The Interplay of Economic Indicators and Cryptocurrency Markets

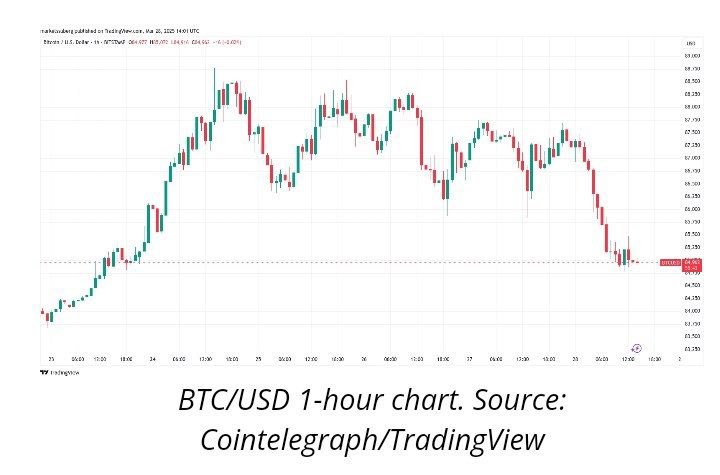

Imagine waking up to the news that Bitcoin, the flagship cryptocurrency, has dropped by 3% in a single day. On March 28, 2025, this became a reality as Bitcoin’s value plummeted to $84,000. The culprit? Higher-than-expected US Personal Consumption Expenditures (PCE) inflation data, which sparked fears of rising core inflation and potential stagflation. This event underscores the intricate dance between economic indicators and cryptocurrency markets. Let’s dive into this fascinating relationship and explore how macroeconomic factors influence digital asset prices.

Understanding the Impact of Economic Indicators

Economic indicators are the pulse of an economy, providing crucial insights into its health. They cover a wide range of metrics, from inflation and employment to consumer spending. For cryptocurrency markets, these indicators can be a double-edged sword, driving both opportunities and volatility.

Inflation and Cryptocurrency Prices

Inflation is a key economic indicator that measures the rate at which prices for goods and services rise. High inflation erodes purchasing power and can lead to economic instability. In the cryptocurrency world, inflation data can sway market sentiment in several ways.

– Risk Perception: High inflation often prompts investors to seek alternative stores of value, such as gold or cryptocurrencies. However, if inflation is seen as uncontrollable, it can increase market volatility and risk aversion, leading to sell-offs in cryptocurrencies.

– Monetary Policy: Central banks often respond to high inflation by tightening monetary policy, which can include raising interest rates. Higher interest rates make borrowing more expensive, potentially slowing economic growth and reducing demand for riskier assets like cryptocurrencies.

– Stagflation Concerns: Stagflation, a combination of stagnant economic growth and high inflation, is particularly worrisome for investors. It suggests a weak economy with rising prices, a scenario that can lead to significant market turbulence and a decline in cryptocurrency prices.

The Role of Artificial Intelligence in Cryptocurrency Trading

As the cryptocurrency market continues to evolve, so do the tools and technologies used to navigate it. Artificial Intelligence (AI) is increasingly being leveraged to enhance trading strategies, particularly in the realm of cryptocurrency arbitrage.

AI-Driven Arbitrage

Cryptocurrency arbitrage involves exploiting price differences between various exchanges to generate profits. AI can significantly improve the efficiency of this process by analyzing vast amounts of data in real-time. Machine learning algorithms can identify patterns and opportunities that human traders might miss, leading to more accurate and timely trades.

– Data Analysis: AI can process and analyze large datasets from multiple exchanges, providing traders with a comprehensive view of market conditions.

– Algorithmic Trading: AI-driven algorithms can execute trades automatically, ensuring that opportunities are seized as soon as they arise.

– Risk Management: AI can also help in risk management by predicting potential market movements and adjusting trading strategies accordingly.

The Future of Cryptocurrency Asset Recovery

As the cryptocurrency market grows, so does the need for robust security measures to protect digital assets. Blockchain analysis and cryptocurrency tracking capabilities are becoming increasingly important in this regard.

Advanced Blockchain Analysis

Blockchain analysis involves examining the blockchain ledger to trace transactions and identify patterns. This can be crucial for recovering lost or stolen cryptocurrencies.

– Transaction Tracing: By tracking transactions on the blockchain, it is possible to identify the flow of funds and potentially recover lost assets.

– Security Enhancements: Advanced blockchain analysis can also help in identifying vulnerabilities and enhancing the security of cryptocurrency wallets and exchanges.

– Regulatory Compliance: Blockchain analysis can assist in ensuring compliance with regulatory requirements, which is becoming increasingly important as governments around the world tighten their oversight of cryptocurrencies.

Investing in Cryptocurrencies: Strategies for Success

For investors looking to capitalize on the opportunities presented by the cryptocurrency market, it is essential to adopt a strategic approach. This includes understanding both technical and fundamental analysis.

Technical Analysis (TA)

Technical analysis involves using charts, patterns, and indicators to predict price movements. Key tools in technical analysis include:

– Relative Strength Index (RSI): Measures the speed and change of price movements, helping to identify overbought or oversold conditions.

– Moving Average Convergence Divergence (MACD): Helps in identifying changes in the strength, direction, momentum, and duration of a trend.

– Bollinger Bands: Provide a visual representation of volatility and can help in identifying potential breakouts or reversals.

Fundamental Analysis (FA)

Fundamental analysis involves evaluating the underlying factors that influence the value of a cryptocurrency. This includes:

– Project Fundamentals: Assessing the technology, use case, and potential of the cryptocurrency project.

– Team and Partnerships: Evaluating the expertise and experience of the team behind the project, as well as any strategic partnerships.

– Real-World Use Cases: Considering the practical applications and adoption of the cryptocurrency in the real world.

Conclusion: Navigating the Cryptocurrency Landscape

The cryptocurrency market is a dynamic and complex landscape, influenced by a multitude of factors. Economic indicators, such as inflation data, play a crucial role in shaping market sentiment and price movements. As investors, it is essential to stay informed and adapt to these changes. Leveraging AI and advanced blockchain analysis can provide a competitive edge, while a strategic approach to investing can help in navigating the challenges and opportunities presented by the cryptocurrency market. As we look to the future, the intersection of technology and finance will continue to evolve, offering new avenues for growth and innovation. The key to success lies in staying informed, adaptable, and strategic in our approach to investing.

Sources