The Intriguing World of Cryptocurrency Trading

The Art of Cryptocurrency Trading

Keeping It Simple

Cryptocurrency trading has become a global phenomenon, attracting a diverse range of investors and traders. The volatile nature of digital currencies presents both significant opportunities and risks. To navigate this market successfully, it’s essential to understand its dynamics and adopt a disciplined approach. Trading in the cryptocurrency market doesn’t have to be stressful; in fact, it should be a calculated endeavor. The key to successful trading lies in simplicity and adherence to a well-defined strategy. When trading feels more like gambling, it’s a clear sign that it’s time to reassess your approach. Emotions can cloud judgment, leading to impulsive decisions that often result in losses. Instead, let analysis guide your actions. By focusing on data and trends, you can make more informed decisions that align with your trading goals.

The Role of Analysis

Analysis is the backbone of successful cryptocurrency trading. Whether it’s technical analysis, which involves studying price charts and patterns, or fundamental analysis, which looks at the underlying value of a cryptocurrency, both approaches provide valuable insights. For instance, technical analysis can help identify key levels that a cryptocurrency might break through, indicating a potential rally. Fundamental analysis, on the other hand, examines factors like the technology behind a cryptocurrency, its use cases, and market demand. Combining these two types of analysis can give you a comprehensive view of the market, enabling you to make more accurate predictions and better trading decisions.

The Impact of Emotions

The Danger of Emotional Trading

Emotions play a significant role in trading, often leading to poor decisions. Fear, greed, and excitement can all influence your trading behavior, pushing you to act impulsively. For example, fear of missing out (FOMO) can drive you to buy a cryptocurrency at its peak, only to watch its value plummet shortly after. Similarly, greed can lead you to hold onto a losing position, hoping it will rebound, only to see it drop further. Recognizing and managing these emotions is crucial for maintaining a disciplined trading approach.

Strategies for Emotional Control

One effective strategy for controlling emotions is setting clear trading rules and sticking to them. This includes defining your entry and exit points, setting stop-loss orders, and adhering to your risk management plan. Additionally, taking regular breaks from trading can help you maintain a clear mindset and prevent emotional burnout. Engaging in activities that promote relaxation and mental clarity, such as meditation or exercise, can also be beneficial. By cultivating emotional discipline, you can make more rational decisions and improve your overall trading performance.

The Power of Community and Information

The Value of Community

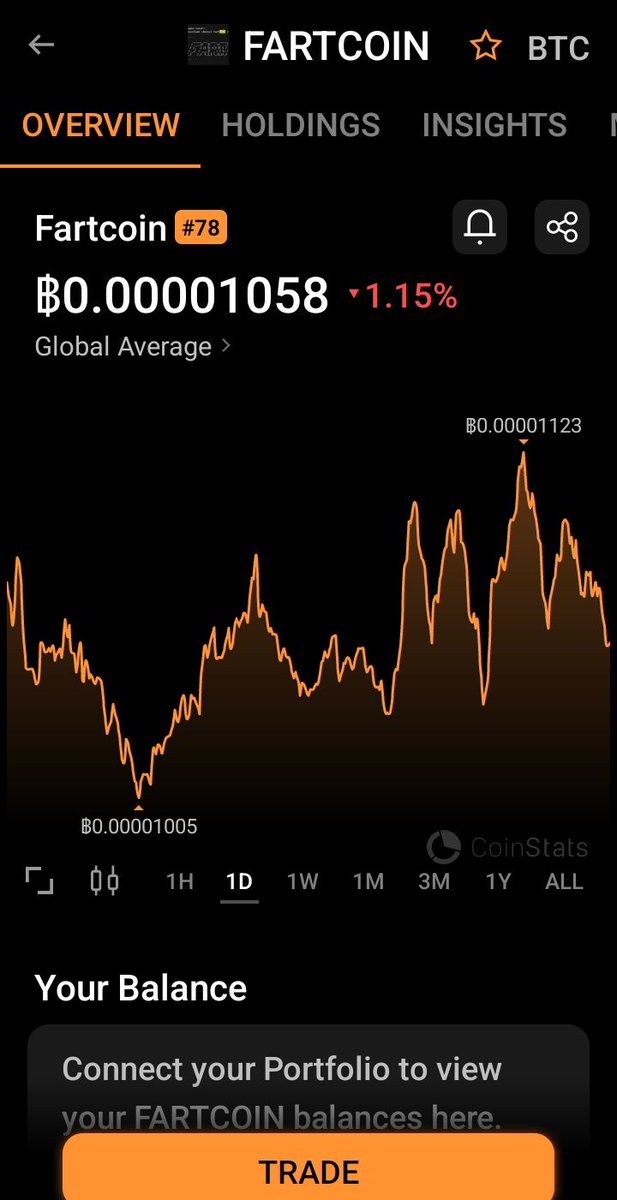

The cryptocurrency community is a rich source of information and support. Platforms like Twitter and Reddit are buzzing with traders sharing their insights, analyses, and trading tips. Engaging with this community can provide you with valuable perspectives and help you stay updated on the latest market trends. For example, following traders who specialize in specific cryptocurrencies, like Fartcoin or Pi Coin, can give you a deeper understanding of their market dynamics and potential opportunities.

Staying Informed

Staying informed is essential for successful trading. Regularly reading cryptocurrency news, analyzing market charts, and following expert opinions can help you make better-informed decisions. Websites and blogs dedicated to cryptocurrency analysis, such as Common Sense Crypto, offer in-depth insights and the latest news, keeping you ahead of the curve. Additionally, participating in webinars and online courses can enhance your trading skills and knowledge, making you a more confident and competent trader.

The Future of Cryptocurrency Trading

Emerging Trends

The cryptocurrency market is constantly evolving, with new trends and technologies emerging regularly. For instance, the rise of decentralized finance (DeFi) has opened up new avenues for trading and investment, offering higher yields and more flexible financial products. Similarly, the increasing adoption of blockchain technology across various industries is driving the demand for cryptocurrencies, making them more mainstream. Staying abreast of these trends can help you identify new opportunities and adapt your trading strategies accordingly.

The Role of Technology

Technology plays a pivotal role in cryptocurrency trading. Advanced trading platforms, automated trading bots, and AI-driven analysis tools are transforming the way traders operate. These technologies provide more accurate data, faster execution, and better risk management, enabling traders to make more informed and timely decisions. Embracing these technological advancements can give you a competitive edge in the market, helping you achieve better trading outcomes.

Conclusion: Embracing the Future

Cryptocurrency trading is a dynamic and exciting field, offering immense opportunities for those who approach it with discipline and knowledge. By keeping your trading simple, adhering to a well-defined strategy, and managing your emotions, you can navigate the market’s volatility more effectively. Engaging with the cryptocurrency community, staying informed, and embracing technological advancements can further enhance your trading skills and success. As the market continues to evolve, embracing these principles will be key to thriving in the world of cryptocurrency trading.