A Glimpse into the Future: Bitcoin’s Current Landscape

Imagine standing at the edge of a vast, digital frontier. This is the world of Bitcoin, a realm where fortunes are made and lost in the blink of an eye. As of April 15, 2025, Bitcoin is at a crossroads, shaped by a confluence of market trends, technical indicators, and innovative developments. Let’s embark on a journey to understand the current state of Bitcoin and what lies ahead.

Market Trends and Technical Analysis

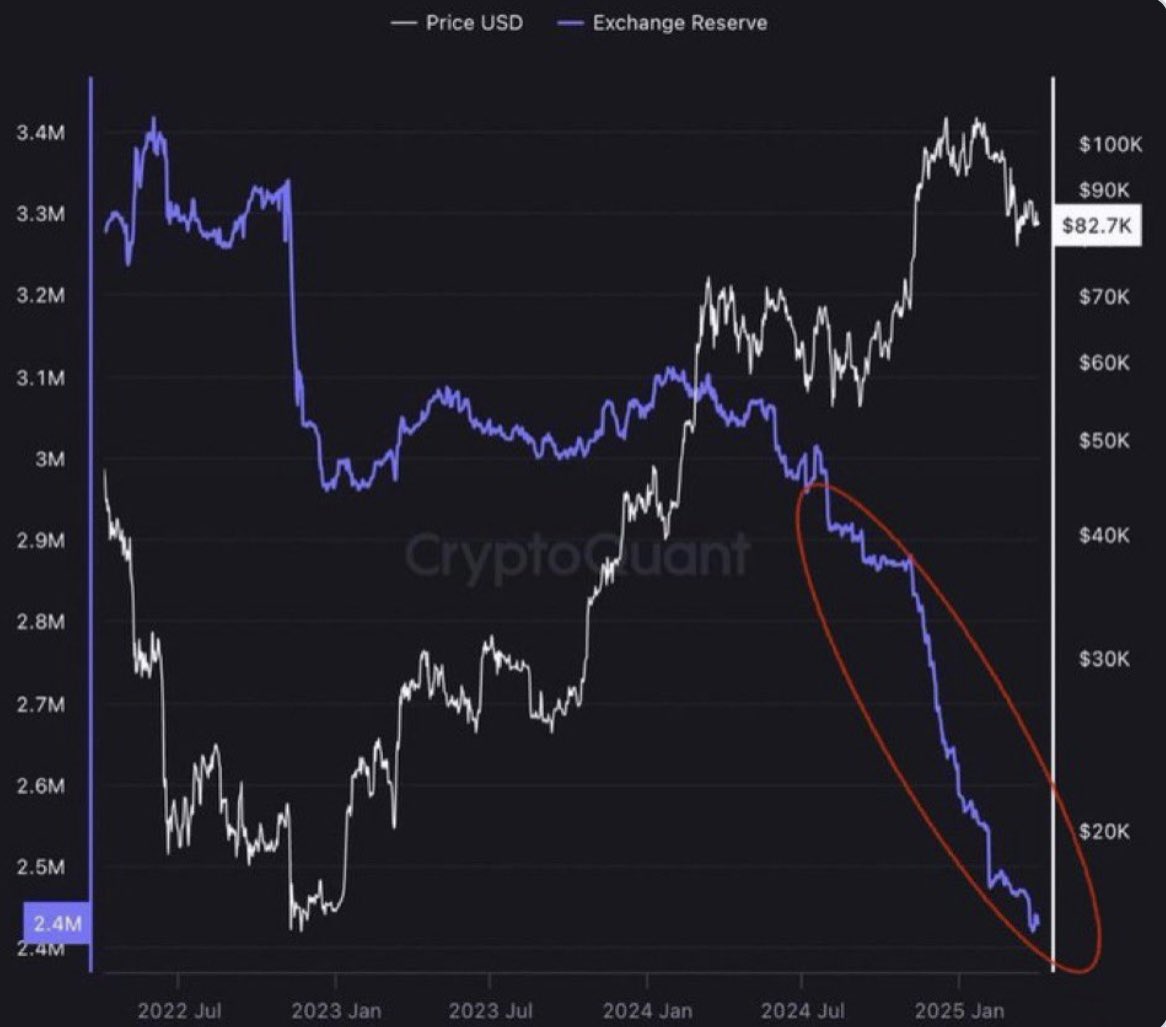

Supply Shock and Exchange Dynamics

In the world of Bitcoin, supply and demand are the lifeblood of the market. Recently, exchanges have been experiencing a supply shock, a phenomenon where the available Bitcoin supply is dwindling. This scarcity is not just a fleeting trend but a significant shift in the market dynamics. As exchanges run out of Bitcoin, the buying and selling dynamics are changing, potentially leading to increased demand and a surge in prices. This supply shock is a critical factor to monitor, as it could signal a bullish reversal pattern, hinting at a potential price rally in the near future[1].

Key Support and Resistance Levels

Technical analysis is the compass that guides traders through the volatile waters of the cryptocurrency market. As of April 15, 2025, Bitcoin is hovering around a critical support level of $92,810, with the Relative Strength Index (RSI) at 45. This indicates a potential bullish reversal pattern, a scenario where the price could bounce back after a period of decline. Traders are keeping a close eye on this level, as a break above it could signal a shift in market sentiment. Additionally, the 4-hour technical analysis highlights the importance of the 300 consolidated Moving Average (MA), which has struggled to stay above multiple times, suggesting a downward trend until a solid close above $86,000 on the 4-hour chart[2].

Retail Trader Sentiment

Retail traders, the everyday investors who are not part of large institutions, are becoming increasingly cautious about Bitcoin. This caution is reflected in the market’s consolidation near $84,000, with support at $83,000. The market is showing cautious bullish signs after breaking out of a falling wedge pattern and a multi-month downtrend. However, it is essential not to confuse early momentum with a parabolic breakout just yet. Key levels to watch include $85,000 as resistance and $76,000 as support. This cautious sentiment is a double-edged sword, offering both opportunities and challenges for traders[3].

Innovations in Bitcoin’s Layer 2

Scalability and Decentralization

