A Polarized Market

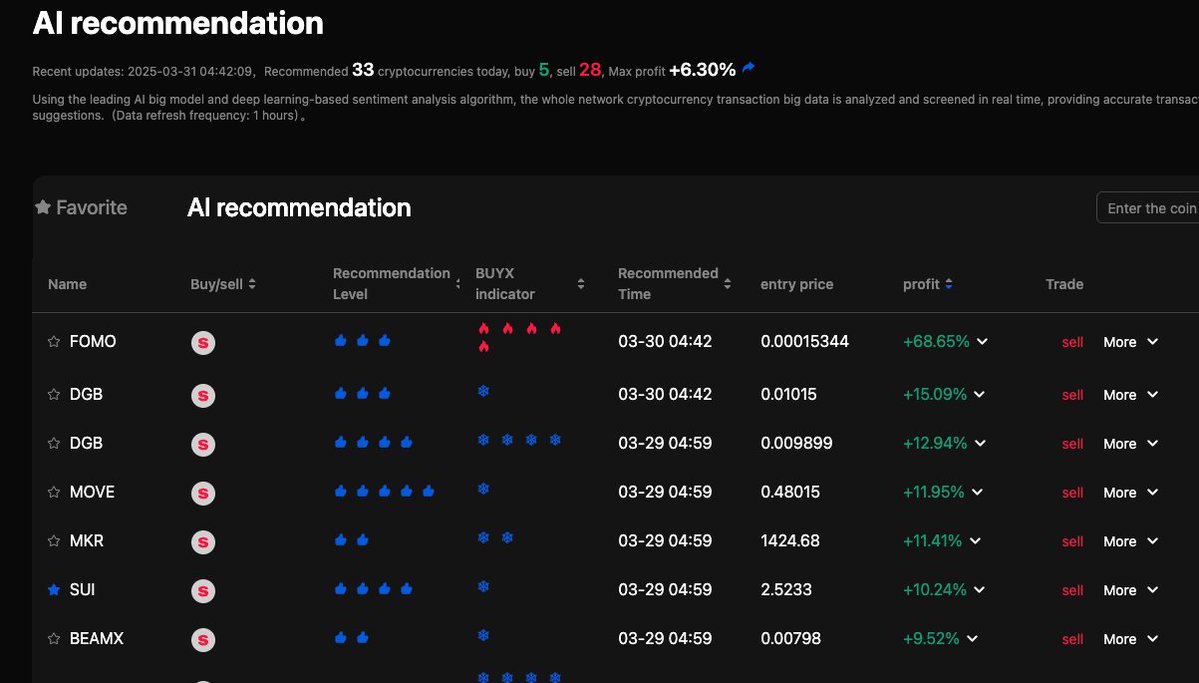

Imagine standing at a crossroads where one path leads to potential growth and the other to caution. This is the cryptocurrency market on March 31, 2025. Among the 33 targets screened by AI, only 5 show promise, primarily focusing on the Real-World Asset (RWA) track and compliance agreements. The remaining 28 require vigilance, painting a picture of a market that is as polarized as it is dynamic.

The Bearish Trend

Descending Channel Pattern

The total cryptocurrency market cap is currently consolidating within a descending channel pattern. This pattern is a clear indication of a bearish trend, where the market is making lower highs and lower lows. The resistance trendline has been acting as a barrier, preventing the market from breaking out to the upside. This pattern is not just a temporary blip but a sustained trend that has been observed over several months. Traders and investors need to be cautious, as this pattern suggests that the market may continue to decline unless there is a significant shift in market sentiment or external factors.

Ichimoku Cloud Resistance

Adding to the bearish sentiment is the Ichimoku Cloud, which is acting as a resistance barrier above the channel. The Ichimoku Cloud is a comprehensive indicator that provides insights into trend direction, momentum, and support/resistance levels. Its presence above the channel suggests that any upward movement is likely to be met with significant resistance. The Ichimoku Cloud’s components, such as the Conversion Line and the Base Line, further reinforce this bearish outlook. Traders should pay close attention to these indicators, as they can provide valuable insights into potential market movements.

The Role of AI and Bots

AI-Driven Market Screening

AI has become an integral part of the cryptocurrency market, with platforms like Buyx.ink using AI to screen targets. This technology can analyze vast amounts of data to identify potential growth opportunities and risks, providing traders with valuable insights. AI-driven market screening can help traders make more informed decisions by identifying patterns and trends that may not be immediately apparent. For example, AI can analyze social media sentiment, news articles, and market data to provide a comprehensive view of the market. This can help traders stay ahead of the curve and make more profitable trades.

DAO Services

Decentralized Autonomous Organizations (DAOs) are also playing a significant role. Services like Sniper CopyBot, Market AnalysisBot, and APTM MiningBot offer trading strategies, technical analysis, and virtual mining tools, respectively. These services leverage AI and blockchain technology to provide users with advanced trading and mining capabilities. DAOs can help democratize the cryptocurrency market by providing access to advanced tools and strategies that were previously only available to institutional investors. This can help level the playing field and provide more opportunities for individual traders and investors.

Community and Development

Community Growth

Platforms like CoinGecko are not just about monitoring prices and volumes. They also track community growth, open-source code development, key events, and on-chain metrics. This holistic approach provides a comprehensive view of the market, helping traders and investors make informed decisions. Community growth is a crucial indicator of a cryptocurrency project’s success. A strong and active community can help drive adoption, foster innovation, and provide support to new users. Platforms that track community growth can help traders and investors identify promising projects and make more informed decisions.

Open-Source Development

The open-source nature of many cryptocurrency projects fosters innovation and collaboration. Developers from around the world can contribute to these projects, leading to rapid advancements and improvements. This collaborative environment is a key driver of growth in the cryptocurrency market. Open-source development can help accelerate innovation by allowing developers to build on each other’s work. This can lead to the development of new features, improvements in security, and increased interoperability between different cryptocurrency projects. Traders and investors should pay close attention to open-source development, as it can provide valuable insights into a project’s potential for growth and success.

The Future of AI in Crypto

Specialized AI Models

The future of AI in cryptocurrency looks promising, with specialized models being developed to cater to specific needs. For instance, AI agents can be used for market prediction, risk management, and even automated trading. These models can analyze market data, identify patterns, and make predictions with a high degree of accuracy. Specialized AI models can help traders and investors make more informed decisions by providing valuable insights into market trends and potential risks. For example, AI can be used to predict market movements, identify arbitrage opportunities, and manage risk more effectively. As AI continues to evolve, it is likely to play an even more significant role in the cryptocurrency market.

The Role of Openledger

Openledger is at the forefront of this evolution, providing insights into the role of AI agents in crypto. Their work highlights the potential of AI to revolutionize the way we interact with the cryptocurrency market, from trading to mining and beyond. Openledger’s research and development efforts are focused on leveraging AI to provide more accurate market predictions, improved risk management, and enhanced trading strategies. By staying at the cutting edge of AI technology, Openledger is helping to shape the future of the cryptocurrency market and provide traders and investors with the tools they need to succeed.

Navigating the Polarized Market

As we stand at this crossroads, it’s clear that the cryptocurrency market is a complex and dynamic landscape. While there are opportunities for growth, there are also significant risks. The key to navigating this market lies in staying informed, leveraging technology, and being prepared to adapt to changing conditions.

The future of cryptocurrency is bright, but it’s not without its challenges. As we continue to explore this evolving landscape, let’s remember that every challenge is an opportunity for growth. So, whether you’re a seasoned trader or a newcomer to the world of crypto, stay informed, stay vigilant, and most importantly, stay curious.