Introduction

Imagine standing at the edge of a vast, digital frontier, where the only constant is change. Welcome to the cryptocurrency market in 2025, a landscape that is as exhilarating as it is unpredictable. In this dynamic world, Bitcoin continues to be the star, while altcoins and memecoins carve out their niches. Let’s embark on a journey to explore the latest trends and insights that are shaping the crypto market today.

The Bitcoin Rollercoaster

Bitcoin, the original cryptocurrency, remains the bellwether of the market. Its price movements are closely watched by investors and enthusiasts alike. Understanding Bitcoin’s current trends can provide valuable insights into the broader market dynamics.

Micro and Macro Analysis

Micro Trends

At the micro level, Bitcoin has completed its first three waves of a lower degree, with wave three showing an extended bullish momentum. However, the confirmation of a pullback in wave four is still uncertain. If 104.3k was indeed the peak of wave three, we might be on the cusp of a correction[1].

Macro Trends

From a macro perspective, Bitcoin has completed a five-wave impulse from the 74.5k bottom. While the uptrend could extend slightly, a correction in wave two seems likely. The typical target for a wave two correction is between 0.5 and 0.618 Fibonacci retracement levels, suggesting a potential pullback to around 62.2k to 71.4k[2].

Technical Analysis

Technical indicators offer further clues about Bitcoin’s potential movements. Currently, Bitcoin is facing resistance at a horizontal supply zone, with the Ichimoku Cloud providing strong support. A breakout above the supply zone could signal a bullish move, but a rejection at this level might lead to a downside correction[10].

Altcoins and Memecoins: The Solana Ecosystem

Beyond Bitcoin, the Solana ecosystem is buzzing with activity. Several projects within this ecosystem are gaining traction, showcasing the diversity and innovation within the crypto space.

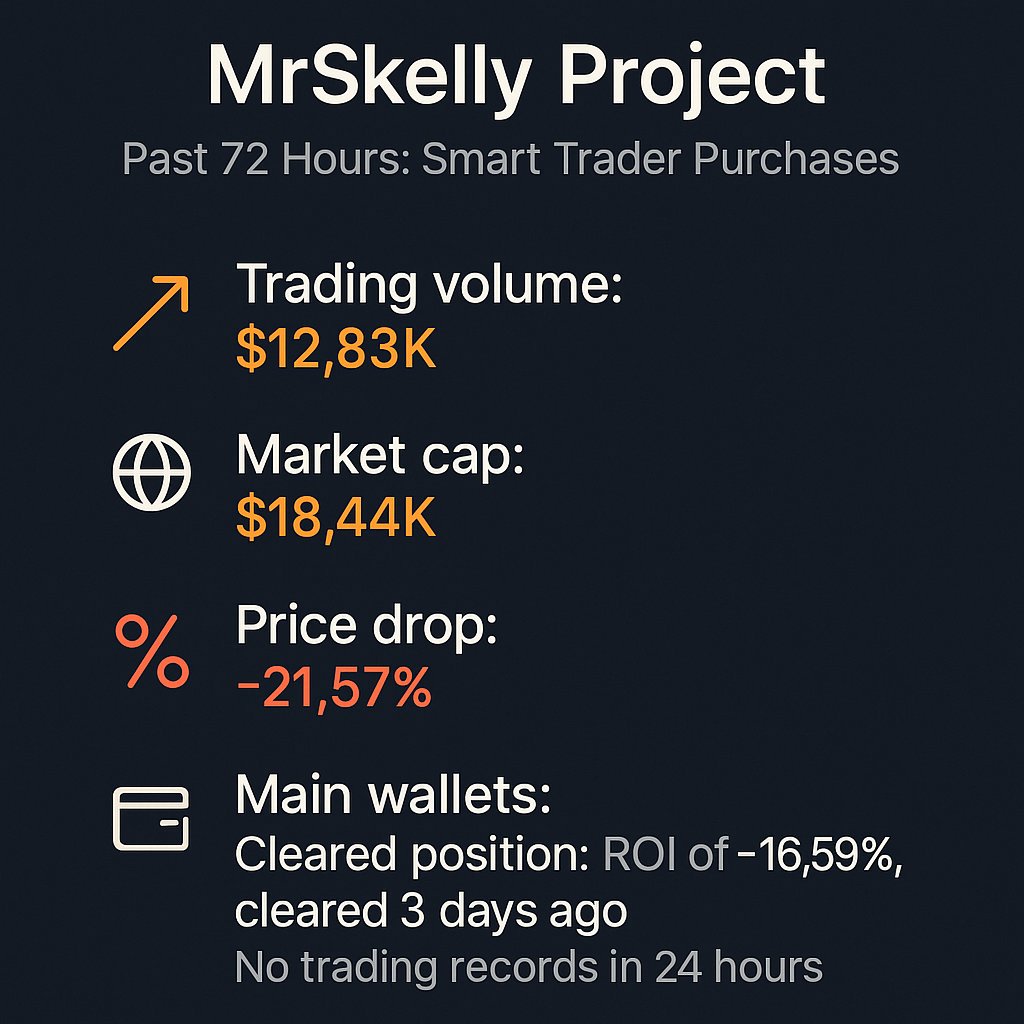

MrSkelly Project

The MrSkelly project on the Solana chain has seen significant activity, with $35.79K in Smart Trader purchases. This indicates a growing interest and potential bullish sentiment within the project[3].

Desla and BWAH Projects

Similarly, the Desla project has recorded $22.98K in Smart Trader purchases, highlighting its rising popularity. The BWAH project on the Solana chain has also shown substantial Smart Trader activity, further emphasizing the vibrant ecosystem within Solana[4][5].

Brownie Project

The Brownie project on the Solana chain has also seen notable Smart Trader activity, suggesting strong community and investor interest. These projects collectively underscore the robust and dynamic nature of the Solana ecosystem[6].

The Broader Crypto Landscape

The broader crypto landscape is filled with intriguing developments, from regulatory shifts to technological advancements. Understanding these trends can help investors navigate the market more effectively.

Market Value Milestones

Bitcoin’s market value has surpassed that of Amazon, positioning it as the fifth-largest global asset. This milestone underscores the growing acceptance and integration of cryptocurrencies into mainstream finance[7].

AI and Crypto Trading

The integration of artificial intelligence in crypto trading is becoming increasingly prevalent. AI-based data analysis apps are gaining traction, offering investors more sophisticated tools to navigate the volatile crypto market. These advancements promise to enhance trading strategies and improve decision-making processes[8].

Conclusion: Navigating the Crypto Waves

The cryptocurrency market in 2025 is a blend of opportunity and uncertainty. Bitcoin’s potential correction, coupled with the burgeoning activity in the Solana ecosystem, paints a picture of a market in transition. For investors, staying informed and adaptable is key to capitalizing on these trends.

As we navigate the crypto waves, it’s essential to remember that the market is driven by a complex interplay of technical indicators, market sentiment, and external factors. Whether you’re a seasoned trader or a curious enthusiast, understanding these dynamics can help you make informed decisions and seize the opportunities that lie ahead.