Bitcoin’s journey towards mainstream adoption is paved with challenges, chief among them being scalability and decentralization. Layer 2 innovations are stepping in to address these issues, promising a more efficient and decentralized future for Bitcoin. Projects like Solaxy and Truebit are at the forefront of this revolution, driving significant advancements in scalability and decentralization. These innovations are crucial for Bitcoin’s long-term sustainability and adoption, as they tackle some of the most pressing challenges facing the network[4].

The Role of Vitalik Buterin

Vitalik Buterin, the co-founder of Ethereum, has shown a keen interest in Bitcoin’s Layer 2 developments. His involvement and curiosity underscore the potential impact of Layer 2 solutions on Bitcoin’s future. Buterin’s endorsement of these innovations highlights their importance in the broader cryptocurrency ecosystem, signaling a shift towards more scalable and decentralized networks[5].

Navigating the Future of Bitcoin

As we stand on the precipice of a new era in Bitcoin’s evolution, it is crucial to stay informed about the latest market trends, technical indicators, and innovative developments. The potential supply shock, key support and resistance levels, and Layer 2 innovations are all critical factors that will shape the future of Bitcoin. By understanding these dynamics, investors and traders can make more informed decisions and navigate the ever-changing landscape of the cryptocurrency market.

The future of Bitcoin is filled with both opportunities and challenges. As the market continues to evolve, it is crucial to remain vigilant and adaptable, leveraging the latest insights and innovations to stay ahead of the curve. The journey of Bitcoin is far from over, and the next few years promise to be as exciting and transformative as ever.

The Road Ahead

As we conclude our deep dive into the current state of Bitcoin, it is clear that the digital currency is at a pivotal moment. The convergence of market trends, technical indicators, and innovative developments is setting the stage for a future filled with both opportunities and challenges. By staying informed and adaptable, investors and traders can navigate this dynamic landscape and position themselves for success in the ever-evolving world of Bitcoin.

The road ahead is filled with uncertainty, but it is also brimming with potential. As Bitcoin continues to evolve, it will undoubtedly shape the future of finance and technology. The journey of Bitcoin is a testament to the power of innovation and the relentless pursuit of a decentralized future. The next few years promise to be as exciting and transformative as ever, and those who stay informed and adaptable will be well-positioned to capitalize on the opportunities that lie ahead.