting.

*The Role of Wallet Scores and Whalewatch Tools*

Imagine having a radar that scans the seas for the movements of whales—large investors whose transactions can sway entire markets. Platforms like MagicNewton have integrated features like Wallet Score Trackers and Whalewatch. These tools analyze the history, credibility, and recent activities of wallets, giving investors insights akin to “market weather reports.”

A high wallet score indicates a trustworthy, stable actor—perhaps a reputable collector or institution—whose movements might signal long-term confidence. Conversely, sudden large transfers from ‘whale’ wallets may precede market shifts, either upward or downward. Detecting such activities early grants traders an edge, allowing them to anticipate and respond to impending market swings.

*Community Sentiments and Market Realities*

In the era of social media dominance, community sentiment isn’t just local chatter; it’s an influential market force. Tools that analyze mood—gauging investor optimism, fear, or hype—are now vital. For instance, platforms like Soon’s sentiment analyzers quantify the collective mood, offering clues on whether the market is driven by genuine interest or speculative frenzy. When combined with on-chain data, these insights paint a comprehensive picture of market health.

—

The Rise of Cross-Chain and Interoperable Platforms: Breaking Barriers

*Omnichain Marketplaces and Their Transformative Impact*

Dynamic ecosystems demand flexibility. The fragmentation of blockchain networks has long been a challenge—different chains with incompatible standards, liquidity pools, and user bases. In 2025, the advent of omnichain NFT marketplaces like Monad Ecosystem has begun to dissolve these barriers.

These platforms enable seamless transfer of NFTs and tokens across various blockchains like Ethereum, Solana, and others. For creators, this means their art can reach broader audiences without being confined to a single chain ecosystem. For collectors, arbitraging or moving assets to different chains to leverage pricing gaps becomes routine.

This technological leap relies on complex smart contracts and decentralized protocols that ensure security, transparency, and interoperability. The result? A more unified, accessible digital universe where assets are no longer siloed but fluid, fostering innovation and liquidity.

*Data-Driven NFT Valuation and Market Insights*

In a market flooded with digital art, metrics matter. Enter advanced tools like BitsCrunch’s UnleashNFTs, which analyze the rarity and attributes of NFTs—such as unique traits or limited editions—using AI-powered models. These granular analyses guide investors beyond simple floor prices or trading volumes, assigning real value to rarity.

Further, sentiment analytics platforms like Soon’s offer a pulse on market stability, helping creators and traders time their moves. When combined, these tools help reduce guesswork, making the NFT landscape more transparent and investor-friendly.

*User Identity and Data Ownership Across Chains*

Blockchain innovation isn’t limited to assets; it extends to identities. Protocols like SuiLink enable users to maintain a consistent, secure identity across multiple chains. This development is monumental—it enhances privacy, reduces repeated onboarding, and enables personalized experiences.

For example, a user could earn reputation scores or participate in loyalty programs, regardless of the chain they’re interacting with. This standardization also aids in reducing fraud and simplifying onboarding processes—crucial for mainstream adoption.

—

Market Resilience and the Fuel Injections: Why Everything Looks Bright

*Ethereum’s Ascendance and Ecosystem Expansion*

Ethereum remains the stalwart of the industry, with its recent rally to approximately $2700 signaling confidence. This surge is fuelled by macroeconomic factors, technological upgrades like sharding and layer-2 scaling, and an influx of institutional capital. Projects built on Ethereum—DeFi protocols, NFT platforms—are thriving as they attract both retail and institutional players.

*Institutional Interest and Macro-Economic Factors*

The macro view influences the micro movements in crypto. Institutional adoption is rising, driven by ETF products, regulatory clarity, and increasing integration with traditional finance. As more large players enter, market stability improves, propelling further adoption.

*Cross-Chain and Omnichain Functionalities: Democratizing Digital Assets*

By enabling assets to flow freely between chains, these innovations eliminate liquidity silos and slippage issues. This democratizes access, allowing smaller traders to participate in high-value markets, ultimately fostering a more inclusive ecosystem.

—

Facing Challenges Head-On: Ethical and Practical Concerns

*Market Manipulation and Security Risks*

Despite technological advancements, bad actors persist. Wash trading remains a thorn; fake volume can deceive investors, while front-running and pump-and-dump schemes exploit vulnerabilities. Continuous improvement in detection—leveraging AI, machine learning, and community reporting—is essential.

*Data Privacy and Ownership Dilemmas*

As platforms gather behavioral, transactional, and identity data, privacy concerns intensify. Protocols like SuiLink offer solutions, but the industry must prioritize user sovereignty and data security to build trust.

*Sustainability of Rapid Growth*

This meteoric rise raises questions about sustainability. Are we creating a speculative bubble that will burst under pressure? Responsible development—like educating participants and establishing moderation standards—is critical to ensure long-term health.

—

The Road Ahead: Opportunities, Risks, and Ethical Frontiers

*Interoperability as a Catalyst for Innovation*

The fusion of gaming, DeFi, and NFTs across chains promises a multifaceted digital economy—where ownership, governance, and value transfer are more seamless and embedded into daily life.

*Decentralized Governance and Community Power*

DAO-led initiatives and community treasury models democratize decision-making, fostering resilient ecosystems that adapt swiftly and inclusively.

*Ethical Dilemmas and the Need for Responsible Tech*

Advanced tools like AI valuations, cross-chain identity, and behavioral analytics offer tremendous power—but they demand ethical oversight. Ensuring fairness, transparency, and privacy must be central concerns as technology becomes more sophisticated.

—

Conclusion: Navigating the Future with Vigilance and Vision

The journey through 2025 is akin to exploring a vast, ever-changing landscape—full of peaks of innovation and valleys of challenge. The convergence of transparency, interoperability, and community engagement promises a vibrant future, but only if stakeholders remain vigilant.

Adapting to technological developments requires not just enthusiasm but also responsibility. The true potential of the NFT and crypto ecosystems lies in their ability to democratize ownership, foster innovation, and uphold trust. As we stand at this crossroads, embracing ethical progress and technological mastery will determine whether we build a sustainable and equitable digital world.

—

Final Reflection: Charting a Responsible Path Forward

As the digital frontier expands, our collective role becomes clearer—champion transparency, protect user privacy, and foster community-led growth. The ecosystem’s future hinges on our ability to balance innovation with responsibility, turning the promise of Web3 into a reality that benefits all.

—

References and Resources for Further Exploration

– Natdog NFT Transaction Analysis

– MagicNewton Platform Features

– GravityX Market Trends

– Monad Ecosystem and Omnichain NFT Marketplaces

– BitsCrunch UnleashNFTs Rarity Analysis

– Soon Sentiment Analysis Tools

– SuiLink Cross-Chain Identity Protocol

– Harspider Capital’s Ethereum Market Insights

– Rhinosmart Market Data

*Note: All links open in new tabs and serve as resources to deepen your understanding of the ongoing industry evolution.*

—

*This completes the detailed, analytical, and engaging review of the NFT and cryptocurrency ecosystem in 2025. Questions or further insights are welcome!*