The Current State of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, remains a focal point in the financial world due to its volatility and transformative potential. As of April 13, 2025, Bitcoin is traversing a multifaceted landscape shaped by technical analysis, market sentiment, and technological progress. Let’s explore the various dimensions that define Bitcoin’s present state and future prospects.

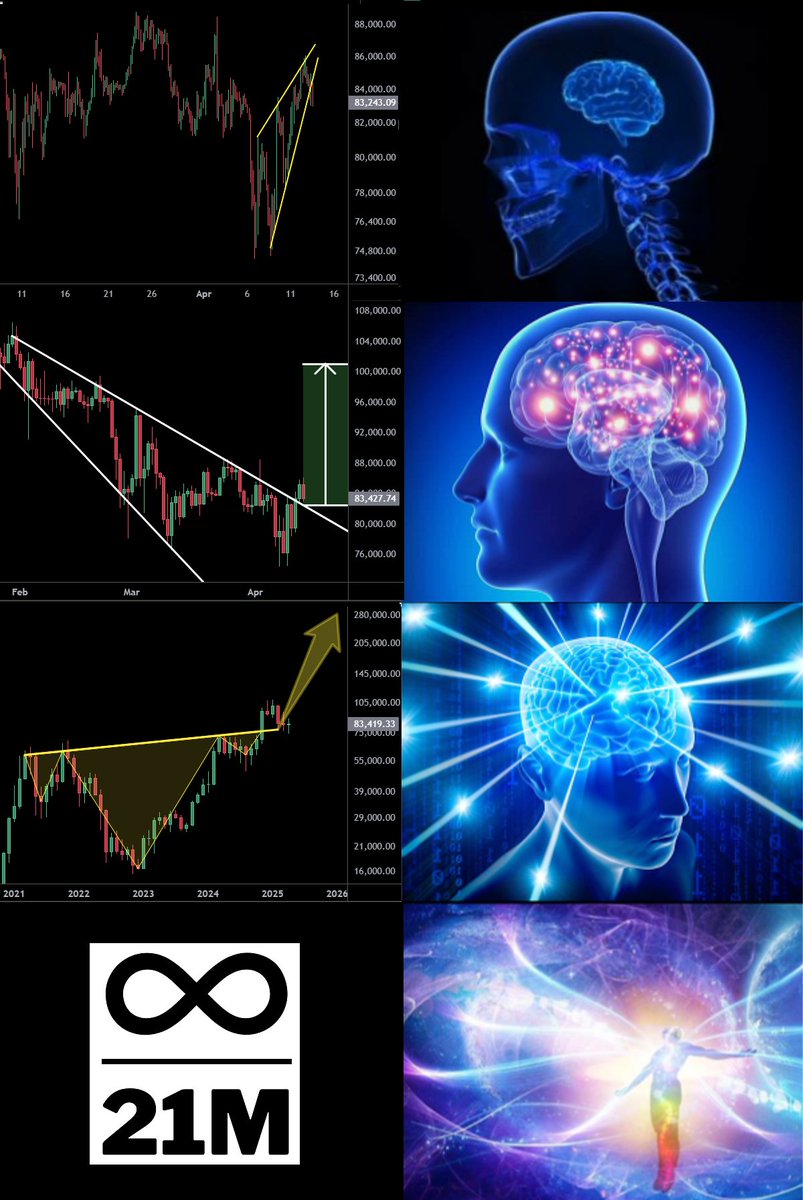

Technical Analysis: Patterns and Predictions

Consolidation and Reversal Patterns

Bitcoin is currently consolidating within a falling wedge pattern, a structure that often indicates a potential bullish reversal. This pattern is characterized by converging trend lines that compress price movements, typically leading to a breakout in the direction of the prevailing trend. The 50-day moving average (50MA) is acting as an additional resistance, making the current scenario critical for traders and investors. The rejection from the resistance trendline indicates a tug-of-war between buyers and sellers, with the outcome determining the next significant move. This pattern suggests that a breakout could be imminent, potentially leading to a substantial price increase.

