The Ever-Evolving Landscape of Cryptocurrency Analysis in 2025

Introduction: Navigating the Crypto Frontier

In the fast-paced world of cryptocurrency, staying informed and making smart decisions can mean the difference between striking gold and losing it all. As we venture into 2025, the landscape of cryptocurrency analysis is more dynamic and complex than ever. This report will delve into the tools, trends, and strategies that are shaping the way investors and traders navigate this volatile yet lucrative market.

The Rise of AI in Cryptocurrency Analysis

Automated Insights with CryptoAnalyzerPro

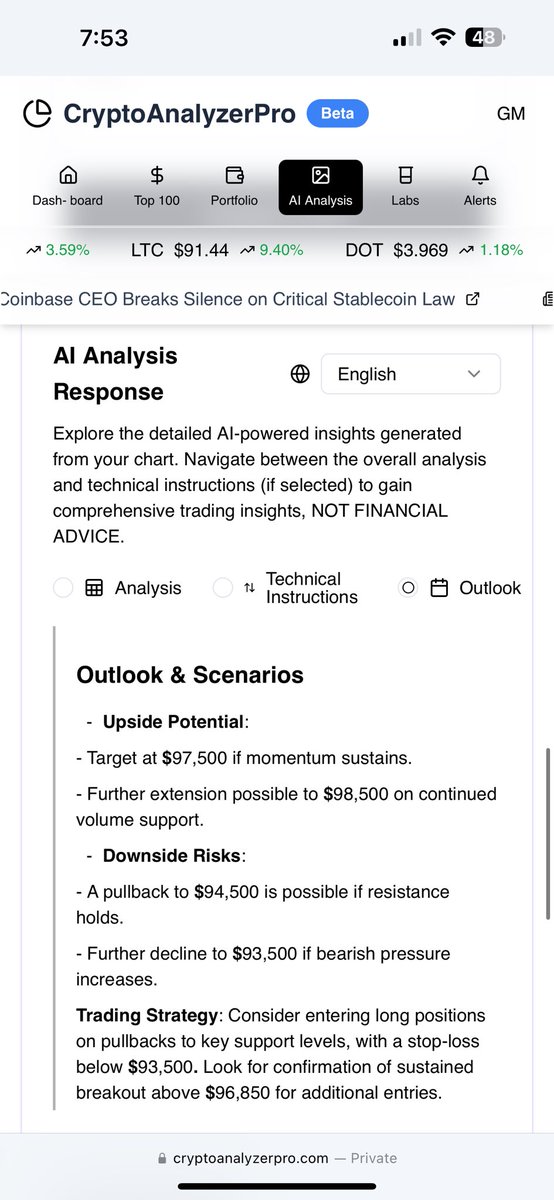

Imagine having a personal assistant that never sleeps, constantly analyzing market trends and providing you with actionable insights. That’s precisely what CryptoAnalyzerPro offers. This cutting-edge platform leverages artificial intelligence to deliver free AI-driven analysis, helping traders make informed decisions in real-time. Whether you’re a seasoned trader or a curious newcomer, CryptoAnalyzerPro’s AI analysis can be a game-changer, providing a deeper understanding of market movements and potential opportunities.

The platform’s AI algorithms sift through vast amounts of data, identifying patterns and trends that might go unnoticed by the human eye. This level of precision and efficiency is invaluable in a market that operates 24/7. By integrating AI into their analysis, traders can gain a competitive edge, making quicker and more accurate decisions.

The Power of Predictive Analytics

Predictive analytics is another area where AI is making significant strides. Platforms like Pi Network are utilizing predictive analysis to understand market behaviors and trends. By analyzing vast amounts of data, these systems can predict market movements with remarkable accuracy, giving traders a competitive edge. The Pi Network’s core team strategy is a testament to the power of predictive analytics, demonstrating how AI can be used to navigate the complexities of the crypto market.

Predictive analytics goes beyond just identifying trends; it anticipates future market conditions based on historical data and current trends. This proactive approach allows traders to stay ahead of the curve, making strategic moves before the market shifts.

Technical Analysis: The Bedrock of Crypto Trading

Chart Patterns and Market Indicators

Technical analysis remains a cornerstone of cryptocurrency trading. Chart patterns, such as the descending triangle pattern observed in SOL/USD, provide valuable insights into potential market movements. For instance, a breakout above the upper trend line in a descending triangle pattern can signal a bullish reversal, while a breakdown below the lower trend line may indicate further declines. These patterns, combined with other technical indicators, help traders make informed decisions.

