Understanding Impulsive Moves in Cryptocurrency Futures Trading

In the ever-evolving landscape of cryptocurrency, impulsive moves in futures trading are akin to the sudden storms that can dramatically alter the course of a voyage. These abrupt shifts, driven by a myriad of factors including market sentiment, news, and technical analysis, can lead to significant price fluctuations. For traders, understanding these impulsive moves is akin to mastering the art of sailing through turbulent waters.

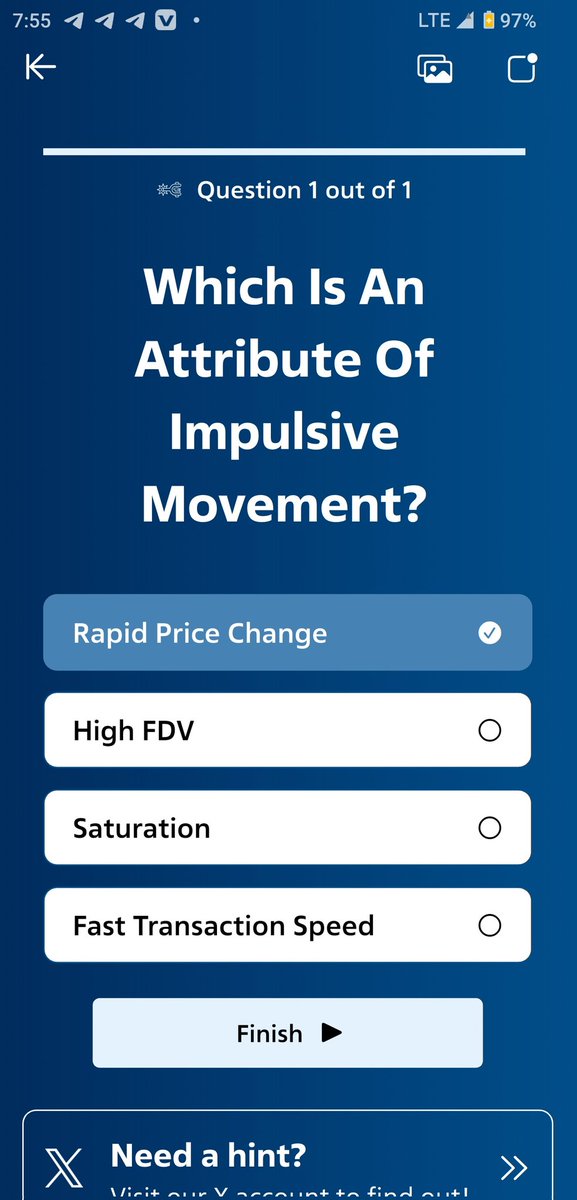

The Nature of Impulsive Moves

Impulsive moves in cryptocurrency futures trading are marked by their abrupt and substantial nature. Unlike the steady, gradual price movements influenced by fundamental analysis, impulsive moves are often the result of fleeting market sentiment, breaking news, or even viral social media trends. These moves can be both exhilarating and daunting, offering opportunities for substantial gains or losses within a short timeframe.

The Role of Market Sentiment

Market sentiment is a powerful driver of impulsive moves. It is often influenced by a confluence of factors, including social media buzz, news headlines, and the collective mood of traders. For instance, a positive tweet from an influential figure can send a cryptocurrency’s price soaring within minutes. Conversely, negative news can cause a sharp decline. Understanding and navigating this emotional landscape is crucial for any trader looking to succeed in the crypto market.

The Impact of News and Social Media

News and social media have a profound impact on cryptocurrency prices. A positive news story about a particular cryptocurrency can lead to a sudden surge in its price, while negative news can cause a sharp decline. Social media platforms like Twitter and Reddit are hotbeds of market sentiment, where influential figures and communities can drive impulsive moves. For example, a tweet from a well-known crypto influencer can lead to a significant price movement, as seen in various instances where market sentiment was heavily influenced by social media posts. [1][2]

Technical Analysis and Chart Patterns

Technical analysis is another key factor in impulsive moves. Traders often rely on chart patterns and technical indicators to make trading decisions. Patterns like head and shoulders, double tops, and flags can signal potential price movements. Indicators such as moving averages, relative strength index (RSI), and Bollinger Bands are also commonly used. These tools help traders identify trends and potential reversal points, which can lead to impulsive moves when the market reacts to these signals. [3][4]

Regulatory News and Its Influence

Regulatory news can also trigger impulsive moves. Announcements from regulatory bodies about new guidelines, bans, or approvals can significantly impact cryptocurrency prices. For example, news about a country legalizing or banning cryptocurrencies can lead to sudden price changes. Similarly, regulatory approvals for new cryptocurrency products or services can drive impulsive moves. Traders need to stay informed about regulatory developments to anticipate and react to these moves. [5]

The Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD)

Market sentiment is a powerful driver of impulsive moves. The fear of missing out (FOMO) is a common phenomenon where traders rush to buy a cryptocurrency due to the fear of missing out on potential gains. This can lead to sudden price surges, often followed by sharp corrections. Conversely, fear, uncertainty, and doubt (FUD) can cause traders to sell off their holdings, leading to price declines. Understanding and managing these emotional responses is crucial for successful trading. [6]

The Altcoin Season Phenomenon

The concept of “altseason” refers to periods when alternative cryptocurrencies (altcoins) experience significant price increases relative to Bitcoin. This phenomenon is often driven by impulsive moves, as traders shift their focus from Bitcoin to altcoins in search of higher returns. Altseason can be influenced by various factors, including market sentiment, technical analysis, and regulatory news. Traders need to be aware of the signs of an impending altseason to capitalize on these opportunities. [7]

The Role of Bitcoin Dominance

Bitcoin dominance, the percentage of the total cryptocurrency market capitalization that is accounted for by Bitcoin, is another important factor. A decrease in Bitcoin dominance often signals the beginning of an altseason, as traders move their investments to altcoins. Conversely, an increase in Bitcoin dominance can indicate a shift back to the leading cryptocurrency. Monitoring Bitcoin dominance can help traders anticipate impulsive moves in the altcoin market. [8]

Total Market Cap Analysis

The total cryptocurrency market cap is a key indicator of market trends. A breakout from a descending channel with strong volume can signal a bullish trend, while a solid bounce can indicate a reversal. Resistance and support levels, as well as moving averages, are crucial in analyzing market cap movements. Traders need to pay attention to these indicators to identify potential impulsive moves. [9]

Navigating the Impulsive Moves

In conclusion, impulsive moves in cryptocurrency futures trading are an inherent part of the market’s volatile nature. Understanding the factors that drive these moves, from market sentiment and news to technical analysis and regulatory developments, is essential for successful trading. By staying informed and managing emotional responses, traders can navigate these impulsive moves and capitalize on the opportunities they present. The crypto market is a pulsating heart, and those who understand its rhythms can thrive in its dynamic environment.

References