## Billionaire Salinas Says Elektra Delisting Will Set Him Free: A Detailed Analysis

Introduction

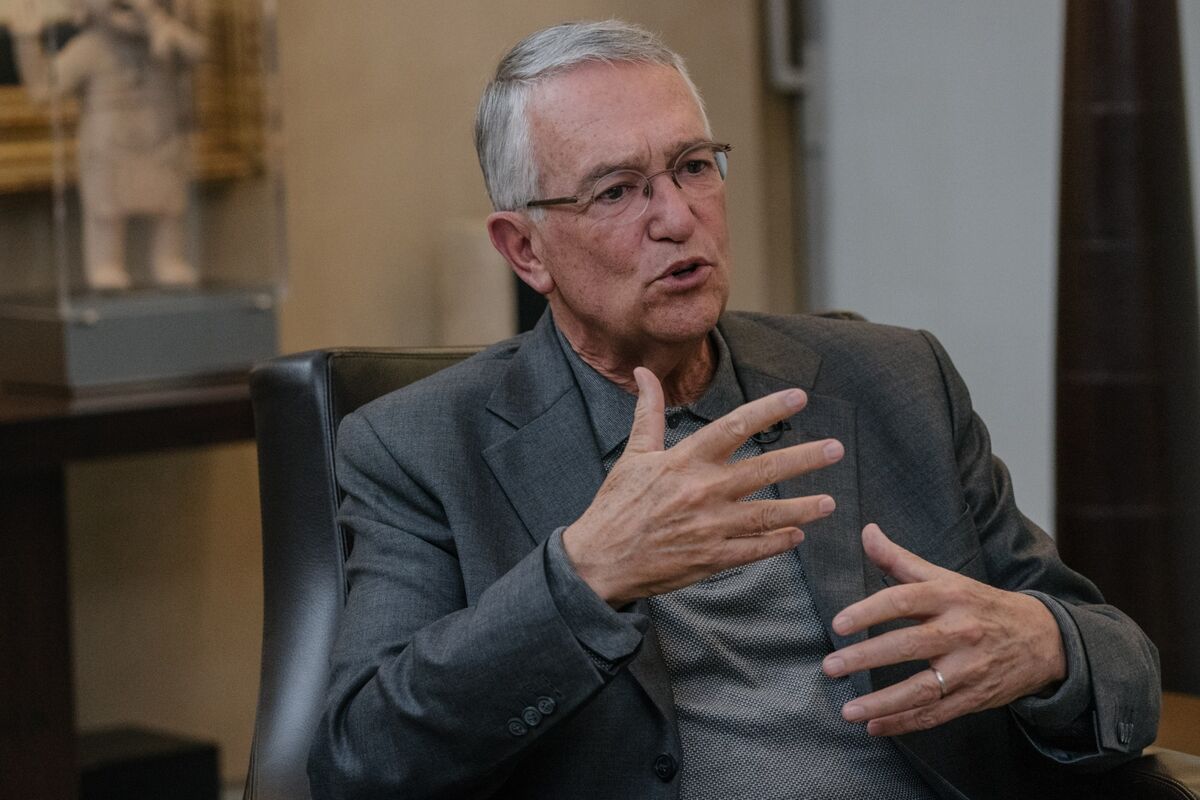

Billionaire Ricardo Salinas, the founder of Grupo Elektra, has expressed that the delisting of Elektra from the stock market will provide him with greater freedom to manage the company. This move is part of a broader strategy to restructure Elektra’s business divisions and potentially seek partnerships rather than relying on debt or equity financing. In this report, we will analyze the implications of Elektra’s delisting and how it aligns with Salinas’ vision for the company’s future.

Background: Grupo Elektra and Its Operations

Grupo Elektra is a Mexican conglomerate with diverse interests in retail, banking, and other sectors. The company has been listed on the Mexican Stock Exchange (BMV) for many years, which has subjected it to various regulatory and transparency requirements. However, Salinas believes that delisting will allow Elektra to operate more flexibly and make strategic decisions without the scrutiny of public markets.

Reasons for Delisting

1. Operational Flexibility: By delisting, Elektra can avoid the stringent reporting and compliance requirements associated with being a publicly traded company. This flexibility is crucial for making swift strategic decisions without needing to disclose detailed financial information to the public.

2. Financial Strategy: Salinas plans to restructure Elektra’s financial approach by seeking partnerships rather than relying on debt or equity financing. This strategy could help reduce financial risks and provide more stable funding sources.

3. Strategic Partnerships: Delisting allows Elektra to explore partnerships that might not be feasible under the scrutiny of public markets. These partnerships could enhance the company’s competitiveness and growth potential.

Implications of Delisting

– Market Perception: The decision to delist could impact investor confidence, as it reduces transparency and may be perceived as a move away from accountability.

– Regulatory Environment: While delisting reduces regulatory oversight from stock exchanges, Elektra will still need to comply with other regulatory requirements, especially in sectors like banking.

– Future Growth: The ability to operate more freely could facilitate faster decision-making and innovation, potentially leading to increased growth and competitiveness for Elektra.

Conclusion

Billionaire Ricardo Salinas’ decision to delist Elektra reflects a strategic shift towards greater operational flexibility and financial stability. While this move may have implications for transparency and investor confidence, it aligns with Salinas’ vision for Elektra’s future growth and competitiveness. The success of this strategy will depend on how effectively Elektra leverages its newfound flexibility to secure strategic partnerships and drive innovation.

Recommendations

1. Monitor Regulatory Compliance: Ensure that Elektra remains compliant with all relevant regulations outside of stock exchange requirements.

2. Communicate with Stakeholders: Maintain open communication with stakeholders to address concerns about transparency and accountability.

3. Explore Diverse Partnerships: Actively seek partnerships that align with Elektra’s strategic goals and enhance its market position.

By following these recommendations, Elektra can maximize the benefits of delisting while minimizing potential drawbacks.

Related sources:

[3] cdn-lfs.hf.co