Understanding these patterns requires a keen eye and a solid grasp of technical analysis principles. Tools like moving averages, relative strength index (RSI), and Bollinger Bands can complement chart patterns, providing a more comprehensive view of market conditions.

Key Resistance Levels and Bullish Outlooks

Understanding key resistance levels is crucial for any trader. For example, Chainlink (LINK) has several key resistance levels that, when breached, can signal a bullish outlook. By identifying these levels, traders can better anticipate market movements and adjust their strategies accordingly. The Currency Analytics provides a detailed analysis of these resistance levels, offering traders a roadmap to navigate the crypto market.

Resistance levels are not just arbitrary lines on a chart; they represent significant points where the market has previously struggled to break through. Identifying these levels can help traders set stop-loss orders and take-profit targets, managing risk more effectively.

The Impact of Regulatory Decisions and Market Sentiment

SEC Decisions and Market Reactions

Regulatory decisions can have a profound impact on the crypto market. For instance, the SEC’s decision on Canary Capital’s Litecoin ETF has been closely watched by investors. Bloomberg analyst James Seyffart noted that this decision could significantly influence market sentiment and trading volumes. Such regulatory actions often lead to market volatility, presenting both risks and opportunities for traders.

Regulatory bodies play a crucial role in shaping the crypto landscape. Their decisions can either boost market confidence or create uncertainty. Staying informed about regulatory developments is essential for traders to anticipate market reactions and adjust their strategies accordingly.

Global Firms and Crypto-Friendly Policies

The global regulatory landscape is also evolving, with countries like the United States adopting more crypto-friendly policies. Trump’s crypto-friendly stance, for example, has drawn global firms to the US, as reported by the Financial Times. This shift in policy can lead to increased investment and innovation in the crypto sector, further driving market growth.

Crypto-friendly policies can attract more investors and businesses to the market, fostering growth and stability. Traders should keep an eye on regulatory developments in different regions, as they can significantly impact market dynamics.

Innovations and Trends Shaping the Future

The Launch of CMC AI

CoinMarketCap’s unveiling of CMC AI at their VIP event in Dubai is another significant development. Set to launch mid-May, CMC AI promises to revolutionize the way traders access and utilize market data. By integrating AI into their platform, CoinMarketCap aims to provide more accurate and timely insights, helping traders make better-informed decisions.

CMC AI represents the next step in the evolution of cryptocurrency analysis. By leveraging AI, the platform can offer more precise and actionable insights, helping traders navigate the market more effectively.

The IPO of eToro

eToro’s plans to raise $500 million through a U.S. IPO is another indicator of the growing mainstream acceptance of cryptocurrencies. As more traditional financial institutions enter the crypto space, the market is expected to become more stable and regulated, attracting a broader range of investors.

The IPO of eToro signals a shift towards greater institutional involvement in the crypto market. This can lead to increased liquidity and stability, making the market more attractive to a wider range of investors.

Conclusion: Embracing the Future of Crypto Analysis

As we stand on the precipice of a new era in cryptocurrency analysis, it’s clear that the future is bright and full of possibilities. From the rise of AI-driven insights to the power of technical analysis and the impact of regulatory decisions, the crypto market is more dynamic and exciting than ever. By staying informed and leveraging the latest tools and strategies, traders can navigate this ever-evolving landscape with confidence and success.

The future of crypto analysis is here, and it’s time to embrace it. Whether you’re a seasoned trader or a curious newcomer, the opportunities are endless. So, dive in, explore, and let the power of analysis guide you to new heights in the world of cryptocurrency.

—

[1]: CryptoAnalyzerPro – CryptoAnalyzerPro.com

[2]: Pi Network – π(Pi) is Money itself

[3]: CryptoPilot – CryptoPilot

[4]: The Currency Analytics – The Currency Analytics

[5]: Vaibhav Mahadkar – Vaibhav Mahadkar

[6]: Vaibhav Mahadkar – Vaibhav Mahadkar

[7]: Vaibhav Mahadkar – Vaibhav Mahadkar

[8]: Vaibhav Mahadkar – Vaibhav Mahadkar