Unraveling the Mystery of Back-to-Back Weekly Hammer Candles in Bitcoin

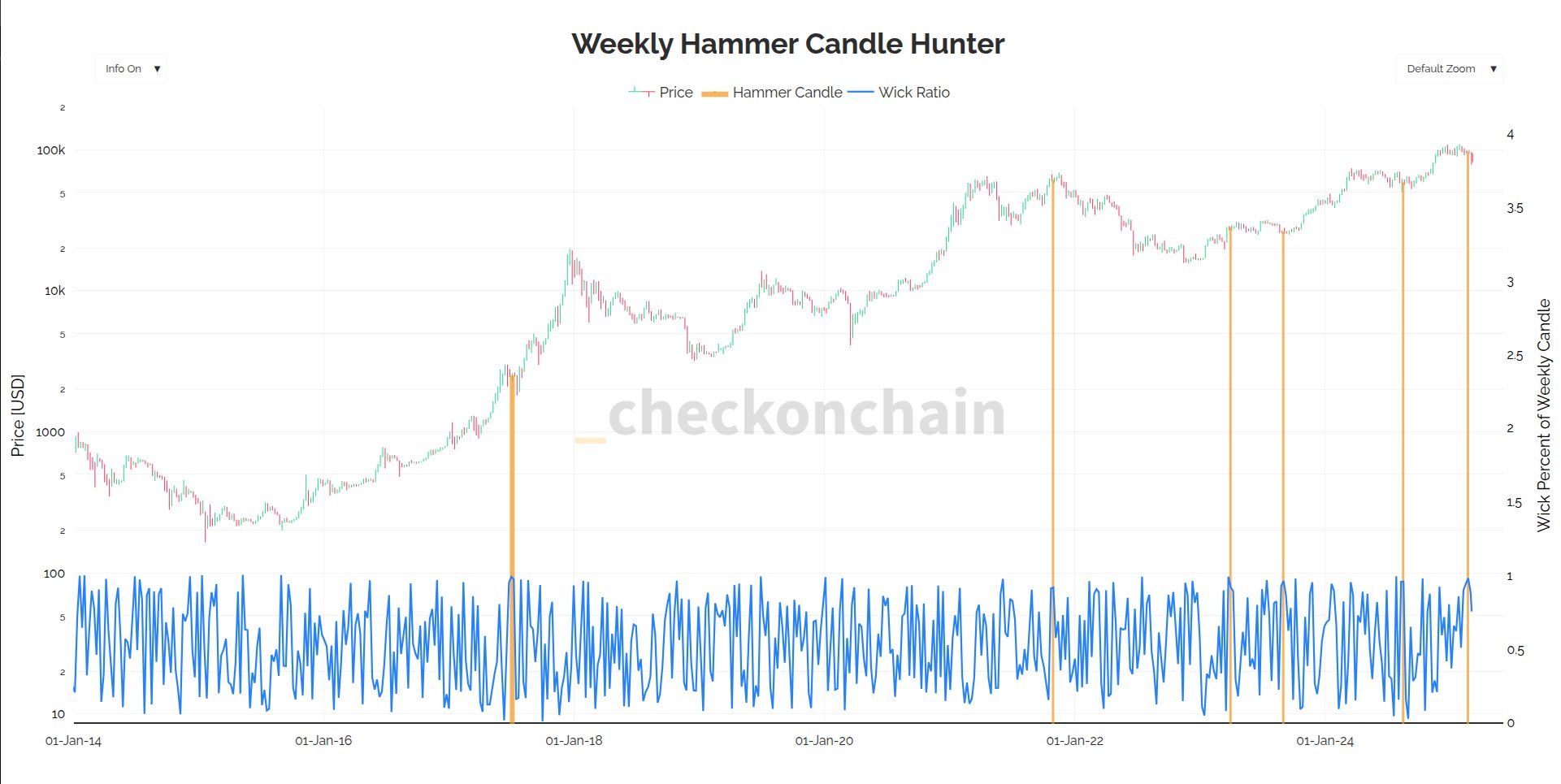

Bitcoin, the world’s most popular cryptocurrency, has recently experienced something unusual: back-to-back weekly hammer candles. These aren’t just any candles, they’re a rare sight on Bitcoin’s price charts. Let’s find out what they mean, why they’re important, and what they might tell us about Bitcoin’s future.

What are Hammer Candles?

Imagine a candle on a chart that looks like a hammer. That’s a hammer candle! It has a small body at the top or bottom, with a long wick making up most of its length – usually 90% or more[1]. This pattern often signals that the market might be changing direction.

Only Five Times Before

Checkmate’s analysis shows that Bitcoin has had a weekly hammer candle with a 90% lower wick only five times in its history[1]. These times were during big market events, like the 2017 bull run, the peak of the late 2021 bull market, twice in 2023 after the Silicon Valley Bank crisis and the summer downturn, and once in 2024 during a summer lull[1]. Since it’s so rare, it might be a big deal when it happens.

Recent Volatility

In the past two weeks, Bitcoin’s price has been on a rollercoaster ride. It swung by 23% in one week and 16% in the next[1]. This shows how volatile Bitcoin can be. Even with these ups and downs, CryptoQuant CEO Ki Young Ju thinks Bitcoin is still in a bull cycle, and a drop to $77,000 wouldn’t change that[2].

What It Means for Investors

Back-to-back hammer candles might signal that Bitcoin’s price could turn around or stabilize. However, investors should also think about other things, like support levels. For example, U.S. Bitcoin ETF investors have a cost basis of $89,000, which is a strong support level[2]. Also, Bitcoin miners start losing money if the price falls below $57,000, a level that’s marked the start of bear markets in the past[2].

A Powerful Signal in Volatile Times

In short, these back-to-back weekly hammer candles in Bitcoin are a rare and important event. They don’t guarantee what will happen, but they can give us clues about big changes in the market. As Bitcoin keeps going through volatile times, understanding these patterns can help investors and traders make better decisions. No matter what happens next, these hammer candles are a strong signal that we should pay attention to in the ever-changing world of cryptocurrency.

—