Multi-Timeframe Analysis

Analyzing Bitcoin across different timeframes provides a comprehensive view of its market behavior. On the 1-hour chart, the sentiment is neutral, reflecting short-term indecision. However, the 4-hour chart presents a more optimistic outlook, predicting a breakout to $95,206 with support at $78,678. This multi-timeframe approach helps in identifying both short-term trading opportunities and long-term investment strategies. By examining multiple timeframes, traders can gain a more holistic understanding of market dynamics and make more informed decisions.

Market Sentiment: FOMO and Fear

The Fear of Missing Out (FOMO)

Market sentiment plays a crucial role in Bitcoin’s price movements. The Fear of Missing Out (FOMO) is a powerful psychological factor that drives many investors to buy during bullish trends. Analysts are closely monitoring the FOMO index to gauge market enthusiasm and potential overbought conditions. Understanding where you stand on the FOMO chart can provide valuable insights into the market’s emotional state and potential reversals. For instance, if the FOMO index is high, it might indicate that the market is overheated, and a correction could be on the horizon.

Historical Cycles and Seasonality

Historical data reveals intriguing patterns in Bitcoin’s price movements. Comparing price curves from 2013, 2017, 2021, and 2025 shows that Bitcoin tends to trend upwards between July and November. This seasonal trend suggests that the current period could be ripe for growth, aligning with historical data that hints at more significant price appreciation. However, it’s essential to consider both bullish and bearish scenarios to make informed decisions. For example, while historical cycles suggest a potential uptick, external factors such as regulatory changes or economic conditions could influence market behavior.

Technological Advancements: Layer 2 and Beyond

Bitcoin Layer 2 Solutions

Bitcoin’s technological ecosystem is evolving rapidly, with Layer 2 solutions at the forefront of innovation. These solutions aim to enhance scalability, reduce transaction costs, and improve overall network efficiency. Discussions around Bitcoin Layer 2 have sparked excitement, with insights from industry leaders like Vitalik Buterin highlighting the ethical implications and potential of blockchain technology. The development of stablecoins outpacing traditional payment systems like Visa underscores the transformative potential of these advancements. For instance, Layer 2 solutions like the Lightning Network enable faster and cheaper transactions, making Bitcoin more viable for everyday use.

Distributed Financial Analysis (DFA)

The introduction of the Distributed Financial Analysis (DFA) module by CB Pro adds another layer of sophistication to Bitcoin’s analysis. This module tracks market bets for each cryptocurrency in the top 250 ranked by market capitalization, using Coingecko as a reference. Such tools provide traders with real-time data and insights, enabling them to make more informed decisions in the dynamic cryptocurrency market. For example, the DFA module can help traders identify emerging trends and potential investment opportunities by analyzing market sentiment and trading volumes.

Conclusion: Navigating the Bitcoin Landscape

Bitcoin’s 2025 landscape is a tapestry of technical patterns, market sentiment, and technological innovations. The falling wedge pattern and multi-timeframe analysis offer clues to potential price movements, while market sentiment indicators like FOMO and historical cycles provide context for understanding investor behavior. Technological advancements, particularly in Layer 2 solutions and distributed financial analysis, are set to revolutionize the financial landscape.

As we navigate this complex terrain, it’s crucial to stay informed and adaptable. Whether you’re a short-term trader or a long-term investor, understanding the multi-dimensional aspects of Bitcoin will be key to success. So, where do you stand on the chart? Are you ready to ride the wave of potential growth, or are you preparing for a pause? The choice is yours, but the journey is sure to be exhilarating.

Sources

Bitcoin multi-timeframe analysis{target=”_blank”}

Tactical analysis of Bitcoin FOMO{target=”_blank”}

Bitcoin Layer 2’s latest discussions{target=”_blank”}

CB Pro DFA module features{target=”_blank”}

BTC/USDT falling wedge pattern{target=”_blank”}

Neutral sentiment on BTC/USDT 1-hour chart{target=”_blank”}

Long prediction on BTC/USD 4-hour chart{target=”_blank”}

Cipher Mining stock price simulation{target=”_blank”}

Bitcoin breakout insights{target=”_blank”}

Bitcoin cycles and historical data{target=”_blank”}